Mortgage Statutory Form with Representative Acknowledgment Washington

What is the mortgage statutory form with representative acknowledgment Washington

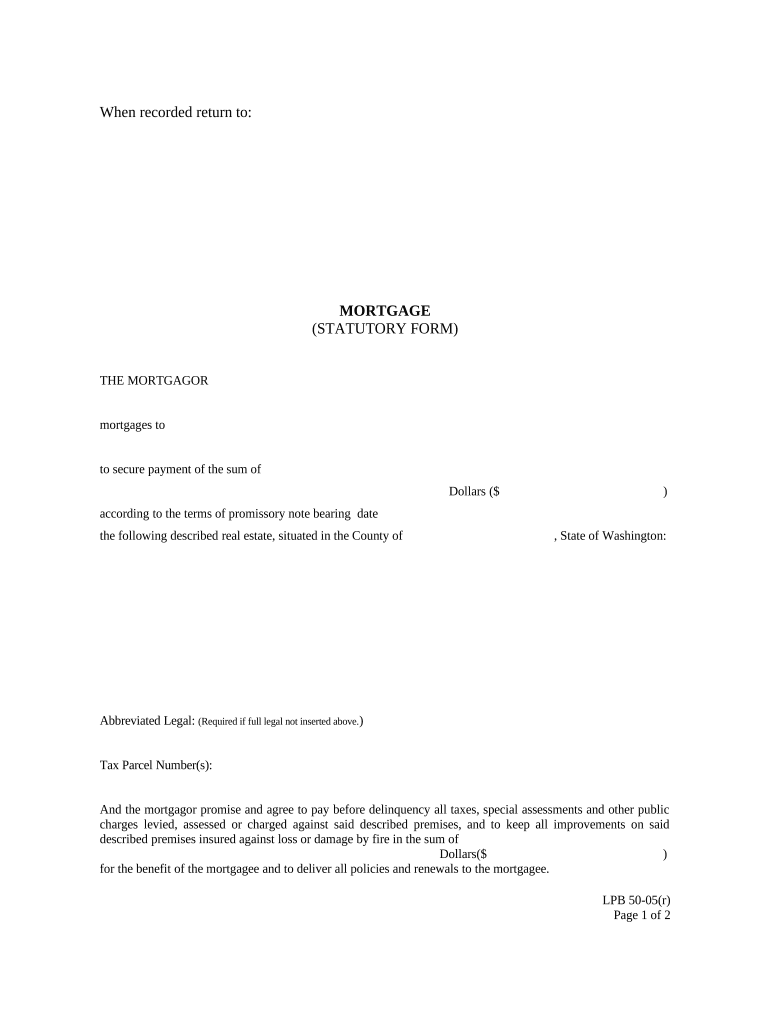

The mortgage statutory form with representative acknowledgment Washington is a specific legal document used in the state of Washington. It serves to formalize the acknowledgment of a mortgage agreement, ensuring that all parties involved understand their rights and obligations. This form typically includes essential details such as the names of the parties, the property address, and the terms of the mortgage. Its primary purpose is to provide a clear record of the agreement, which can be referenced in case of disputes or legal proceedings.

Key elements of the mortgage statutory form with representative acknowledgment Washington

Understanding the key elements of the mortgage statutory form is crucial for its proper execution. The form generally includes:

- Parties involved: Names and addresses of the borrower and lender.

- Property description: A detailed description of the property being mortgaged.

- Loan amount: The total amount of money being borrowed.

- Interest rate: The rate at which interest will accrue on the loan.

- Repayment terms: Information on how and when the borrower will repay the loan.

- Signatures: Required signatures of all parties involved, along with dates.

Steps to complete the mortgage statutory form with representative acknowledgment Washington

Completing the mortgage statutory form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal details of all parties and property information.

- Fill out the form accurately, ensuring that all sections are completed.

- Review the form for any errors or omissions before signing.

- Have all parties sign the form in the presence of a notary public to ensure legal validity.

- Make copies of the signed document for all parties involved.

- Submit the form to the appropriate county office for recording, if required.

Legal use of the mortgage statutory form with representative acknowledgment Washington

The legal use of the mortgage statutory form is essential for protecting the rights of all parties involved. When executed properly, this form serves as a legally binding agreement that can be enforced in a court of law. It is crucial that the form complies with state laws and regulations, including proper notarization and recording. Failure to adhere to these legal requirements may result in the form being deemed invalid, which can lead to complications in the mortgage process.

How to use the mortgage statutory form with representative acknowledgment Washington

Using the mortgage statutory form effectively involves understanding its purpose and the process for completion. This form is typically utilized during the mortgage application process and must be filled out accurately to reflect the terms agreed upon by the borrower and lender. Once completed, it should be signed in front of a notary public, ensuring that all parties' identities are verified. After notarization, the form may need to be filed with the local government office to officially record the mortgage.

State-specific rules for the mortgage statutory form with representative acknowledgment Washington

Each state has specific rules governing the use of mortgage statutory forms. In Washington, it is important to be aware of the following regulations:

- The form must be notarized by a licensed notary public.

- It should be filed with the county auditor's office for public record.

- All parties must provide valid identification during the signing process.

- Specific language may be required in the acknowledgment section to comply with state law.

Quick guide on how to complete mortgage statutory form with representative acknowledgment washington

Complete Mortgage Statutory Form With Representative Acknowledgment Washington effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, amend, and eSign your documents swiftly without delays. Manage Mortgage Statutory Form With Representative Acknowledgment Washington on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Mortgage Statutory Form With Representative Acknowledgment Washington with minimal effort

- Locate Mortgage Statutory Form With Representative Acknowledgment Washington and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, through email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Alter and eSign Mortgage Statutory Form With Representative Acknowledgment Washington to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage statutory form?

A mortgage statutory form is a legal document required in certain jurisdictions to secure the loan against real property. It outlines the terms of the mortgage agreement and serves to protect the lender's interests. Understanding this form is crucial for anyone looking to secure a mortgage.

-

How can airSlate SignNow help with mortgage statutory forms?

airSlate SignNow simplifies the process of sending and signing mortgage statutory forms by providing a user-friendly online platform. With our service, users can quickly prepare, send, and eSign these forms from anywhere, ensuring a smoother mortgage application experience. Our solution increases efficiency while maintaining compliance with legal standards.

-

What features does airSlate SignNow offer for handling mortgage statutory forms?

Our platform offers several features tailored for mortgage statutory forms, such as customizable templates, document storage, and real-time tracking of signatures. Additionally, users can set reminders for signatory actions and utilize in-person signing capabilities. These features streamline the signing process and enhance overall document management.

-

Are there any costs associated with using airSlate SignNow for mortgage statutory forms?

Yes, airSlate SignNow offers various pricing plans depending on your needs, with options suitable for individuals and businesses alike. The costs are competitive and aim to provide value by enhancing your document management capabilities for mortgage statutory forms. You can start with a free trial to explore our features before making a commitment.

-

What are the benefits of using airSlate SignNow for eSigning mortgage statutory forms?

Using airSlate SignNow for eSigning mortgage statutory forms offers numerous benefits, including faster turnaround times and reduced paperwork. Our electronic signature solution enhances the security and authenticity of your documents. Moreover, it makes the process more convenient for all parties involved, saving time and resources.

-

Can I integrate airSlate SignNow with other software for mortgage statutory forms?

Absolutely! airSlate SignNow supports a variety of integrations with popular software tools, enhancing your workflow for mortgage statutory forms. Whether you're using CRM systems or project management apps, integrating our solution can signNowly streamline your document processes. Check our integration options to see what fits your needs best.

-

Is airSlate SignNow compliant with legal regulations for mortgage statutory forms?

Yes, airSlate SignNow complies with electronic signature laws, ensuring that your mortgage statutory forms are legally binding. Our platform adheres to industry standards for data security and privacy, giving you peace of mind when sending sensitive documents. It's essential to know that using our service keeps you aligned with legal requirements.

Get more for Mortgage Statutory Form With Representative Acknowledgment Washington

- Maryland motor vehicle bill of sale form templates

- Bill of sale of automobile and odometer disclosure form

- Optional notice required only if the homeowner has borrowed or is borrowing money to form

- Notice to contractors regarding new requirements for home form

- Home improvement guide maryland consumer rights form

- Waste disposalhaulinghazardous waste handling form

- Optional notice required only if the homeowner has borrowed or is borrowing money to finance the form

- Glossary of terms cloudcroft properties form

Find out other Mortgage Statutory Form With Representative Acknowledgment Washington

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed