Au 11 Form

What is the Au 11 Form

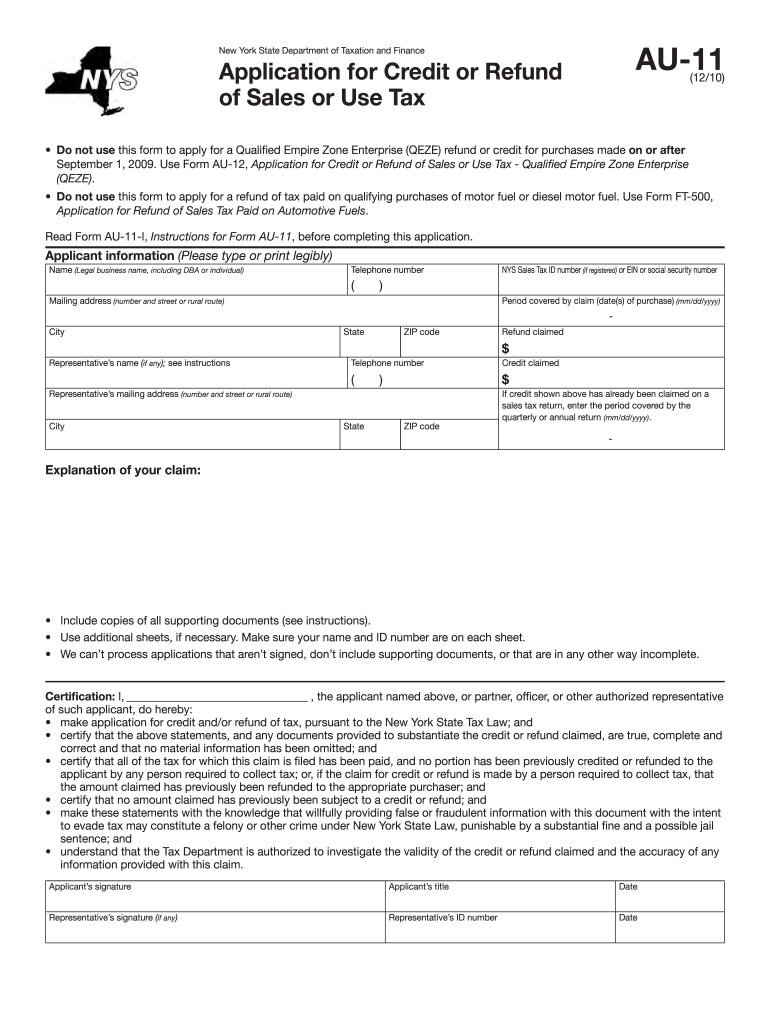

The Au 11 form is a specific document used for tax purposes in New York State. It is primarily utilized to report certain financial information to the New York State Department of Taxation and Finance. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding its purpose and requirements is crucial for accurate filing and to avoid potential penalties.

Steps to Complete the Au 11 Form

Completing the Au 11 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with accurate information, ensuring that all entries match your supporting documents. Pay special attention to any calculations, as errors can lead to delays or penalties. After completing the form, review it thoroughly for any mistakes before submitting it.

How to Obtain the Au 11 Form

The Au 11 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in a fillable PDF format, allowing users to complete it electronically. Additionally, physical copies can be requested from local tax offices or by contacting the department directly. Ensure you have the most current version of the form to avoid complications during submission.

Legal Use of the Au 11 Form

The legal use of the Au 11 form is governed by New York State tax laws. It must be filled out accurately and submitted by the designated deadlines to be considered valid. The form serves as an official record of your financial activities and obligations, making it essential for compliance with state regulations. Failure to use the form correctly may result in legal repercussions, including fines or audits.

Form Submission Methods

The Au 11 form can be submitted through various methods to accommodate different preferences. Users have the option to file online through the New York State Department of Taxation and Finance’s e-filing system, which is secure and efficient. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so it is important to choose one that aligns with your filing deadlines.

Required Documents

When completing the Au 11 form, certain documents are required to support the information provided. These typically include income statements, previous tax returns, and any relevant financial records that substantiate your claims. Having these documents ready will facilitate a smoother filing process and help ensure that your form is completed accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Au 11 form are crucial to ensure compliance with tax regulations. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline. It is important to stay informed about any changes to these dates, as late submissions can result in penalties or interest charges. Keeping a calendar of important tax dates can help you stay organized and compliant.

Quick guide on how to complete au 11 tax formpdffillercom

Complete Au 11 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Au 11 Form on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The simplest way to modify and electronically sign Au 11 Form with ease

- Find Au 11 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional written signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Au 11 Form and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How can I do my income tax return filing without the help of an auditor?

You can do the same, by using online tools available, free chat forums and with the help of professionals that are ready to help at Quora. Even i try to answer all the queries that are posted on QuoraHowever, a word of advise, do not try to do your self. The filing of return, apparently has been simplified. But the correlation in returns from external source of information is so much that filing one-self(unless you are a professional) can be dangerous

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Is it illegal for my boss to fill out the tax papers to tell them how much to take out?

It would be illegal for an employer to fill out a W-4 form for you.However, if you have not signed a W-4 form and given it to your employer, the employer is still required to withhold taxes. If I remember correctly they must do as if you'd filled out the form as single with 0 exemptions.If you want to change what your employer is withholding, you should be able to go to Internal Revenue Service, print out a W-4 form, fill it out and give it to your employer.If after that your withholding doesn't change in a reasonable time (I think they're allowed a couple of weeks), then talk to the IRS.

-

How do I fill out services tax?

HelloTwo cases here.You want to make service tax payment: Click this link to move the Service tax payment page on ACES site. EASIESTYou need to fill service tax return.Other than the paid software in the market. You can fill it from two utilities.a. St-3 offline utility.b. Online in aces website.Excel utility procedure is here: A separate excel utility is launched by the department for April to June 17 period. You can download utility from here. ACES’s Excel Utility for e-filing of ST-3/ ST-3C (Service Tax Return) for Apr. 2017 to Jun. 2017Going with the excel utility.You need to enable macro when you open excel. Excel asks to enable them when you open this file.Worksheet (Return): You need to fill the information of your company, service tax number, Type of return (Original), Constituion (e.g private limited company) and description of services. Validate the sheet and click next, you will get more tabs in the excel workbook after click next.Worksheet (Payable Services(1)): It includes the services provided, export and tax, taxable services under reverse charge. The sheet calculates the taxes by default after filling the necessary info of outward supplies.Paid-Service: Need to mention the tax paid in cash and by input credit recd. from your supplier of services. Separate figures of ST, KKC and SBC to be provided.Challan-Service: All the challan number and amountCenvat: This sheet comprises your opening cenvat as on 1st April 17 and credit taken and availed. You closing balance of Taxes in your account books should match with the closing balance in this sheet.Hope this answer your queries.Please upvote if this answer your queries. Thanks

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the au 11 tax formpdffillercom

How to create an electronic signature for the Au 11 Tax Formpdffillercom in the online mode

How to generate an electronic signature for your Au 11 Tax Formpdffillercom in Google Chrome

How to generate an eSignature for putting it on the Au 11 Tax Formpdffillercom in Gmail

How to create an eSignature for the Au 11 Tax Formpdffillercom right from your smart phone

How to generate an electronic signature for the Au 11 Tax Formpdffillercom on iOS

How to make an electronic signature for the Au 11 Tax Formpdffillercom on Android devices

People also ask

-

What is the Au 11 Form and how can I use it with airSlate SignNow?

The Au 11 Form is a specific document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign the Au 11 Form, streamlining your document management process. Our platform allows you to customize this form to fit your needs, ensuring a seamless experience.

-

Is airSlate SignNow suitable for handling the Au 11 Form?

Absolutely! airSlate SignNow is designed to handle various types of documents, including the Au 11 Form. Our user-friendly interface makes it simple to upload, edit, and send the form for eSignature, making it a perfect fit for businesses looking to enhance their workflow.

-

What are the pricing options for using airSlate SignNow with the Au 11 Form?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including those requiring the Au 11 Form. We have monthly and annual subscription options that provide access to all features, including unlimited eSigning and document templates, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other software while using the Au 11 Form?

Yes, airSlate SignNow supports integrations with various applications, making it easy to manage the Au 11 Form alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our platform allows for seamless data transfer, enhancing your overall efficiency.

-

What features does airSlate SignNow offer for the Au 11 Form?

With airSlate SignNow, you get a range of features tailored for the Au 11 Form, including customizable templates, automated workflows, and secure eSigning. These features help you save time, reduce errors, and ensure compliance, making document handling more efficient.

-

How secure is the Au 11 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the Au 11 Form, your documents are protected with robust encryption and secure access controls. Our platform also complies with industry standards, ensuring that your sensitive information remains safe.

-

Can I track the status of the Au 11 Form sent for eSignature?

Yes, airSlate SignNow provides real-time tracking for all documents, including the Au 11 Form sent for eSignature. You can easily monitor when the form is viewed, signed, and completed, giving you peace of mind and allowing you to follow up promptly.

Get more for Au 11 Form

Find out other Au 11 Form

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy