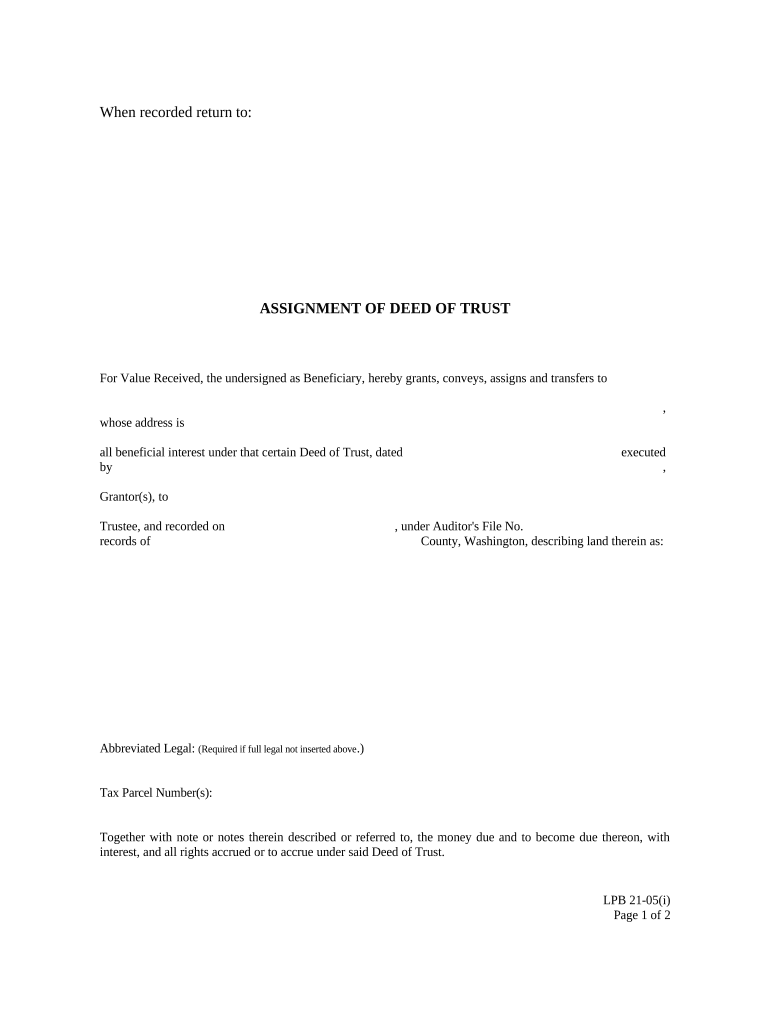

Washington Assignment Form

What is the deed trust individual?

A deed trust individual is a legal arrangement that allows an individual to hold property for the benefit of another person or group. This type of trust is often used in estate planning to manage assets and ensure they are distributed according to the individual's wishes after their passing. The individual, known as the grantor, transfers property into the trust, which is then managed by a trustee. The trustee has a fiduciary duty to manage the trust in the best interests of the beneficiaries.

Key elements of the deed trust individual

Several key elements define a deed trust individual. These include:

- Grantor: The person who creates the trust and transfers property into it.

- Trustee: The individual or institution responsible for managing the trust assets and ensuring compliance with the trust's terms.

- Beneficiaries: The individuals or entities that will benefit from the trust, receiving assets or income as specified in the trust document.

- Trust document: A legal document outlining the terms of the trust, including how assets are to be managed and distributed.

Steps to complete the deed trust individual

Completing a deed trust individual involves several important steps:

- Determine the purpose: Clearly define the reasons for creating the trust, such as asset protection or estate planning.

- Select a trustee: Choose a reliable person or institution to manage the trust.

- Draft the trust document: Work with a legal professional to create a comprehensive trust document that outlines the terms and conditions.

- Transfer assets: Legally transfer ownership of the property or assets into the trust.

- Review and update: Regularly review the trust to ensure it meets current needs and legal requirements.

Legal use of the deed trust individual

The legal use of a deed trust individual is primarily to manage and protect assets. It allows for a smooth transition of property upon the grantor's death, minimizing probate complications. Furthermore, it can provide tax benefits and protect assets from creditors. Understanding the legal implications and requirements is crucial to ensure the trust is valid and enforceable under state law.

State-specific rules for the deed trust individual

Each state in the U.S. has its own laws governing trusts, including deed trusts. It is essential to be aware of state-specific rules that may affect the creation and management of a deed trust individual. These rules can include requirements for the trust document, the powers of the trustee, and the rights of beneficiaries. Consulting with a legal expert familiar with local laws can help ensure compliance and effectiveness.

Examples of using the deed trust individual

Deed trusts can be utilized in various scenarios, such as:

- Protecting family assets from potential creditors.

- Providing for minor children or dependents by controlling how and when they receive assets.

- Avoiding probate by transferring assets directly to beneficiaries upon the grantor's death.

- Facilitating charitable giving by establishing a trust for a specific charity or cause.

Quick guide on how to complete washington assignment 497429622

Prepare Washington Assignment easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and easily. Manage Washington Assignment on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

Ways to edit and eSign Washington Assignment effortlessly

- Locate Washington Assignment and click Get Form to kick off.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this function.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Washington Assignment and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed trust individual?

A deed trust individual is a legal arrangement where a person holds the property for the benefit of another. This setup allows for clear delineation of rights and responsibilities, making it an effective estate planning tool.

-

How can airSlate SignNow assist with creating a deed trust individual document?

airSlate SignNow provides intuitive templates and tools for creating a deed trust individual document quickly and efficiently. With its eSigning capabilities, you can collect signatures easily, ensuring your documents are legally binding.

-

What are the benefits of using airSlate SignNow for deed trust individual agreements?

Using airSlate SignNow streamlines the process of signing deed trust individual agreements, saving you time and reducing paperwork. Its secure platform ensures that your documents are safe and accessible from anywhere.

-

Is there a cost associated with using airSlate SignNow for deed trust individual documents?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including those who require deed trust individual services. The cost is competitive, especially when considering the value of its features and security.

-

Can I integrate airSlate SignNow with other tools for managing deed trust individual documents?

Absolutely! airSlate SignNow seamlessly integrates with various productivity tools and applications, enhancing your ability to manage deed trust individual documents alongside your existing workflows.

-

How secure is airSlate SignNow for handling deed trust individual files?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance measures to protect your deed trust individual files. This ensures that your sensitive information remains confidential and secure.

-

What features does airSlate SignNow offer for effective management of deed trust individual agreements?

airSlate SignNow offers features like automated templates, real-time tracking, and customizable workflows to effectively manage deed trust individual agreements. These tools simplify the signing process and keep you organized.

Get more for Washington Assignment

- Tutorship of form

- Justia order for trustee to act as attorney or accountant form

- Petition for declaration of death form

- State of louisiana 16th judicial district court in re parish form

- On this day of 20 i certify that the preceding following attached form

- Massachusetts acknowledgmentsindividualus legal forms

- Request to add attorney or amend attorney information

- Petition for forfeiture c90 s24w form

Find out other Washington Assignment

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form