Virginia Deed Gift Form

What is the Virginia Deed Gift

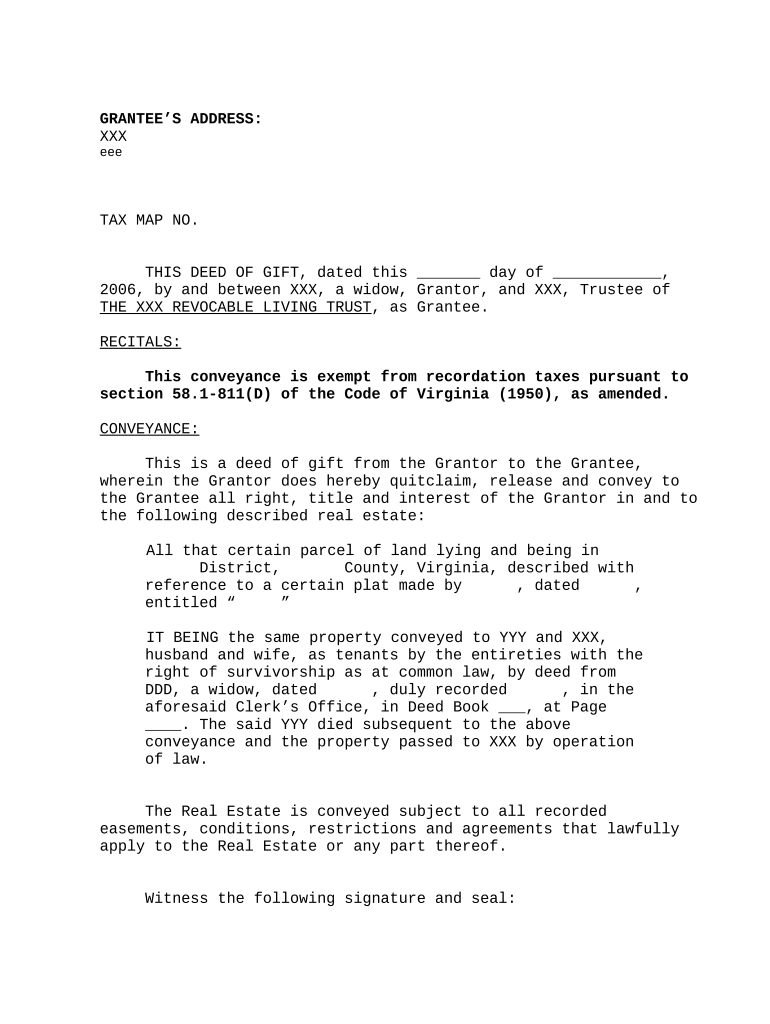

The Virginia deed gift is a legal document used to transfer ownership of real property from one individual to another without the exchange of money. This type of deed is often utilized to facilitate gifts between family members or friends, allowing the donor to retain certain rights while transferring the property. The deed must be executed in accordance with Virginia state laws to ensure its validity and effectiveness.

Key elements of the Virginia Deed Gift

Several key elements must be included in a Virginia deed gift to ensure it is legally binding. These elements include:

- Grantor and Grantee Information: The full names and addresses of both the person giving the gift (grantor) and the person receiving it (grantee).

- Property Description: A detailed description of the property being transferred, including its physical address and any relevant parcel identification numbers.

- Intent to Gift: A clear statement indicating that the transfer is a gift and not a sale.

- Signatures: The signatures of the grantor and, in some cases, the grantee, along with a notary public's acknowledgment.

Steps to complete the Virginia Deed Gift

Completing a Virginia deed gift involves several steps to ensure the document is properly prepared and executed:

- Gather necessary information about the property and the parties involved.

- Draft the deed gift document, including all required elements.

- Review the document for accuracy and completeness.

- Sign the deed in the presence of a notary public to ensure legal validity.

- File the executed deed with the local county clerk’s office to record the transfer.

Legal use of the Virginia Deed Gift

The legal use of the Virginia deed gift is governed by state laws, which dictate how property transfers must be conducted. It is essential to comply with these regulations to avoid potential disputes or challenges to the deed's validity. The deed must be executed voluntarily, without coercion, and with a clear understanding of the implications of the gift. Additionally, it is advisable to consult with a legal professional to ensure compliance with all relevant laws and regulations.

Who Issues the Form

The Virginia deed gift does not have a specific issuing authority like some government forms. Instead, it is typically prepared by the grantor or their legal representative. Once completed, the deed must be signed and notarized before being filed with the local county clerk’s office, which serves to officially record the transfer of property ownership.

State-specific rules for the Virginia Deed Gift

Virginia has specific rules governing the execution and recording of deed gifts. These include requirements for notarization, the necessity of including a legal description of the property, and guidelines for filing with the county clerk. Additionally, the deed must comply with Virginia's laws regarding property transfers to ensure it is enforceable. Understanding these state-specific rules is crucial for anyone considering a deed gift in Virginia.

Quick guide on how to complete virginia deed gift

Complete Virginia Deed Gift effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without complications. Manage Virginia Deed Gift on any platform through airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Virginia Deed Gift without breaking a sweat

- Obtain Virginia Deed Gift and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Virginia Deed Gift and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Virginia deed trust?

A Virginia deed trust is a legal arrangement where property is transferred to a trustee for the benefit of designated beneficiaries. It serves as an effective way to manage assets and can be used for estate planning purposes. Understanding this can help you utilize airSlate SignNow for efficient document management.

-

How can airSlate SignNow help with Virginia deed trust documents?

AirSlate SignNow simplifies the process of creating, sending, and eSigning Virginia deed trust documents. With our platform, you can easily manage your trust agreements and ensure they are signed securely and quickly. Utilizing our solution adds efficiency to your estate planning process.

-

What features does airSlate SignNow offer for Virginia deed trust management?

AirSlate SignNow offers features like customizable templates, secure eSigning, and real-time tracking for Virginia deed trust documents. These features streamline the document workflow and guarantee that all signatures and approvals are captured accurately. This ensures that your trust agreements are processed smoothly.

-

What are the benefits of using airSlate SignNow for Virginia deed trusts?

Using airSlate SignNow for Virginia deed trusts provides multiple benefits, including time savings, enhanced security, and ease of use. Our platform ensures that you can eSign important documents from anywhere, reducing delays associated with traditional signing methods. This modern approach can signNowly improve your workflow.

-

Is airSlate SignNow cost-effective for Virginia deed trust transactions?

Yes, airSlate SignNow offers a cost-effective solution for managing Virginia deed trust transactions. Our pricing plans are designed to cater to various business needs, allowing you to choose a package that fits your budget while benefiting from our full range of services. This way, you receive quality at an affordable price.

-

Can I integrate airSlate SignNow with other tools for managing Virginia deed trusts?

Absolutely! AirSlate SignNow integrates seamlessly with various tools that can enhance your management of Virginia deed trusts, including CRMs and document storage solutions. These integrations enhance your workflow, making it easier to manage your documents in one centralized platform.

-

How secure is airSlate SignNow for handling Virginia deed trust documents?

AirSlate SignNow prioritizes the security of your Virginia deed trust documents with robust measures including encryption and compliance with industry standards. We protect sensitive information at every stage, ensuring that your legal documents remain confidential and secure during transfer and storage.

Get more for Virginia Deed Gift

- Full text of ampquotannual report of the state engineer and form

- Generic samples of church articles of incorporation and form

- How to write personal statements may 2017 form

- Department of justice ada title iii regulation 28 cfr part form

- Share purchase agreement template form

- 14 form checklist for software license agreement

- Sample nonprofit bylaws template to start a form 1023

- The official site of minor league baseballmilbcom homepage form

Find out other Virginia Deed Gift

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online