Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Washington Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

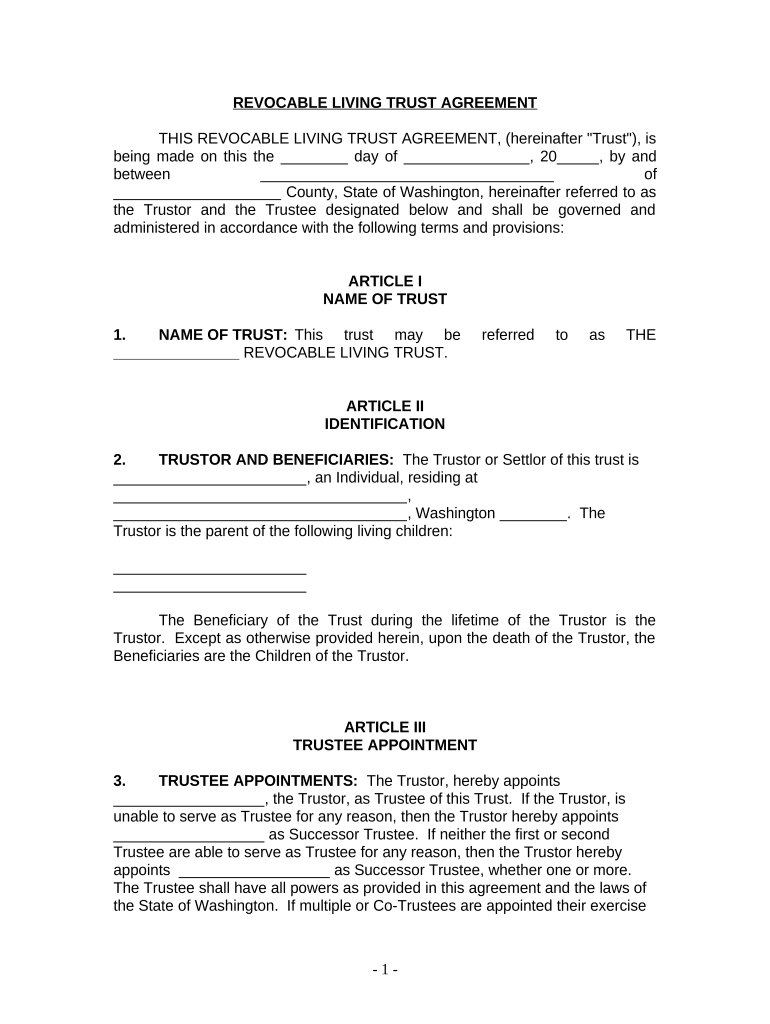

A living trust for individuals who are single, divorced, or widowed with children in Washington is a legal arrangement that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. It is particularly beneficial for those with children, as it allows for clear instructions regarding guardianship and asset management for minors.

How to use the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

Using a living trust involves several steps. First, you need to identify the assets you want to place in the trust, which may include real estate, bank accounts, and investments. Next, you will create the trust document, detailing how the assets will be managed and distributed. It is essential to designate a trustee, who will be responsible for managing the trust according to your wishes. Finally, you will need to transfer ownership of the identified assets into the trust, ensuring they are legally held by the trust.

Steps to complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

Completing a living trust involves a systematic approach:

- Gather Information: Collect details about your assets, including property titles, account numbers, and any relevant documentation.

- Draft the Trust Document: You can either use a template or hire an attorney to draft a custom document that meets your needs.

- Designate a Trustee: Choose a reliable individual or institution to manage the trust.

- Transfer Assets: Legally transfer ownership of your assets into the trust by changing titles and beneficiary designations.

- Review and Update: Periodically review the trust to ensure it reflects your current wishes and circumstances.

Legal use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

The legal use of a living trust in Washington is recognized by state law, provided it meets specific requirements. The trust must be properly executed, which typically includes signing in front of a notary. It is essential that the trust document clearly outlines the terms, beneficiaries, and the powers granted to the trustee. This ensures that the trust is enforceable and that your wishes are honored after your passing.

State-specific rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

Washington state has specific regulations regarding living trusts. The trust must comply with the Revised Code of Washington (RCW) and must be executed in accordance with state laws. It is important to ensure that the trust is funded correctly and that all assets are retitled in the name of the trust. Additionally, Washington does not impose a state inheritance tax, which can be beneficial for beneficiaries receiving assets from a living trust.

Key elements of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

Key elements of a living trust include:

- Trustee: The individual or entity responsible for managing the trust.

- Beneficiaries: The individuals or organizations that will receive the trust assets.

- Trust Property: The assets placed into the trust.

- Trust Terms: Instructions on how the assets should be managed and distributed.

- Revocability: Most living trusts are revocable, allowing the grantor to change terms or dissolve the trust at any time during their lifetime.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children washington

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the essential tools to create, revise, and electronically sign your documents rapidly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington on any device using airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

The easiest way to modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington without any hassle

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington is a legal document that allows you to manage your assets during your lifetime and dictate their distribution after your death. This type of trust is particularly beneficial as it simplifies the process for your children while ensuring your wishes are honored.

-

How does a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington benefit my family?

Establishing a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington can protect your children’s inheritance and avoid probate court, which can be lengthy and costly. It provides peace of mind knowing that your assets will be distributed according to your wishes, allowing for a smoother transition for your loved ones.

-

What are the costs associated with creating a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington?

The costs of setting up a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington can vary based on complexity and the service providers you choose. On average, fees may range from a few hundred to a couple of thousand dollars, depending on your specific needs and requirements.

-

Can I update my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington?

Yes, one of the key features of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington is that it is revocable. This means that you can update, modify, or revoke your trust at any time, ensuring that it remains aligned with your current circumstances and wishes.

-

What documents are needed to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington?

To create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington, you'll need to provide documentation regarding your assets, any prior wills, and information about your beneficiaries. Additionally, it might be beneficial to have legal advice to ensure that everything is accurately prepared and executed.

-

How does airSlate SignNow simplify the process of creating a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington?

airSlate SignNow provides an easy-to-use platform that allows individuals to draft and eSign their Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington documents conveniently. With step-by-step guidance and templates available, it makes the process efficient and cost-effective.

-

Are there any integrations available with airSlate SignNow for my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington?

Yes, airSlate SignNow integrates with various applications to streamline the management of your Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington. This allows for seamless sharing and collaboration with legal professionals or family members involved in the trust process.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

- The court instructs the jury that should you find from a preponderance of the evidence form

- By and through hisher attorneys form

- Administratrix of the form

- Useful terms in motor vehicle accident lawsuit settlement or form

- By and through hisher form

- Motherfather and next friend form

- Proposed defendant intervenors motion to intervene 417 cv form

- Files this answer and responds to the complaint as follows form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Washington

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later