Virginia Creditor Form

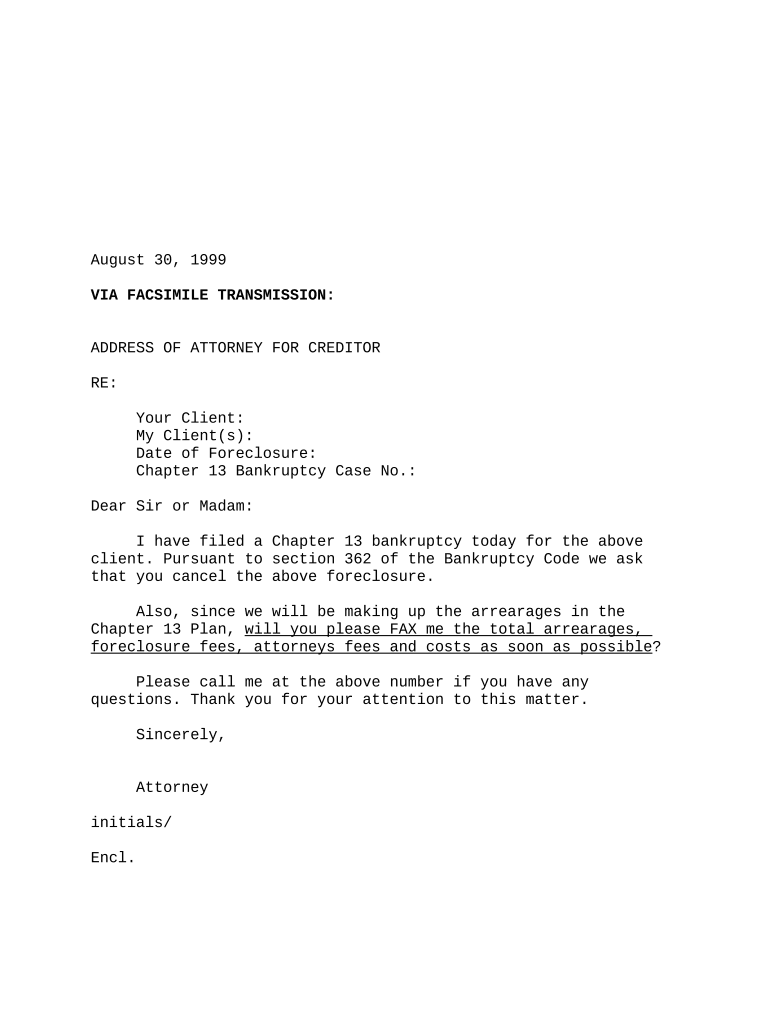

What is the Virginia Creditor?

The Virginia Creditor is a legal form used by creditors in the state of Virginia to initiate the collection process for outstanding debts. This form serves as a formal request for payment and outlines the details of the debt owed, including the amount, the debtor's information, and the nature of the debt. It is essential for creditors to understand the specific requirements and legal implications associated with this form to ensure compliance with Virginia laws.

Steps to Complete the Virginia Creditor

Completing the Virginia Creditor form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the debtor, including their full name, address, and any relevant account numbers. Next, clearly state the amount owed and provide a detailed description of the debt. After filling out the form, review all entries for accuracy. Finally, ensure that the form is signed and dated appropriately, as this is crucial for its legal validity.

Legal Use of the Virginia Creditor

The Virginia Creditor form must be used in accordance with state laws governing debt collection practices. It is important to follow the Fair Debt Collection Practices Act (FDCPA) to avoid any potential legal issues. This includes ensuring that the debtor is notified of their rights and that the collection process is conducted fairly and ethically. Using the form legally can help creditors recover debts while maintaining compliance with applicable regulations.

Key Elements of the Virginia Creditor

Several key elements must be included in the Virginia Creditor form to ensure its effectiveness. These elements include:

- Creditor Information: Name, address, and contact details of the creditor.

- Debtor Information: Full name, address, and any pertinent identification numbers.

- Debt Details: Clear description of the debt, including the amount owed and the date the debt was incurred.

- Signature: The creditor's signature is required to validate the form.

State-Specific Rules for the Virginia Creditor

Virginia has specific rules that govern the use of the Virginia Creditor form. Creditors must adhere to state regulations regarding the timing and method of delivering the form to the debtor. Additionally, there are limitations on how often a creditor can contact a debtor and the methods used for communication. Understanding these rules is crucial for creditors to avoid potential legal challenges and ensure the collection process is conducted properly.

Examples of Using the Virginia Creditor

Examples of situations where the Virginia Creditor form may be utilized include:

- A business seeking payment for unpaid invoices from a client.

- A landlord pursuing overdue rent payments from a tenant.

- A financial institution attempting to collect on a defaulted loan.

In each case, the creditor must ensure that the form is filled out correctly and complies with all legal requirements to facilitate the collection process effectively.

Quick guide on how to complete virginia creditor 497428330

Complete Virginia Creditor effortlessly on any device

Online document management has gained traction among companies and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage Virginia Creditor on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Virginia Creditor with ease

- Find Virginia Creditor and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you select. Modify and eSign Virginia Creditor and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit a Virginia creditor?

airSlate SignNow is an eSignature solution designed for efficiency and ease of use. For a Virginia creditor, it streamlines the process of sending and signing documents, enabling quicker transactions and better customer experiences. This not only saves time but also helps maintain compliance with Virginia state regulations regarding electronic signatures.

-

What pricing plans are available for Virginia creditors using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of Virginia creditors. These plans are designed to accommodate businesses of all sizes, ensuring you find a cost-effective solution that fits your budget. Each plan includes access to essential features for document management and eSigning.

-

Can airSlate SignNow integrate with other tools for Virginia creditors?

Yes, airSlate SignNow offers seamless integration with a variety of business tools that Virginia creditors commonly use. This includes CRM software, document management systems, and other productivity applications. Such integrations enhance workflow efficiency and ensure that all your processes remain interconnected.

-

What document types can Virginia creditors send using airSlate SignNow?

Virginia creditors can send a wide range of document types using airSlate SignNow. This includes contracts, loan agreements, financial disclosures, and more. The platform supports various file formats, making it versatile for the specific needs of creditors in Virginia.

-

Is airSlate SignNow secure for Virginia creditors handling sensitive information?

Absolutely, airSlate SignNow prioritizes the security of documents, making it a great choice for Virginia creditors. The platform utilizes industry-standard encryption and complies with necessary regulations to protect sensitive information. This ensures that your documents remain confidential and secure throughout the signing process.

-

How does airSlate SignNow help Virginia creditors improve customer engagement?

By using airSlate SignNow, Virginia creditors can enhance customer engagement signNowly. The easy-to-use platform allows clients to sign documents quickly, resulting in faster transaction times. Additionally, the user-friendly interface fosters a positive experience, encouraging repeat business.

-

What customer support options are available for Virginia creditors using airSlate SignNow?

airSlate SignNow offers multiple customer support options tailored for Virginia creditors. You can signNow out via live chat, email support, or access an extensive knowledge base. Quick and reliable support helps ensure a seamless experience with the platform.

Get more for Virginia Creditor

- Dwu courses form

- Which is less likely to generate defensiveness mcm301 form

- Polmed plan selection form

- Batch manufacturing record sample format

- Rhino card form

- Summons mohave county courts form

- Dd 2945 mar post government employment advice opinion request form

- Bmc community service form university of colorado boulder

Find out other Virginia Creditor

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe