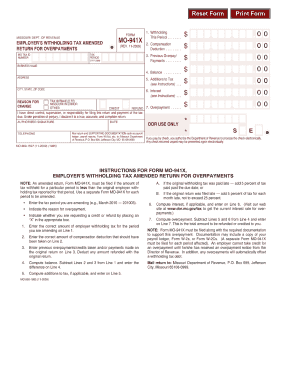

Mo 941x Form

What is the MO 941X?

The MO 941X form is a tax amendment form used by businesses in Missouri to correct previously filed Missouri corporate income tax returns. This form allows taxpayers to make adjustments to their reported income, deductions, or credits. It is essential for ensuring that the tax records accurately reflect the business's financial situation, which can help avoid potential penalties or issues with the Missouri Department of Revenue.

How to use the MO 941X

Using the MO 941X involves several key steps. First, gather all relevant documentation related to the original tax return that needs correction. This may include financial statements, receipts, and prior tax filings. Next, accurately complete the MO 941X form, ensuring that all changes are clearly indicated. Finally, submit the completed form to the Missouri Department of Revenue, either electronically or by mail, depending on your preference and the department's guidelines.

Steps to complete the MO 941X

Completing the MO 941X requires careful attention to detail. Follow these steps:

- Review your original tax return to identify the specific areas that need correction.

- Obtain the latest version of the MO 941X form from the Missouri Department of Revenue website.

- Fill out the form, clearly indicating the corrections made to each line item.

- Attach any supporting documentation that justifies the changes.

- Double-check the completed form for accuracy before submission.

- Submit the form to the appropriate address or electronically as per the department's instructions.

Legal use of the MO 941X

The MO 941X must be used in compliance with Missouri tax laws. It is legally binding when completed and submitted correctly, ensuring that any amendments made to prior tax returns are officially recognized. Taxpayers should be aware that failure to properly use this form can lead to legal repercussions, including fines or audits by the Missouri Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the MO 941X are crucial to avoid penalties. Typically, the form must be submitted within three years from the original filing date of the tax return being amended. It is essential to stay informed about any changes to tax laws or deadlines announced by the Missouri Department of Revenue to ensure timely compliance.

Required Documents

When completing the MO 941X, certain documents are required to support the amendments. These may include:

- Copy of the original tax return.

- Documentation supporting the changes, such as receipts or financial statements.

- Any correspondence received from the Missouri Department of Revenue regarding the original filing.

Who Issues the Form

The MO 941X is issued by the Missouri Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Missouri. Taxpayers should refer to the department's official resources for the most current versions of forms and guidelines for submission.

Quick guide on how to complete mo 941x

Complete Mo 941x seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle Mo 941x on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign Mo 941x effortlessly

- Obtain Mo 941x and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that function.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Mo 941x and guarantee superior communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 941x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo 941x form and why is it important?

The mo 941x form is an adjustment form used to correct errors on previous Missouri employer withholding tax returns. It's important because accurate reporting ensures compliance with state tax laws and shields businesses from potential penalties.

-

How can airSlate SignNow assist in filing the mo 941x form?

airSlate SignNow enables businesses to digitally sign and send the mo 941x form securely. Our platform streamlines the submission process, ensuring that corrections are made quickly and efficiently, which is crucial for maintaining tax compliance.

-

What features does airSlate SignNow offer for document management related to mo 941x?

airSlate SignNow provides robust document management features, such as templates and reminders for filing the mo 941x. These features help users keep track of deadlines and manage their tax documentation seamlessly.

-

Is airSlate SignNow cost-effective for businesses needing to file mo 941x?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to eSign and send the mo 941x form. Our pricing plans are designed to accommodate various business sizes, ensuring that you receive value without compromising functionality.

-

Can airSlate SignNow integrate with accounting software for filing the mo 941x?

Absolutely! airSlate SignNow seamlessly integrates with major accounting software, allowing users to manage their financial documents, including the mo 941x, in one place. This integration enhances efficiency and reduces the risk of errors during tax filing.

-

What benefits does airSlate SignNow provide for remote teams filing the mo 941x?

For remote teams, airSlate SignNow offers the benefit of easy collaboration on documents like the mo 941x, regardless of location. Team members can sign and share documents in real-time, facilitating quicker adjustments to tax filings.

-

How secure is the process of eSigning the mo 941x with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. Our platform employs advanced encryption and authentication protocols, ensuring that the eSigning process for the mo 941x is both secure and compliant with legal requirements.

Get more for Mo 941x

- Form it 241 claim for clean heating fuel credit tax year

- Sc2210 sc department of revenue form

- Form it 637 alternative fuels and electric vehicle recharging

- Tax form 1098 t hawaii pacific university

- Instructions for form it 112 r new york state resident tax

- 502b 121322 a 502b 121322 a form

- Form it 256 claim for special additional mortgage recording

- Form it 205 a fiduciary allocation tax year 2022

Find out other Mo 941x

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online