License to Sell Personal Estate Vermont Form

What is the License To Sell Personal Estate Vermont

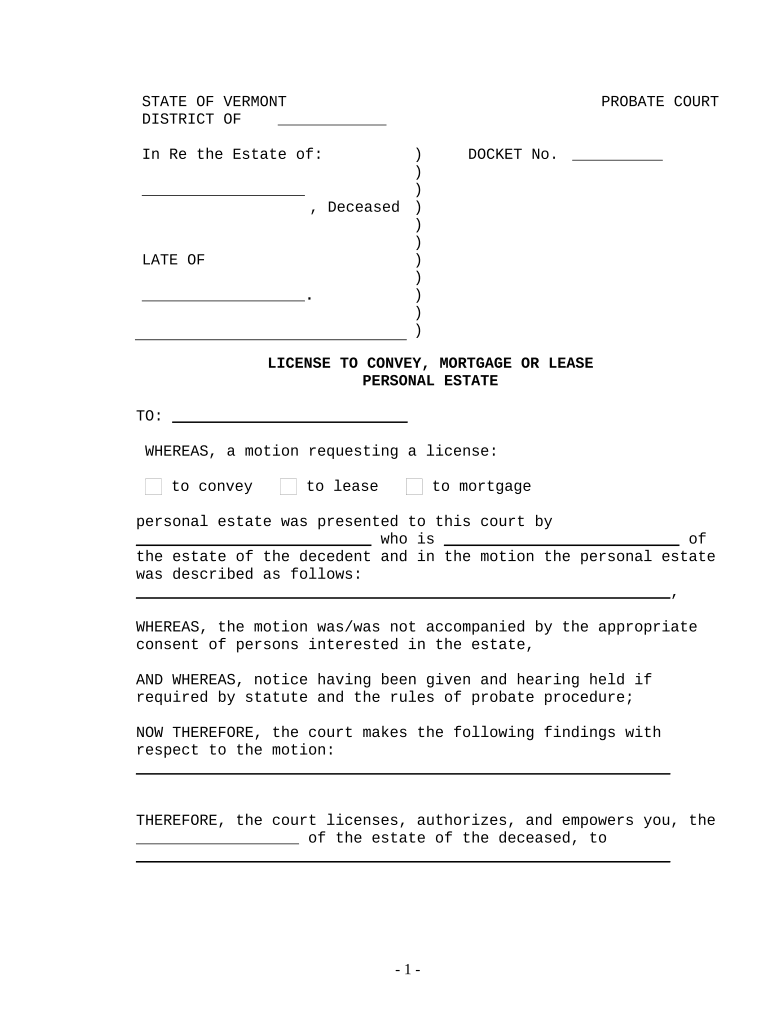

The License To Sell Personal Estate in Vermont is a legal document that authorizes an individual or entity to sell personal property on behalf of another party, often in the context of estate management. This form is essential for executors or administrators of estates, ensuring that they can legally manage and dispose of assets according to the deceased's wishes and state laws. It serves to protect both the seller and the buyer by providing a clear record of the transaction and the authority under which it is conducted.

How to Obtain the License To Sell Personal Estate Vermont

To obtain the License To Sell Personal Estate in Vermont, individuals must typically file a petition with the probate court in the county where the estate is being administered. This process involves submitting necessary documentation, including the death certificate and a list of the estate's assets. The court will review the petition, and upon approval, issue the license, granting the executor or administrator the authority to sell personal property as needed.

Steps to Complete the License To Sell Personal Estate Vermont

Completing the License To Sell Personal Estate in Vermont involves several key steps:

- Gather all necessary documents, including the death certificate and inventory of assets.

- File a petition with the appropriate probate court, including all required information.

- Attend a court hearing if required, where the judge will review the petition.

- Receive the approved license from the court, allowing for the sale of personal property.

Key Elements of the License To Sell Personal Estate Vermont

The key elements of the License To Sell Personal Estate in Vermont include:

- The name of the deceased and the executor or administrator.

- A detailed inventory of the personal property to be sold.

- The court's approval date and any specific conditions attached to the sale.

- Signatures of the executor and, if applicable, the judge.

Legal Use of the License To Sell Personal Estate Vermont

The legal use of the License To Sell Personal Estate in Vermont ensures that the sale of personal property is conducted in accordance with state laws and the wishes of the deceased. It provides a legal framework for the executor or administrator to act on behalf of the estate, protecting them from potential legal disputes and ensuring that the proceeds from the sale are distributed appropriately among beneficiaries.

State-Specific Rules for the License To Sell Personal Estate Vermont

Vermont has specific rules governing the License To Sell Personal Estate, including:

- Requirements for filing petitions in probate court.

- Timeframes for obtaining the license after the death of the estate holder.

- Regulations regarding the sale of certain types of personal property, such as vehicles or real estate.

Quick guide on how to complete license to sell personal estate vermont

Complete License To Sell Personal Estate Vermont effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents swiftly without delays. Manage License To Sell Personal Estate Vermont on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest method to modify and eSign License To Sell Personal Estate Vermont without hassle

- Obtain License To Sell Personal Estate Vermont and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant portions of the documents or redact sensitive information with features that airSlate SignNow specifically provides for that task.

- Create your eSignature using the Sign tool, which takes a few seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign License To Sell Personal Estate Vermont and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a License To Sell Personal Estate Vermont?

A License To Sell Personal Estate Vermont is a legal document that allows authorized individuals to sell personal property within the state. This license ensures that the sale adheres to state regulations and provides protection for both the seller and buyer.

-

How can airSlate SignNow help with obtaining a License To Sell Personal Estate Vermont?

AirSlate SignNow streamlines the process of obtaining a License To Sell Personal Estate Vermont by allowing users to create, send, and eSign necessary documents efficiently. With our user-friendly interface, you can easily manage the paperwork associated with selling personal estate.

-

What features does airSlate SignNow offer for managing a License To Sell Personal Estate Vermont?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure storage for documents related to a License To Sell Personal Estate Vermont. These tools enhance your ability to manage sales processes and maintain compliance with state laws.

-

Are there any fees associated with using airSlate SignNow for a License To Sell Personal Estate Vermont?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for those needing a License To Sell Personal Estate Vermont. You can choose a plan that fits your budget while gaining access to all necessary features.

-

What are the benefits of using airSlate SignNow for my License To Sell Personal Estate Vermont?

By using airSlate SignNow for your License To Sell Personal Estate Vermont, you benefit from enhanced efficiency, cost savings, and secure document management. The platform simplifies the eSigning process, making it easier to close sales quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for my License To Sell Personal Estate Vermont?

Yes, airSlate SignNow offers seamless integrations with various business tools, enhancing your workflow related to a License To Sell Personal Estate Vermont. You can easily connect systems you already use to streamline your document management processes.

-

Is airSlate SignNow compliant with Vermont regulations for a License To Sell Personal Estate?

Absolutely! AirSlate SignNow is designed to comply with Vermont regulations concerning a License To Sell Personal Estate Vermont, ensuring that all eSigned documents meet necessary legal standards. This dedication to compliance helps protect your interests in any transaction.

Get more for License To Sell Personal Estate Vermont

- Optional consent of other form

- An important court proceeding that affects your rights form

- Name change for a minor superior court maricopa county form

- I am familiar with the facts stated in this affidavit and i make this affidavit to show that i have served copies form

- Application for change of name for a family ars 12 601 cvncf11f application for change of name for a family ars 12 601 cvncf11f form

- Department of taxation and finance quarterly inventory form

- Jlclawpittedu form

- Marital waiver of notice form

Find out other License To Sell Personal Estate Vermont

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet