Virginia Creditor Form

What is the Virginia Creditor?

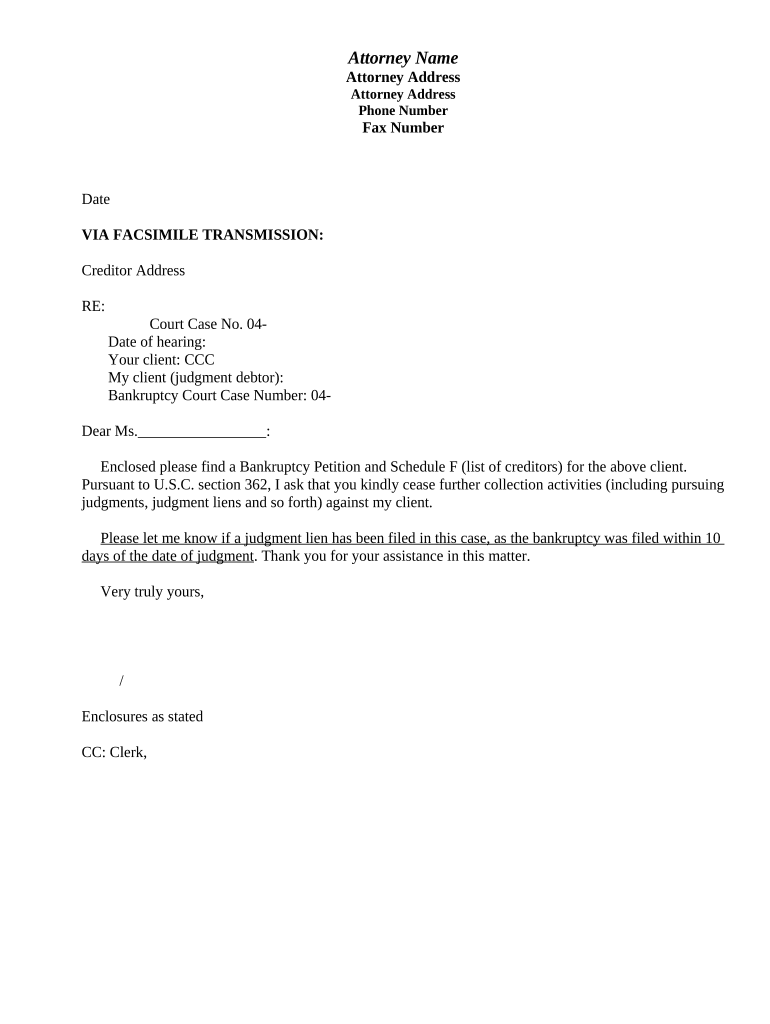

The Virginia creditor form is a legal document used primarily in debt collection processes. It serves as a formal notice to a debtor regarding the outstanding obligations they have towards a creditor. This form outlines the specific details of the debt, including the amount owed, the nature of the debt, and any relevant terms or conditions. Understanding this form is essential for both creditors seeking to recover debts and debtors who need to address their financial responsibilities.

Steps to Complete the Virginia Creditor

Completing the Virginia creditor form involves several key steps to ensure accuracy and compliance with legal standards. Begin by gathering all necessary information about the debtor, including their full name, address, and the specifics of the debt. Next, clearly detail the amount owed and any applicable interest or fees. It is crucial to provide a concise explanation of the debt's origin, such as the service or goods provided. Once the form is filled out, review it for completeness and accuracy before signing it. Finally, ensure that the form is delivered to the debtor through an appropriate method, such as certified mail, to maintain a record of the communication.

Legal Use of the Virginia Creditor

The Virginia creditor form must adhere to specific legal guidelines to be considered valid. It is important to comply with both federal and state laws regarding debt collection practices. This includes providing accurate information, allowing for proper notice periods, and respecting the debtor's rights. Failure to follow these regulations can result in penalties or the dismissal of the debt claim. Utilizing a reliable eSignature platform, such as signNow, can help maintain compliance by ensuring that all signatures and documents are securely handled and legally binding.

Key Elements of the Virginia Creditor

Several key elements are essential for the Virginia creditor form to be effective. These include:

- Creditor Information: Full name, address, and contact details of the creditor.

- Debtor Information: Full name and address of the debtor.

- Debt Details: A clear breakdown of the amount owed, including principal, interest, and any additional fees.

- Payment Terms: Specific terms regarding payment deadlines and methods.

- Signatures: Required signatures from both the creditor and the debtor to validate the agreement.

Who Issues the Form?

The Virginia creditor form is typically issued by the creditor or their representative, such as a collection agency or attorney. It is important for the issuer to have the necessary authority to collect the debt and to ensure that all information provided is accurate and up to date. This helps establish the credibility of the claim and facilitates smoother communication with the debtor.

Form Submission Methods

There are various methods for submitting the Virginia creditor form, each with its own advantages. The most common methods include:

- Online Submission: Utilizing secure eSignature platforms allows for quick and efficient submission while maintaining compliance with legal standards.

- Mail: Sending the form via certified mail provides a physical record of the submission and ensures that the debtor receives the notice.

- In-Person Delivery: Personally delivering the form can establish direct communication and may help resolve any immediate questions or concerns.

Quick guide on how to complete virginia creditor

Effortlessly Prepare Virginia Creditor on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without delays. Manage Virginia Creditor seamlessly on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The Easiest Way to Modify and Electronically Sign Virginia Creditor

- Obtain Virginia Creditor and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Virginia Creditor while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit a Virginia creditor?

airSlate SignNow is an easy-to-use, cost-effective solution that enables Virginia creditors to send and eSign documents effortlessly. With features tailored for seamless document management, Virginia creditors can streamline their processes, ensuring faster transactions and improved client satisfaction.

-

How does airSlate SignNow handle security for Virginia creditors?

Security is paramount for Virginia creditors, and airSlate SignNow ensures that all documents are encrypted and securely stored. The platform complies with various industry standards, providing peace of mind to Virginia creditors when handling sensitive information.

-

What pricing plans does airSlate SignNow offer for Virginia creditors?

airSlate SignNow offers flexible pricing plans designed to fit the needs of Virginia creditors, whether they are small businesses or large enterprises. Each plan provides essential features and capabilities, allowing Virginia creditors to choose a solution that matches their budget and requirements.

-

Can Virginia creditors integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows Virginia creditors to integrate with various applications such as CRM systems, cloud storage, and productivity tools. This integration capability helps Virginia creditors maintain efficient workflows and enhance their overall document management process.

-

What features does airSlate SignNow offer specifically for Virginia creditors?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking, making it an ideal choice for Virginia creditors. These features help Virginia creditors manage their documents more effectively and ensure compliance with legal requirements.

-

How does airSlate SignNow improve productivity for Virginia creditors?

By automating the signing process, airSlate SignNow signNowly boosts productivity for Virginia creditors. It reduces manual paperwork and allows Virginia creditors to focus on core business tasks while ensuring timely document execution.

-

Are there any mobile solutions available for Virginia creditors using airSlate SignNow?

Absolutely, airSlate SignNow provides a mobile app that allows Virginia creditors to manage their documents on the go. This mobile access is essential for Virginia creditors needing to send or sign documents while away from their desks.

Get more for Virginia Creditor

- Respondents original answer set a no children texaslawhelporg form

- Chapter 14 marriage and familyintroduction to sociology2nd form

- Default divorce forms set c squarespace

- State on behalf of lillianna l v hugo c 26 neb ct app 923 form

- This form is to be completed and a copy furnished to opposing counsel and to the clerk of the

- Civil case information sheettexaslawhelporg providing free and

- Form 503 general information assumed name certificate

- Designation form for royalty payment responsibility form onrr 4425

Find out other Virginia Creditor

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement