Non Foreign Affidavit under IRC 1445 Vermont Form

What is the Non Foreign Affidavit Under IRC 1445 Vermont

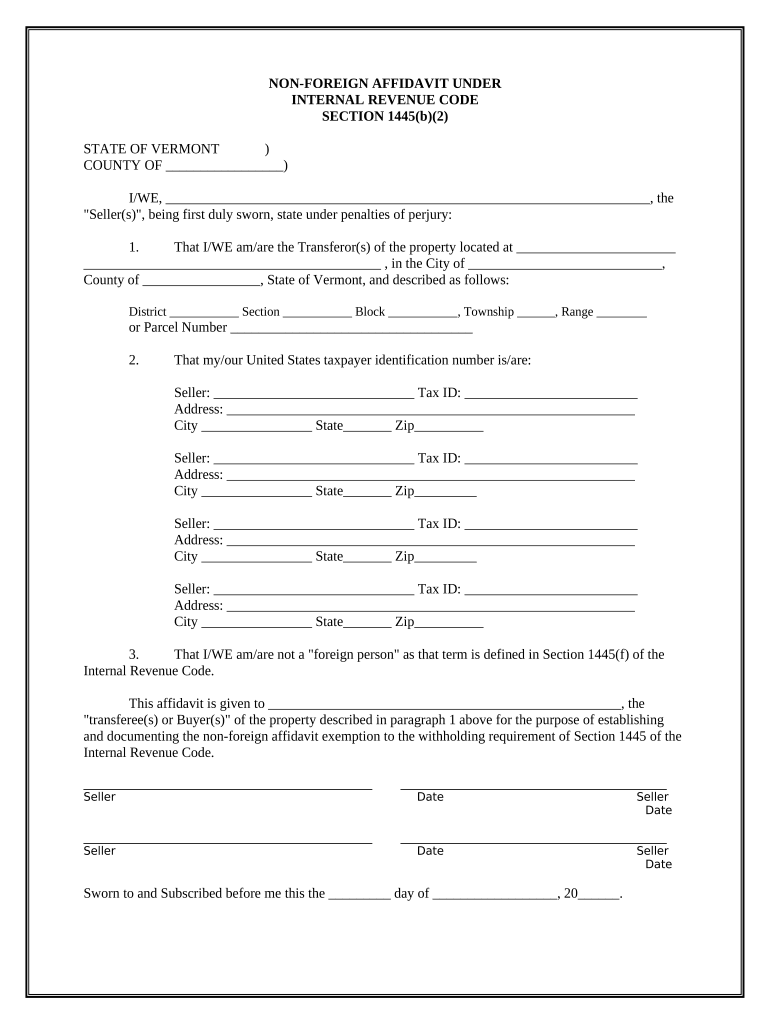

The Non Foreign Affidavit Under IRC 1445 in Vermont is a legal document used primarily in real estate transactions. This affidavit certifies that the seller of the property is not a foreign person, which is crucial for tax purposes. Under the Internal Revenue Code (IRC) Section 1445, buyers are required to withhold tax on the sale of U.S. real property interests if the seller is a foreign person. The affidavit helps to exempt the buyer from this withholding requirement by confirming the seller's status as a non-foreign individual or entity.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Vermont

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Gather necessary information, including the seller's tax identification number and property details.

- Fill out the affidavit form accurately, ensuring all information is current and correct.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the relevant parties involved in the transaction, typically the buyer or their legal representative.

Legal use of the Non Foreign Affidavit Under IRC 1445 Vermont

The legal use of the Non Foreign Affidavit Under IRC 1445 is essential to ensure compliance with federal tax regulations. By submitting this affidavit, sellers declare their non-foreign status, which protects buyers from potential tax liabilities associated with foreign sellers. It is important to ensure that the affidavit is executed properly, as any inaccuracies could lead to legal complications or financial penalties for both parties involved in the transaction.

Key elements of the Non Foreign Affidavit Under IRC 1445 Vermont

Key elements of the Non Foreign Affidavit Under IRC 1445 include:

- The seller's full name and address.

- The seller's taxpayer identification number.

- A declaration of the seller's non-foreign status.

- The property address being sold.

- Signature of the seller and acknowledgment by a notary public.

How to use the Non Foreign Affidavit Under IRC 1445 Vermont

To use the Non Foreign Affidavit Under IRC 1445, the seller must complete the form and provide it to the buyer or their agent during the closing process. This document should be included in the closing paperwork to ensure that all parties are aware of the seller's tax status. The buyer should retain a copy of the affidavit for their records, as it serves as proof of the seller's non-foreign status and protects them from withholding tax obligations.

State-specific rules for the Non Foreign Affidavit Under IRC 1445 Vermont

In Vermont, specific rules govern the use of the Non Foreign Affidavit Under IRC 1445. These rules may include requirements for notarization, specific language that must be included in the affidavit, and deadlines for submission during real estate transactions. It is advisable for sellers and buyers to consult with a legal professional or real estate expert familiar with Vermont laws to ensure compliance and avoid potential issues.

Quick guide on how to complete non foreign affidavit under irc 1445 vermont

Complete Non Foreign Affidavit Under IRC 1445 Vermont effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an optimal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Non Foreign Affidavit Under IRC 1445 Vermont on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Non Foreign Affidavit Under IRC 1445 Vermont without any hassle

- Find Non Foreign Affidavit Under IRC 1445 Vermont and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Non Foreign Affidavit Under IRC 1445 Vermont and ensure excellent communication throughout any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Vermont?

A Non Foreign Affidavit Under IRC 1445 Vermont is a legal document that certifies the non-foreign status of property sellers. It helps prevent withholding taxes on real estate transactions by confirming that the seller is not a foreign entity. Understanding this affidavit is crucial for buyers and sellers in Vermont to ensure compliance with federal tax laws.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 Vermont?

You need a Non Foreign Affidavit Under IRC 1445 Vermont to avoid potential withholding taxes when purchasing property from a seller. It provides proof that the seller is a U.S. person, thus exempting the transaction from automatic tax withholding. This ensures a smoother transaction process and protects your financial interests.

-

How does airSlate SignNow facilitate the signing of a Non Foreign Affidavit Under IRC 1445 Vermont?

airSlate SignNow simplifies the process of signing a Non Foreign Affidavit Under IRC 1445 Vermont by providing an intuitive eSignature platform. Users can upload, sign, and send documents securely from any device. This makes the entire process more efficient, reducing paperwork and saving time.

-

Is airSlate SignNow affordable for small businesses needing a Non Foreign Affidavit Under IRC 1445 Vermont?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including small enterprises. The platform's cost-effective solutions make it accessible for users needing to manage Non Foreign Affidavits Under IRC 1445 Vermont without breaking the bank. Investing in this service can streamline operations and save costs in the long run.

-

What features does airSlate SignNow offer for managing a Non Foreign Affidavit Under IRC 1445 Vermont?

airSlate SignNow comes with features tailored for managing documents like the Non Foreign Affidavit Under IRC 1445 Vermont. Key features include customizable templates, real-time tracking, and secure cloud storage. These tools help ensure your documents are handled efficiently and safely.

-

Can I integrate airSlate SignNow with other software for handling Non Foreign Affidavit Under IRC 1445 Vermont?

Absolutely! airSlate SignNow supports integrations with various business applications such as CRM systems and project management tools. This allows users handling Non Foreign Affidavits Under IRC 1445 Vermont to streamline workflows and improve overall efficiency when managing documents.

-

How secure is airSlate SignNow for signing a Non Foreign Affidavit Under IRC 1445 Vermont?

AirSlate SignNow prioritizes security with features like bank-level encryption and secure access controls, ensuring your Non Foreign Affidavit Under IRC 1445 Vermont is safe from unauthorized access. The platform complies with industry standards, providing peace of mind throughout the signing process.

Get more for Non Foreign Affidavit Under IRC 1445 Vermont

- March madness 2022 ncaa tournament first round schedule form

- Mandatory form of the rgie du logement lease

- First look governors inaugural budget proposal includes form

- What is an oral examination in court form

- Wwwnjcourtsgovforms10294oralexamapploverview of the oral examination for prospective court

- Special licensing and firearms brochure form

- Wwworegongovdorforms2021 publication or estimate oregon estimated income tax

- Exporters name and address form

Find out other Non Foreign Affidavit Under IRC 1445 Vermont

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure