Non Foreign Affidavit under IRC 1445 Virginia Form

What is the Non Foreign Affidavit Under IRC 1445 Virginia

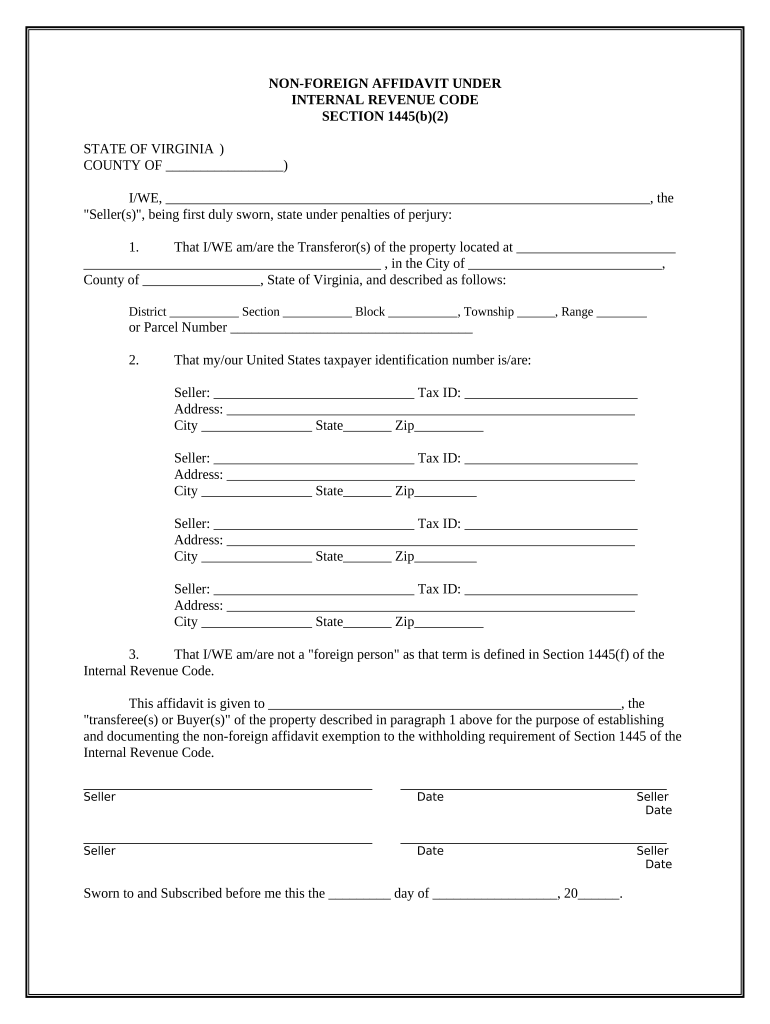

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Virginia to certify that a seller of real property is not a foreign person, as defined by the Internal Revenue Code. This affidavit is essential for buyers to avoid withholding taxes on the sale proceeds. By completing this form, sellers affirm their status as U.S. persons, which helps ensure compliance with federal tax regulations during real estate transactions. This affidavit is particularly relevant in property sales where the buyer may be required to withhold a portion of the sale price if the seller is a foreign entity.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Virginia

Completing the Non Foreign Affidavit involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including the seller's name, address, and tax identification number.

- Clearly state that the seller is not a foreign person under the definitions provided in IRC 1445.

- Sign and date the affidavit in the presence of a notary public to validate the document.

- Provide the completed affidavit to the buyer or their representative before the closing of the sale.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Virginia

The Non Foreign Affidavit serves a critical legal function in real estate transactions. It protects buyers from potential tax liabilities associated with foreign sellers. By obtaining this affidavit, buyers can demonstrate due diligence and compliance with IRS rules. Failure to secure this document may result in the buyer being liable for withholding taxes, which could amount to a significant financial burden. Therefore, it is essential for both parties to understand the legal implications of this affidavit in the context of property sales.

How to Obtain the Non Foreign Affidavit Under IRC 1445 Virginia

The Non Foreign Affidavit can typically be obtained through various channels:

- Real estate attorneys often provide templates or customized affidavits for their clients.

- Title companies may also supply the form as part of the closing process.

- Online resources and legal document services can offer downloadable versions of the affidavit.

It is advisable to consult with a legal professional to ensure that the form meets all necessary legal requirements and is correctly filled out.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Virginia

Several key elements must be included in the Non Foreign Affidavit to ensure its validity:

- The seller's full legal name and address.

- A clear statement confirming the seller's status as a U.S. person.

- Signature of the seller along with the date of signing.

- Notary acknowledgment to authenticate the document.

Including these elements helps to avoid disputes and ensures that the affidavit is legally binding.

IRS Guidelines for the Non Foreign Affidavit Under IRC 1445 Virginia

The IRS provides specific guidelines regarding the Non Foreign Affidavit, emphasizing the importance of accurate completion. Sellers must ensure that they meet the definition of a U.S. person, which includes citizens and certain resident aliens. The IRS also outlines the consequences of providing false information, which can lead to penalties and additional tax liabilities. Understanding these guidelines is crucial for both sellers and buyers to navigate the tax implications associated with real estate transactions.

Quick guide on how to complete non foreign affidavit under irc 1445 virginia

Complete Non Foreign Affidavit Under IRC 1445 Virginia effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for typical printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and eSign your documents quickly without any delays. Handle Non Foreign Affidavit Under IRC 1445 Virginia on any platform with airSlate SignNow Android or iOS applications and ease any document-related tasks today.

The easiest way to modify and eSign Non Foreign Affidavit Under IRC 1445 Virginia with ease

- Obtain Non Foreign Affidavit Under IRC 1445 Virginia and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Non Foreign Affidavit Under IRC 1445 Virginia and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in Virginia?

A Non Foreign Affidavit Under IRC 1445 in Virginia is a legal document used by foreign individuals or entities to signNow their non-foreign status for tax purposes. This affidavit helps avoid withholding taxes during real estate transactions, ensuring compliance with federal and state regulations. Properly completing this document is essential for smooth property transactions in Virginia.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 in Virginia?

You need a Non Foreign Affidavit Under IRC 1445 in Virginia to signNow that you are not a foreign investor, thereby avoiding the mandatory withholding tax on real estate transactions. This affidavit protects both buyers and sellers from unexpected tax liabilities and ensures that the transaction aligns with IRS regulations. It's a vital part of the property selling process in Virginia.

-

How can airSlate SignNow help me with my Non Foreign Affidavit Under IRC 1445 in Virginia?

airSlate SignNow streamlines the eSigning and documentation process for your Non Foreign Affidavit Under IRC 1445 in Virginia. Our user-friendly platform allows you to create, send, and sign documents quickly and securely, ensuring that all parties can complete the necessary paperwork efficiently. This feature saves time and reduces the hassle often associated with traditional methods.

-

Are there any costs associated with using your service for the Non Foreign Affidavit Under IRC 1445 in Virginia?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of our users. You can choose a plan that best suits your requirements for managing documents like the Non Foreign Affidavit Under IRC 1445 in Virginia. Our cost-effective solutions provide great value for small to large businesses handling real estate transactions.

-

What features does airSlate SignNow offer for managing documents like the Non Foreign Affidavit Under IRC 1445 in Virginia?

airSlate SignNow provides robust features including eSignature, document templates, real-time collaboration, and secure storage for your Non Foreign Affidavit Under IRC 1445 in Virginia. These features ensure that your documents can be easily accessed and signed by all parties involved. Additionally, our platform supports tracking and notifications to keep you informed throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling the Non Foreign Affidavit Under IRC 1445 in Virginia?

Absolutely! airSlate SignNow seamlessly integrates with various applications and systems, allowing you to manage your Non Foreign Affidavit Under IRC 1445 in Virginia effectively. Whether using CRM software, document management systems, or cloud storage services, our integrations help streamline your workflow and enhance productivity.

-

Is the Non Foreign Affidavit Under IRC 1445 in Virginia applicable for all real estate transactions?

The Non Foreign Affidavit Under IRC 1445 in Virginia is primarily applicable to transactions involving foreign sellers of U.S. real estate. However, both buyers and sellers should evaluate their situations and consult with a tax professional to determine applicability. Proper use of this affidavit can ensure compliance and avoid unnecessary tax withholding.

Get more for Non Foreign Affidavit Under IRC 1445 Virginia

- Reasonable cause regulations ampamp requirements for missing form

- Pdf 8879 k kentucky department of revenue form

- D5 form rev 5 2021docx

- Tax forms ohio department of taxationdeclaration of tax representativetax forms ohio department of taxation

- Individuals west virginia state tax department form

- Form 8865 return of us persons with respect to certain

- Form w 8ben e rev october 2021 certificate of status of beneficial owner for united states tax withholding and reporting

- Form w 8 ben rev october 2021 certificate of foreign status of beneficial owner for united states tax withholding and reporting

Find out other Non Foreign Affidavit Under IRC 1445 Virginia

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself