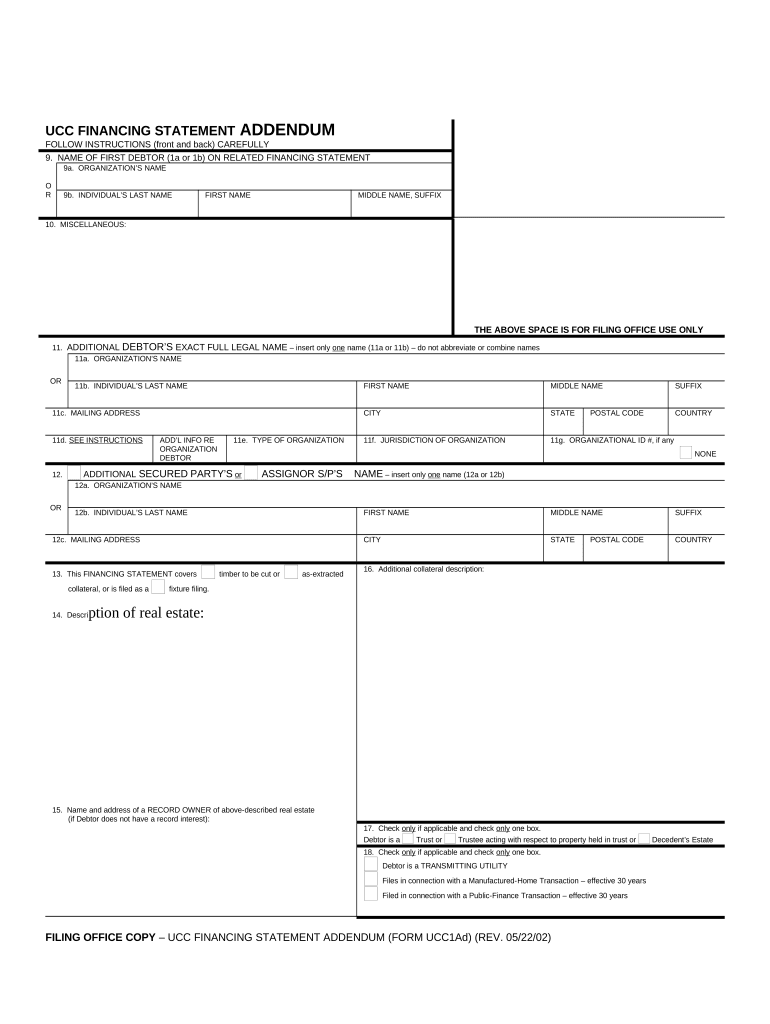

Financing Addendum Contract Form

What is the Financing Addendum Contract

The financing addendum contract is a legal document that outlines the terms and conditions of financing arrangements between parties. It serves as an attachment to a primary contract, detailing specific financing terms such as interest rates, payment schedules, and obligations of each party involved. This document is essential for ensuring that all parties have a clear understanding of their financial commitments and the legal implications of those commitments.

How to use the Financing Addendum Contract

To effectively use the financing addendum contract, first ensure that it is properly attached to the main agreement. Review the terms outlined in the addendum, paying close attention to any conditions related to financing. Both parties should sign the document to indicate their acceptance of the terms. It is advisable to keep a copy of the signed addendum with the main contract for future reference. This ensures that all parties are aware of their responsibilities and can refer back to the document if any disputes arise.

Steps to complete the Financing Addendum Contract

Completing the financing addendum contract involves several key steps:

- Gather necessary information: Collect all relevant financial details, including amounts, interest rates, and payment terms.

- Draft the addendum: Clearly outline the financing terms, ensuring that they align with the primary contract.

- Review the document: Both parties should carefully review the addendum for accuracy and completeness.

- Sign the addendum: Obtain signatures from all parties involved to formalize the agreement.

- Store the document: Keep a copy of the signed addendum with the main contract for easy access.

Key elements of the Financing Addendum Contract

Several key elements must be included in the financing addendum contract to ensure its effectiveness:

- Loan Amount: Specify the total amount being financed.

- Interest Rate: Clearly state the interest rate applicable to the financing.

- Payment Schedule: Outline the timeline for payments, including due dates and amounts.

- Default Terms: Include provisions for what happens in the event of a default on payments.

- Signatures: Ensure that all parties sign the document to validate the agreement.

Legal use of the Financing Addendum Contract

The legal use of the financing addendum contract is governed by state laws and regulations. It is crucial to ensure that the terms comply with local legal requirements to avoid potential disputes. The addendum must be executed in accordance with the laws applicable in the jurisdiction where the contract is enforced. Additionally, it should be stored securely to maintain its legal validity and to provide evidence of the agreed terms in case of future disputes.

State-specific rules for the Financing Addendum Contract

Each state may have specific rules regarding financing addendum contracts. These rules can dictate how the contract should be structured, what disclosures are required, and how disputes are resolved. It is important to familiarize yourself with the regulations in your state to ensure compliance. Consulting with a legal professional can provide valuable guidance on navigating these state-specific requirements and ensuring that the financing addendum is legally sound.

Quick guide on how to complete financing addendum contract

Complete Financing Addendum Contract seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Financing Addendum Contract on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Financing Addendum Contract effortlessly

- Obtain Financing Addendum Contract and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Financing Addendum Contract while ensuring excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is UCC1 financing?

UCC1 financing refers to a legal form that allows lenders to secure their interest in a borrower's assets by filing a UCC-1 financing statement. This process protects the lender's rights in the event of default by creating a public record of their claim. Understanding UCC1 financing is crucial for businesses looking to secure loans against their assets.

-

How does airSlate SignNow assist with UCC1 financing documentation?

airSlate SignNow streamlines the UCC1 financing documentation process by allowing users to easily create, send, and eSign important forms online. By using our platform, businesses can ensure that their UCC1 filings are handled efficiently and securely, reducing the risk of errors that can arise from manual processes.

-

What are the benefits of using airSlate SignNow for UCC1 financing?

Using airSlate SignNow for UCC1 financing offers several benefits, including improved efficiency, cost-effectiveness, and enhanced document security. Our platform enables quick turnaround times for document signing and helps businesses manage their financing agreements with ease. This ensures that you're always a step ahead in your financial dealings.

-

Is there a cost associated with UCC1 financing eSigning on airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit the needs of businesses engaging in UCC1 financing. Whether you need to send a few documents or manage a high volume, we provide affordable solutions that scale with your business. Check our pricing page for the best plan that suits your requirements.

-

Can airSlate SignNow integrate with my existing systems for UCC1 financing?

Absolutely! airSlate SignNow offers seamless integrations with various platforms that can assist with UCC1 financing, including CRM and accounting software. This interoperability ensures a smooth workflow, allowing you to manage your documentation alongside other essential business processes.

-

How secure is airSlate SignNow when handling UCC1 financing documents?

airSlate SignNow prioritizes document security, utilizing advanced encryption and authentication measures to protect your UCC1 financing documents. Our platform is designed to keep your sensitive information confidential while maintaining compliance with regulatory requirements. You can trust us to keep your financing transactions secure.

-

What types of businesses benefit from UCC1 financing?

Various types of businesses can benefit from UCC1 financing, especially those seeking loans secured by collateral. Startups, small businesses, and established enterprises alike use UCC1 filings to access necessary capital for growth. Utilizing airSlate SignNow can simplify the financing process, making it accessible for all business sizes.

Get more for Financing Addendum Contract

Find out other Financing Addendum Contract

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe