New York State Department of Taxation and Financedivision of the Treasury Form 2011

What is the New York State Department Of Taxation And Financedivision Of The Treasury Form

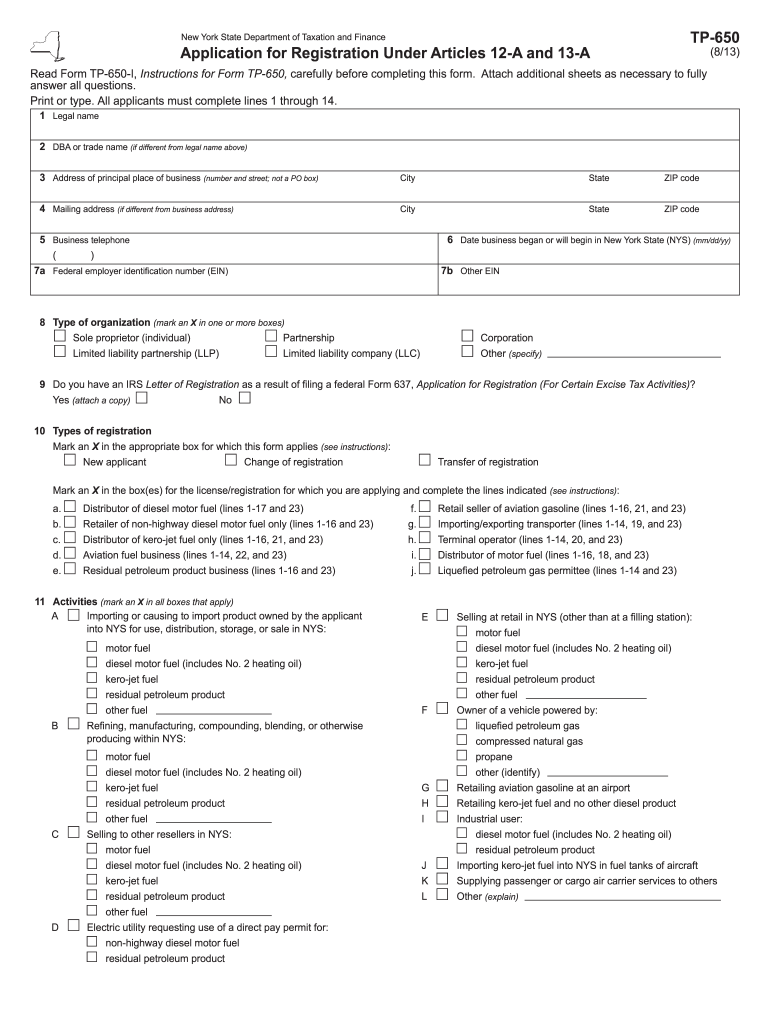

The New York State Department Of Taxation And Financedivision Of The Treasury Form is a crucial document used for various tax-related purposes within the state of New York. This form is designed to facilitate the reporting of income, deductions, and credits for individuals and businesses. It serves as an official record for taxpayers to declare their financial information to the state government, ensuring compliance with state tax laws.

How to use the New York State Department Of Taxation And Financedivision Of The Treasury Form

Using the New York State Department Of Taxation And Financedivision Of The Treasury Form involves several steps. First, ensure you have the correct version of the form, as there may be updates or changes. Next, gather all necessary financial documents, including income statements and previous tax returns. Carefully fill out the form, ensuring all information is accurate and complete. Once completed, you can submit the form electronically or via mail, depending on your preference and the submission guidelines provided by the state.

Steps to complete the New York State Department Of Taxation And Financedivision Of The Treasury Form

Completing the New York State Department Of Taxation And Financedivision Of The Treasury Form requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the official state website.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income, deductions, and any applicable credits.

- Review the form for accuracy before signing it.

- Submit the form according to the specified submission methods.

Legal use of the New York State Department Of Taxation And Financedivision Of The Treasury Form

The legal use of the New York State Department Of Taxation And Financedivision Of The Treasury Form is essential for compliance with state tax regulations. This form must be completed truthfully and submitted within the designated deadlines to avoid penalties. The information provided on the form is subject to verification by the state, and any discrepancies could lead to legal consequences. Therefore, it is important to ensure that all entries are accurate and supported by appropriate documentation.

Form Submission Methods

There are multiple methods for submitting the New York State Department Of Taxation And Financedivision Of The Treasury Form. Taxpayers can choose to file online through the state’s electronic filing system, which offers a quick and efficient way to submit forms. Alternatively, forms can be printed and mailed to the appropriate tax office. In some cases, in-person submission may also be available, depending on the specific requirements of the form and the taxpayer's situation.

Filing Deadlines / Important Dates

Filing deadlines for the New York State Department Of Taxation And Financedivision Of The Treasury Form are critical to ensure compliance and avoid penalties. Typically, individual tax returns are due by April fifteenth each year, while business tax deadlines may vary based on the entity type. It is advisable to check the official state tax website for the most current deadlines and any extensions that may apply. Keeping track of these dates helps taxpayers plan their filings and avoid last-minute issues.

Quick guide on how to complete new york state department of taxation and financedivision of the treasury 2011 form

Your assistance manual on how to prepare your New York State Department Of Taxation And Financedivision Of The Treasury Form

If you're looking to understand how to generate and submit your New York State Department Of Taxation And Financedivision Of The Treasury Form, here are some concise instructions on how to simplify the tax filing process.

Initially, you simply need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, draft, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit answers as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and straightforward sharing capabilities.

Follow the instructions below to complete your New York State Department Of Taxation And Financedivision Of The Treasury Form in just a few minutes:

- Create your account and start working on PDFs almost instantly.

- Utilize our directory to locate any IRS tax form; browse through different versions and schedules.

- Click Get form to open your New York State Department Of Taxation And Financedivision Of The Treasury Form in our editor.

- Populate the necessary fillable sections with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and amend any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Note that paper filing can increase the likelihood of errors and delay refunds. Before e-filing your taxes, be sure to consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct new york state department of taxation and financedivision of the treasury 2011 form

FAQs

-

What does the New York State Department of Taxation and Finance require as proof of non-residency?

If you could prove your ties to Florida by producing documents such as a FL drivers license, voter ID and similar documents, you maybe able to prove non residency. These are just one of the main critetirea. You can refer to Form IT 203 instructions and publications on NY department of revenue site for more details.

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

How did the different islands and territories come together to make the state of New York?

They didn't "come together", they were negotiated by colonial politicians.In 1607-1609, Henry Hudson explored the region on behalf of the Dutch, including sailing up what became the Hudson River. He reported back about the potential for beaver furs in the area. Subsequent voyages in 1611-1614 established a year-round fur-trading post on the site of what became Albany. Those Dutch traders likewise established a fur-trading post at the southern tip of what's now Manhattan island, dubbing it New Amsterdam, which became year-round in 1614. It was in a very strategic spot: the port of (what became) New York is the best natural seaport on the east coast of the continent, it guards the passage up and down the river, and the ground is pretty solid even at the southern tip at the Battery (and on Governors Island), so you can fortify it easily.The layout of that port is pretty convenient, too: it's shielded from most storms by the network of islands around there, and accessible through The Narrows, in between Lange Eylandt (long island - Bay Ridge brooklyn) and Staten Eylandt. Basically, if you were drafting New World real estate, you'd make that spot first pick.The colony grew, particularly once it was made an official colony of Holland in 1624 and not merely a private commercial outpost. Over the next 40 years, they fortified larger chunks of Manhattan, put in saw mills, churches and so on, and tried to keep things peaceful with the native Lenape tribes in the area. Resident Adriaen van der Donck made some drawings of the area, went back to Holland, and persuaded a number of people to sail to this new world and settle there. Various other noblemen in Holland occasionally obtained deeds to territory and financed settlement expeditions, including the east side of Staten Eylandt and the west parts of Lange Eylandt, including the village of Breukelyn (Brooklyn).Unfortunately, they were pretty outnumbered in the region. Here's how the colonies looked in 1664:The English had already kicked out some Dutch settlers that were up by (what's now) New Saybrook, CT, and in 1664, a bunch of English warships sailed into Manhattan harbor and demanded the surrender of the colony, which was renamed New York. Its possession went back and forth a few times in subsequent wars, but the facts on the ground stayed the same: it was mostly Dutch settlers on Manhattan and in the Hudson valley, and English settlers east of there.(for more on this, read The Island at the Center of the Universe, by Russell Shorto - it's a fascinating account of the Dutch colony, with the benefit of a huge amount of newly-discovered and translated works written in the Dutch language of the time).Staten Island was administered from the Dutch (and now English) colonies from the beginning, and treated as a separate jurisdiction by the new government of New York. The second Governor of New York, Francis Lovelace, moved there himself, and there was semi-regular boat service available between Manhattan and the settlements on Staten Island.In 1683, after the final English-Dutch war had returned possession of New York to England, the new Governor Col. Dougan called a general assembly of the people's representatives, which among numerous legislative changes re-defined the counties of the territory for purposes of administration. Their declarations created the present county divisions of New York City, among them:"The county of Richmond to contain all Staten Island, Shutter's Island, and the islands of meadow on the west side thereof."(from History of Richmond County, Part 1, by Richard Bayles)Meanwhile, the King of England had granted the lands in between the Hudson and Delaware rivers to two of his friends who had protected him in the English Civil War, from the island of Jersey. They proclaimed a new colony of New Jersey, and there were immediate disputes over whether that royal grant had included Staten Island or not. After some confusion, the Duke of York proclaimed that all islands in New York harbor which could be circumnavigated in 24 hours would remain in his possession; otherwise, they would be yielded to New Jersey.Some guy named Christopher Billop took up the task of sailing around the island, and did so just under the allotted 24 hours, securing it to the Duke. For his troubles he got a huge grant of land on the south side of the island, on or about 1683. But the question wasn't considered settled, and came back up a couple of times during the Colonial period and later as New Jersey agitated for rights over Staten Island. The question wasn't finally settled, and rights divided to both states' satisfaction, until 1833, a full 150 years later.So in total, the territory of New York (including Staten Island and Long Island) came to be defined by the original fur-trading outposts of Albany and Schenectady, by the border disputes with New Jersey, and the early expansion of English settlements that became Connecticut and Rhode Island. How upstate New York got defined, I'll leave to someone else's telling, but I always loved the story of sailing around Staten Island in 24 hours.

-

How big, economically and in real power, would the US be if the states of Texas, California and New York decided to retract?

Economically, there will be an immediate loss of GDP of 5.417 Trillion Dollars. That is 32% of American GDP, or one third of American GDP. The power and influence of the USA will be affected by this move, as now it will be behind EU and almost equal to China in GDP(nominal).Population wise, it will a lose of 85.51 Million people. That too the higher end population, which is better than Rest of the Nation (in general), loss of some very best universities of the world, loss of Silicon Valley, Loss of NYC, loss of holly wood, loss of some very important and strategic Army bases, quite a loss of trade on the western coast.Additionally, if they all decide to be separate countries, USA will be surrounded by 5 nations, 3 of them will not be so supportive and hence further tensions on the border.In short, IMO, USA would not be able to bear the expenses to loose these states.

-

How do I get a loved one out of a voluntary commitment to a mental hospital in New York State? The conditions and treatment there are making her worse.

talk to an attorney about it. i don’t think there’s anything you can do if you don’t have legal custody of the person. or, if possible, take action as far as her treatment is concerned. go in and speak with the director, if possible, with a big, yellow legal pad and take notes. if you still can’t get anywhere, call up a couple of newspapers and get some nosy reporters on their backs. that usually does the trick. good luck!!

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and financedivision of the treasury 2011 form

How to make an eSignature for the New York State Department Of Taxation And Financedivision Of The Treasury 2011 Form in the online mode

How to generate an electronic signature for the New York State Department Of Taxation And Financedivision Of The Treasury 2011 Form in Google Chrome

How to make an eSignature for signing the New York State Department Of Taxation And Financedivision Of The Treasury 2011 Form in Gmail

How to make an eSignature for the New York State Department Of Taxation And Financedivision Of The Treasury 2011 Form from your smartphone

How to create an eSignature for the New York State Department Of Taxation And Financedivision Of The Treasury 2011 Form on iOS devices

How to create an electronic signature for the New York State Department Of Taxation And Financedivision Of The Treasury 2011 Form on Android OS

People also ask

-

What is the New York State Department Of Taxation And Financedivision Of The Treasury Form used for?

The New York State Department Of Taxation And Financedivision Of The Treasury Form is essential for various tax-related submissions in New York. It helps individuals and businesses report financial information accurately to comply with state regulations. Utilizing this form ensures that all required documentation is submitted in a timely manner.

-

How can I fill out the New York State Department Of Taxation And Financedivision Of The Treasury Form digitally?

You can easily fill out the New York State Department Of Taxation And Financedivision Of The Treasury Form using airSlate SignNow's intuitive platform. Our electronic signature solution allows you to complete and sign documents online, ensuring a smooth and efficient process. Simply upload the form, fill in the required fields, and eSign.

-

Does airSlate SignNow offer integrations for the New York State Department Of Taxation And Financedivision Of The Treasury Form?

Yes, airSlate SignNow provides integrations with various applications that can streamline the process of managing the New York State Department Of Taxation And Financedivision Of The Treasury Form. Our platform connects with tools like Google Drive, Salesforce, and more, enhancing your workflow and document management.

-

What are the pricing options for using airSlate SignNow with the New York State Department Of Taxation And Financedivision Of The Treasury Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs when using the New York State Department Of Taxation And Financedivision Of The Treasury Form. You can choose from individual, team, or enterprise plans, ensuring you get the right features and support at an affordable rate. Visit our pricing page for more details.

-

What features does airSlate SignNow provide for the New York State Department Of Taxation And Financedivision Of The Treasury Form?

airSlate SignNow offers a range of features for the New York State Department Of Taxation And Financedivision Of The Treasury Form, including customizable templates, secure eSigning, and automated workflows. These features help you manage your documents efficiently while ensuring compliance with state regulations.

-

How does airSlate SignNow enhance the security of the New York State Department Of Taxation And Financedivision Of The Treasury Form?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like the New York State Department Of Taxation And Financedivision Of The Treasury Form. Our platform employs advanced encryption methods and complies with industry standards to protect your data throughout the signing process.

-

Can I access the New York State Department Of Taxation And Financedivision Of The Treasury Form on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to access the New York State Department Of Taxation And Financedivision Of The Treasury Form from anywhere. This mobile capability ensures you can fill out, sign, and send your forms on the go, enhancing your productivity.

Get more for New York State Department Of Taxation And Financedivision Of The Treasury Form

Find out other New York State Department Of Taxation And Financedivision Of The Treasury Form

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word