Individual Credit Application Vermont Form

What is the Individual Credit Application Vermont

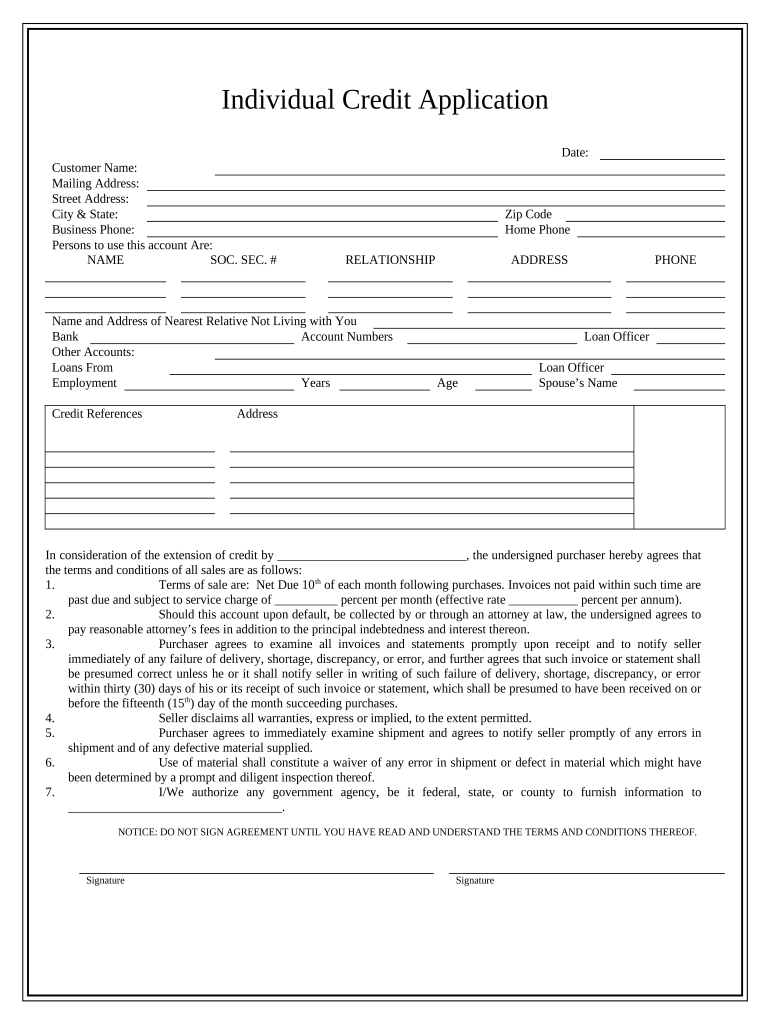

The Individual Credit Application Vermont is a formal document used by individuals seeking credit from financial institutions in Vermont. This application collects essential personal and financial information, allowing lenders to assess creditworthiness. The form typically requires details such as name, address, social security number, employment information, income, and existing debts. By completing this application, individuals initiate the process of obtaining loans or credit lines tailored to their financial needs.

How to use the Individual Credit Application Vermont

To use the Individual Credit Application Vermont effectively, follow these steps:

- Gather necessary personal and financial information, including income details, employment history, and existing liabilities.

- Access the application form through a reliable source, ensuring it is the most current version.

- Fill out the form accurately, providing truthful and comprehensive information to avoid delays.

- Review the completed application for any errors or omissions before submission.

- Submit the application to the lender via the preferred method, which may include online submission, mailing, or in-person delivery.

Steps to complete the Individual Credit Application Vermont

Completing the Individual Credit Application Vermont involves several key steps:

- Begin by downloading or accessing the application form.

- Fill in your personal information, including your full name, address, and contact details.

- Provide your social security number and date of birth for identity verification.

- Detail your employment status, including your employer's name, position, and duration of employment.

- List your monthly income, including any additional sources of revenue.

- Disclose any existing debts or financial obligations, such as loans or credit card balances.

- Sign and date the application, confirming the accuracy of the information provided.

Legal use of the Individual Credit Application Vermont

The Individual Credit Application Vermont is legally binding when completed and submitted according to state and federal regulations. It is essential to provide accurate and truthful information, as any discrepancies can lead to legal consequences or denial of credit. The application must comply with the Fair Credit Reporting Act, which protects consumers' rights regarding the use of their credit information. Additionally, lenders must adhere to the Equal Credit Opportunity Act, ensuring that all applicants are treated fairly and without discrimination.

Key elements of the Individual Credit Application Vermont

Several key elements are critical to the Individual Credit Application Vermont:

- Personal Information: Full name, address, social security number, and date of birth.

- Employment Details: Current employer, job title, and length of employment.

- Income Information: Monthly income and any additional sources of income.

- Debt Disclosure: Existing debts, including loans and credit card balances.

- Signature: A signature confirming the accuracy of the provided information.

Eligibility Criteria

Eligibility for the Individual Credit Application Vermont typically includes several criteria that applicants must meet:

- Applicants must be at least eighteen years old.

- Must possess a valid social security number.

- Must have a stable source of income to demonstrate repayment ability.

- Credit history may be evaluated to assess creditworthiness.

Quick guide on how to complete individual credit application vermont

Effortlessly Prepare Individual Credit Application Vermont on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Manage Individual Credit Application Vermont on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Easiest Way to Modify and Electronically Sign Individual Credit Application Vermont with Ease

- Find Individual Credit Application Vermont and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or save it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Individual Credit Application Vermont while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application Vermont?

An Individual Credit Application Vermont is a document that allows individuals to apply for credit in the state of Vermont. It collects necessary financial and personal information to assess creditworthiness. airSlate SignNow simplifies the submission of this application through its electronic signature capabilities.

-

How does airSlate SignNow help with the Individual Credit Application Vermont?

airSlate SignNow streamlines the process of filling out and submitting your Individual Credit Application Vermont. With its user-friendly interface, you can complete your application quickly and securely. The platform also provides an option to eSign, ensuring that your documents are valid and legally binding.

-

What are the pricing options for using airSlate SignNow for the Individual Credit Application Vermont?

airSlate SignNow offers various pricing plans to suit different business needs, including those who need to handle the Individual Credit Application Vermont. Each plan provides access to essential features such as tracking and managing signatures. You can choose a plan based on your volume of applications and additional features required.

-

Are there any benefits to using airSlate SignNow for my Individual Credit Application Vermont?

Using airSlate SignNow for your Individual Credit Application Vermont comes with numerous benefits, including efficiency and faster processing times. The platform reduces the need for paper documents, making it easier to store and manage applications electronically. Moreover, it enhances security by offering encrypted signing options.

-

Can I integrate airSlate SignNow with other tools for my Individual Credit Application Vermont?

Yes, airSlate SignNow provides integrations with various third-party applications, enhancing your workflow for processing the Individual Credit Application Vermont. This allows you to connect seamlessly with customer relationship management (CRM) systems, document management software, and other tools. Integration helps improve overall efficiency and data management.

-

Is it easy to eSign my Individual Credit Application Vermont using airSlate SignNow?

Absolutely! airSlate SignNow makes it very easy to eSign your Individual Credit Application Vermont. With just a few clicks, you can electronically add your signature using various secure methods, ensuring your application is completed quickly and correctly. This user-friendly feature is designed to save you time and hassle.

-

What support features are available when using airSlate SignNow for my Individual Credit Application Vermont?

airSlate SignNow offers robust support features for users handling the Individual Credit Application Vermont. You can access comprehensive FAQs, how-to guides, and customer support via chat or email. This ensures that any questions or issues you encounter can be resolved promptly.

Get more for Individual Credit Application Vermont

- N 470 application form

- Fillable online application for entrepreneur parole form

- Consent disclose information form

- Form i 765v instructions

- I 602 form

- Citizenship immigration services application form

- I 140 immigrant form

- Locksmith company application for license locksmith company application for license form

Find out other Individual Credit Application Vermont

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer