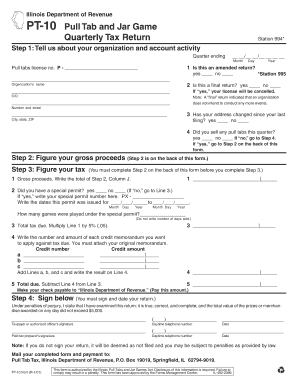

PT 10 Pull Tab and Jar Game Quarterly Tax Return Form

What is the PT 10 Pull Tab And Jar Game Quarterly Tax Return

The PT 10 Pull Tab And Jar Game Quarterly Tax Return is a specialized tax form used by organizations that conduct pull tab and jar games, typically in a fundraising context. This form is essential for reporting the gross receipts and expenses associated with these games to the appropriate tax authorities. It is specifically designed to ensure compliance with state regulations governing gaming activities and to provide transparency in financial reporting.

Steps to complete the PT 10 Pull Tab And Jar Game Quarterly Tax Return

Completing the PT 10 Pull Tab And Jar Game Quarterly Tax Return involves several key steps:

- Gather all necessary financial records, including receipts from pull tab and jar game sales.

- Calculate the total gross receipts from these games for the quarter.

- Document all allowable expenses related to the games, such as costs for supplies and promotional materials.

- Fill out the form accurately, ensuring that all figures are correct and reflect the financial records.

- Review the completed form for any errors before submission.

Legal use of the PT 10 Pull Tab And Jar Game Quarterly Tax Return

The legal use of the PT 10 Pull Tab And Jar Game Quarterly Tax Return is crucial for organizations involved in gaming activities. This form serves as a formal declaration of income generated from pull tab and jar games, ensuring compliance with state gaming laws. By submitting this form, organizations affirm their commitment to transparency and accountability in their fundraising efforts, which can help avoid legal penalties and maintain good standing with regulatory bodies.

Filing Deadlines / Important Dates

Filing deadlines for the PT 10 Pull Tab And Jar Game Quarterly Tax Return are typically set by state authorities and may vary. It is important to be aware of the specific due dates to avoid penalties. Generally, these deadlines align with the end of each quarter, requiring submission within a specified period after the quarter closes. Organizations should consult their state’s gaming commission or tax authority for the exact dates relevant to their jurisdiction.

Who Issues the Form

The PT 10 Pull Tab And Jar Game Quarterly Tax Return is usually issued by the state gaming regulatory agency. This agency oversees all gaming activities within the state, including the operation of pull tab and jar games. Organizations must obtain the form directly from the issuing authority to ensure they are using the most current version and comply with state requirements.

Penalties for Non-Compliance

Failure to file the PT 10 Pull Tab And Jar Game Quarterly Tax Return on time or inaccuracies in the submitted information can lead to significant penalties. These may include fines, loss of gaming privileges, or other legal repercussions. Organizations must ensure timely and accurate reporting to avoid these consequences, which can impact their ability to conduct future gaming activities legally.

Quick guide on how to complete pt 10 pull tab and jar game quarterly tax return

Manage PT 10 Pull Tab And Jar Game Quarterly Tax Return effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without complications. Handle PT 10 Pull Tab And Jar Game Quarterly Tax Return on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign PT 10 Pull Tab And Jar Game Quarterly Tax Return with ease

- Locate PT 10 Pull Tab And Jar Game Quarterly Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that reason.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign PT 10 Pull Tab And Jar Game Quarterly Tax Return to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 10 pull tab and jar game quarterly tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PT 10 Pull Tab And Jar Game Quarterly Tax Return?

The PT 10 Pull Tab And Jar Game Quarterly Tax Return is a specialized game that combines entertainment with fundraising. It enables organizations to generate revenue while providing participants with an engaging experience. This game simplifies the time-consuming tax return process, making it a great choice for seasonal events.

-

How does the PT 10 Pull Tab And Jar Game Quarterly Tax Return work?

Participants buy pull tabs for a chance to win prizes, while the jar game aspect adds an interactive element. The proceeds from ticket sales contribute to the quarterly tax return obligations, making it both a fun and responsible way to fundraise. Every purchase directly impacts your organization's goals.

-

What are the benefits of using the PT 10 Pull Tab And Jar Game Quarterly Tax Return?

Utilizing the PT 10 Pull Tab And Jar Game Quarterly Tax Return can enhance community engagement and boost fundraising efforts. It combines entertainment with financial responsibility, allowing for a unique experience that attracts more participants. This helps organizations fulfill their tax obligations while providing valuable entertainment.

-

Are there any specific pricing plans for the PT 10 Pull Tab And Jar Game Quarterly Tax Return?

Yes, the PT 10 Pull Tab And Jar Game Quarterly Tax Return offers flexible pricing plans to fit different organizational needs. Pricing is typically structured based on the number of participants and the scale of the event. signNow out to our support team for a detailed breakdown and to find a plan that suits your budget.

-

What features are included in the PT 10 Pull Tab And Jar Game Quarterly Tax Return?

The PT 10 Pull Tab And Jar Game Quarterly Tax Return includes customizable templates, real-time tracking of sales, and easy distribution options. It also provides detailed reporting tools to help organizations review their fundraising success and prepare for tax filing. These features are designed to streamline the entire process.

-

Can the PT 10 Pull Tab And Jar Game Quarterly Tax Return integrate with other fundraising tools?

Absolutely! The PT 10 Pull Tab And Jar Game Quarterly Tax Return is designed to integrate seamlessly with various fundraising and payment processing systems. This allows organizations to manage their events more efficiently and maximize their signNow. Check for compatibility with your existing tools to ensure a smooth workflow.

-

Is it easy to set up the PT 10 Pull Tab And Jar Game Quarterly Tax Return?

Yes, setting up the PT 10 Pull Tab And Jar Game Quarterly Tax Return is user-friendly and straightforward. Our platform guides you through the entire setup process, from creating tickets to distributing them to your audience. With intuitive design, even those with minimal technical experience can successfully launch their events.

Get more for PT 10 Pull Tab And Jar Game Quarterly Tax Return

Find out other PT 10 Pull Tab And Jar Game Quarterly Tax Return

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer