Wi Homestead Form

What is the Wi Homestead Form

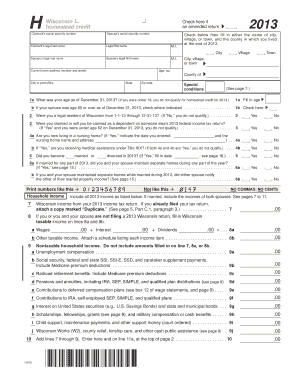

The Wi Homestead Form is a crucial document used in Wisconsin for property tax relief. It allows eligible homeowners to claim a property tax credit based on their income and property taxes paid. This form is designed to assist low-income residents, particularly seniors and disabled individuals, in managing their property tax burdens. By completing this form, homeowners can potentially receive significant financial assistance, making homeownership more affordable.

How to use the Wi Homestead Form

Using the Wi Homestead Form involves several straightforward steps. First, homeowners must gather necessary information, including their income details and property tax statements. Next, they should carefully fill out the form, ensuring all required fields are completed accurately. After completing the form, it can be submitted either online or via mail, depending on the homeowner's preference. It is essential to keep a copy of the submitted form for personal records.

Steps to complete the Wi Homestead Form

Completing the Wi Homestead Form requires attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and property tax bills.

- Download the Wi Homestead Form from the official state website or obtain a physical copy.

- Fill in personal information, including name, address, and Social Security number.

- Provide details about your property, including the assessed value and property taxes paid.

- Report your total income for the previous year, ensuring accuracy.

- Review all entries for correctness before submission.

- Submit the completed form online or mail it to the appropriate state office.

Legal use of the Wi Homestead Form

The legal use of the Wi Homestead Form is governed by state laws and regulations. To ensure compliance, homeowners must meet specific eligibility criteria, such as income limits and residency requirements. The form must be submitted within the designated filing period to qualify for the property tax credit. Failure to adhere to these legal stipulations may result in the denial of the claim or penalties.

Eligibility Criteria

To qualify for the benefits associated with the Wi Homestead Form, applicants must meet certain eligibility criteria. Generally, homeowners must be residents of Wisconsin and occupy the property as their primary residence. Additionally, there are income limits that vary based on household size. Seniors aged sixty-five and older, as well as individuals with disabilities, may have different thresholds. It is important to review the current guidelines to determine eligibility before applying.

Required Documents

When completing the Wi Homestead Form, several documents are required to support the application. Homeowners must provide proof of income, such as W-2 forms or tax returns, along with property tax statements that detail the amount paid. Additionally, identification documents, such as a driver's license or Social Security card, may be necessary to verify identity and residency. Ensuring all required documents are included will facilitate a smoother application process.

Form Submission Methods

Homeowners can submit the Wi Homestead Form through various methods. The most convenient option is online submission, which allows for immediate processing. Alternatively, homeowners may choose to mail the completed form to the designated state office. In-person submissions may also be accepted at local government offices, providing another avenue for residents to file their claims. Each method has its own timeline for processing, so it is beneficial to choose the one that best fits individual needs.

Quick guide on how to complete wi homestead form

Complete Wi Homestead Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without holdups. Manage Wi Homestead Form on any device using the airSlate SignNow apps for Android or iOS, and simplify any document process today.

How to alter and eSign Wi Homestead Form effortlessly

- Find Wi Homestead Form and click on Get Form to begin.

- Employ the tools available to finalize your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Recheck all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Modify and eSign Wi Homestead Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wi homestead form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wi Homestead Form and why is it important?

The Wi Homestead Form is a critical document for property owners in Wisconsin seeking to claim a property tax exemption. This form can help reduce your tax liability, making it an essential item for homeowners. Completing the Wi Homestead Form accurately through airSlate SignNow ensures you don't miss any potential savings.

-

How can airSlate SignNow assist with the Wi Homestead Form?

airSlate SignNow simplifies the process of filling out and submitting the Wi Homestead Form electronically. Our platform enables users to easily edit, sign, and send the form while ensuring compliance with state regulations. By using our service, you can complete the Wi Homestead Form quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the Wi Homestead Form?

airSlate SignNow offers a cost-effective solution for managing the Wi Homestead Form and other paperwork. Our pricing plans are designed to be budget-friendly, making it accessible for individual homeowners or businesses. Check our plans to find the one that fits your needs and start using the Wi Homestead Form today.

-

What features does airSlate SignNow provide for the Wi Homestead Form?

airSlate SignNow offers a variety of features that enhance the efficiency of managing the Wi Homestead Form. This includes easy document editing, secure electronic signatures, and cloud storage for easy access. Our user-friendly interface makes completing the Wi Homestead Form a breeze, ensuring you can focus on what matters most.

-

Can I integrate airSlate SignNow with other applications for the Wi Homestead Form?

Yes, airSlate SignNow integrates seamlessly with multiple applications to streamline the process of managing the Wi Homestead Form. Whether you need to connect with CRM systems, cloud storage, or project management tools, our integration options ensure a smooth workflow. This capability enhances your overall experience when dealing with the Wi Homestead Form.

-

Is airSlate SignNow secure for handling my Wi Homestead Form?

Absolutely, airSlate SignNow prioritizes the security of your documents, including the Wi Homestead Form. Our platform is built with industry-leading encryption and compliance measures to protect your sensitive information. You can confidently handle your Wi Homestead Form, knowing your data is secure with us.

-

How do I get started with the Wi Homestead Form using airSlate SignNow?

Getting started with the Wi Homestead Form on airSlate SignNow is simple. First, sign up for an account, then access our platform to fill out the form electronically. Our guided setup ensures you understand each step, allowing you to submit your Wi Homestead Form efficiently.

Get more for Wi Homestead Form

- South dakota annual form

- Notices resolutions simple stock ledger and certificate south dakota form

- Minutes for organizational meeting south dakota south dakota form

- South dakota file form

- Lead based paint disclosure for sales transaction south dakota form

- Lead based paint disclosure for rental transaction south dakota form

- Notice of lease for recording south dakota form

- Sample cover letter for filing of llc articles or certificate with secretary of state south dakota form

Find out other Wi Homestead Form

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template