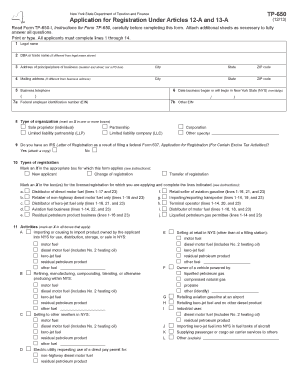

Tp650 Form 2013

What is the Tp650 Form

The Tp650 Form is a tax-related document used primarily in the United States for specific reporting purposes. It is designed to assist individuals and businesses in accurately reporting their financial information to the Internal Revenue Service (IRS). This form is particularly relevant for those who need to disclose certain financial activities, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the Tp650 Form is essential for effective tax reporting.

How to obtain the Tp650 Form

Obtaining the Tp650 Form is a straightforward process. Individuals can access the form through the official IRS website, where it is available for download in a printable format. Additionally, the form may be available at local tax offices or libraries. It is important to ensure that you are using the most current version of the form to meet all regulatory requirements.

Steps to complete the Tp650 Form

Completing the Tp650 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial statements and personal identification. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors or omissions. Finally, sign and date the form before submitting it to the appropriate tax authority, either electronically or via mail.

Legal use of the Tp650 Form

The Tp650 Form is legally recognized for tax reporting purposes, provided it is completed in accordance with IRS guidelines. It is crucial to adhere to the instructions outlined by the IRS to ensure that the form is valid. Using the form correctly helps avoid potential legal issues and ensures that taxpayers fulfill their obligations under federal tax law.

Filing Deadlines / Important Dates

Filing deadlines for the Tp650 Form vary depending on the specific tax year and the taxpayer's situation. Generally, the form must be submitted by the standard tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines to avoid penalties for late filing.

Form Submission Methods

The Tp650 Form can be submitted through multiple methods, including online submission, mailing a physical copy, or delivering it in person to the appropriate tax office. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. When mailing the form, ensure it is sent to the correct address to avoid delays in processing.

Quick guide on how to complete tp650 2013 form

Your assistance manual on preparing your Tp650 Form

If you're interested in learning how to generate and submit your Tp650 Form, here are a few straightforward guidelines to make tax submission signNowly simpler.

Firstly, you simply need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can navigate between text, check boxes, and eSignatures, and easily return to modify responses as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Tp650 Form in just a few minutes:

- Set up your account and start working on PDFs in mere minutes.

- Utilize our catalog to find any IRS tax form; explore different versions and schedules.

- Click Get form to open your Tp650 Form in our editor.

- Provide the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting physically could lead to increased return errors and delayed reimbursements. Additionally, prior to e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tp650 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

Create this form in 5 minutes!

How to create an eSignature for the tp650 2013 form

How to make an eSignature for your Tp650 2013 Form online

How to generate an electronic signature for the Tp650 2013 Form in Chrome

How to generate an eSignature for putting it on the Tp650 2013 Form in Gmail

How to generate an eSignature for the Tp650 2013 Form from your smart phone

How to generate an eSignature for the Tp650 2013 Form on iOS

How to generate an electronic signature for the Tp650 2013 Form on Android OS

People also ask

-

What is the Tp650 Form and how does it work?

The Tp650 Form is a key document for businesses that need to manage electronic signatures and document workflows efficiently. With airSlate SignNow, you can create, send, and eSign the Tp650 Form seamlessly, ensuring that your documentation process is both secure and compliant. This user-friendly platform simplifies the handling of the Tp650 Form, making it accessible for all team members.

-

How much does using the Tp650 Form with airSlate SignNow cost?

Pricing for using the Tp650 Form with airSlate SignNow varies based on the plan you choose. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your eSignature needs. Sign up for a free trial to explore how the Tp650 Form can enhance your document management without any initial investment.

-

What features are included when using the Tp650 Form?

When using the Tp650 Form with airSlate SignNow, you gain access to a variety of powerful features including customizable templates, audit trails, and secure storage. These features not only streamline your document signing process but also provide peace of mind with robust security measures. The intuitive interface makes it easy to manage the Tp650 Form and other documents efficiently.

-

Can I integrate the Tp650 Form with other tools?

Absolutely! airSlate SignNow allows you to integrate the Tp650 Form with various third-party applications such as Google Drive, Salesforce, and more. These integrations help automate your workflows and ensure that your document management process is cohesive across all platforms. This connectivity enhances your team's productivity when dealing with the Tp650 Form.

-

What are the benefits of using the Tp650 Form for my business?

Using the Tp650 Form with airSlate SignNow offers numerous benefits such as improved efficiency, reduced turnaround time, and enhanced security for your documents. By digitizing the signing process, you can eliminate the hassle of paper-based workflows, allowing your team to focus on more important tasks. This leads to faster decision-making and a more agile business environment.

-

Is the Tp650 Form compliant with legal standards?

Yes, the Tp650 Form processed through airSlate SignNow is designed to comply with all relevant legal standards, including ESIGN and UETA. This compliance ensures that your electronic signatures are legally binding and recognized in court. You can confidently use the Tp650 Form knowing that your documents meet all necessary legal requirements.

-

How can I track the status of my Tp650 Form?

Tracking the status of your Tp650 Form is straightforward with airSlate SignNow. The platform provides real-time notifications and an easy-to-use dashboard where you can monitor the progress of your documents. This feature allows you to stay informed about when the Tp650 Form is viewed, signed, or completed, enhancing your workflow management.

Get more for Tp650 Form

- I agree to have jane eyelash extensions applied andor removed from my natural eyelashes form

- Solicitud de transferencia bancaria form

- Content form 21462918

- Office of personnel management form 117017

- Richiesta trascrizione divorzio consolato generale damp39italia a san form

- Tuition pymnt selection sheet 21 22 ns form

- Kempsville christian church permission form

- Fort campbell veterinary centerpet registration f form

Find out other Tp650 Form

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast