Mortgage Wisconsin Form

What is the Mortgage Wisconsin

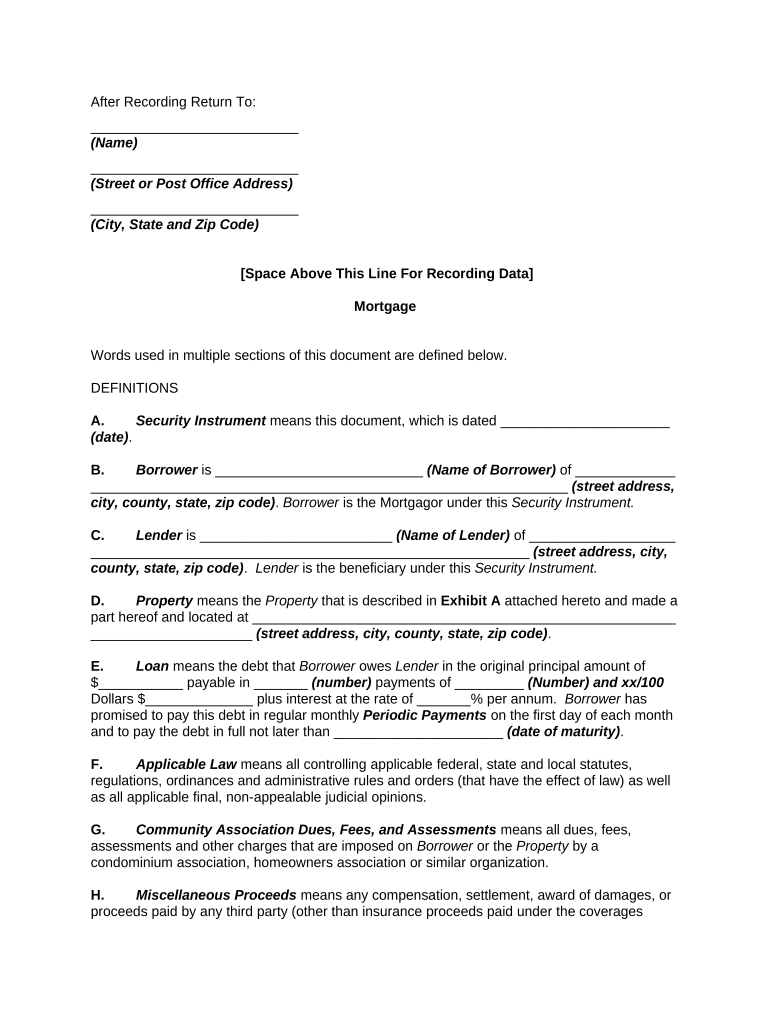

The Mortgage Wisconsin form is a crucial document used in the process of securing a mortgage loan in Wisconsin. This form outlines the terms and conditions of the mortgage agreement between the borrower and the lender. It includes vital information such as the loan amount, interest rate, repayment schedule, and any applicable fees. Understanding this form is essential for borrowers to ensure they are fully aware of their obligations and rights under the mortgage agreement.

How to obtain the Mortgage Wisconsin

Obtaining the Mortgage Wisconsin form typically involves contacting a lender or financial institution that offers mortgage services in Wisconsin. Borrowers can request the form directly from the lender's website or through a physical branch. Additionally, many lenders provide the option to download the form online, making it more accessible. It is important to ensure that the form is the most current version, as mortgage regulations can change over time.

Steps to complete the Mortgage Wisconsin

Completing the Mortgage Wisconsin form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including proof of income, credit history, and identification.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the terms and conditions outlined in the form, paying close attention to the interest rate and repayment terms.

- Sign the form electronically or in person, depending on the lender's requirements.

- Submit the completed form to the lender along with any required supporting documents.

Legal use of the Mortgage Wisconsin

The legal use of the Mortgage Wisconsin form is governed by state and federal laws. For the form to be legally binding, it must be signed by both the borrower and the lender. Additionally, electronic signatures are recognized as valid under the ESIGN Act and UETA, provided that certain conditions are met. It is essential for borrowers to understand their rights and responsibilities as outlined in the form to avoid potential legal issues in the future.

Key elements of the Mortgage Wisconsin

Several key elements must be included in the Mortgage Wisconsin form to ensure its validity:

- Borrower Information: Full name, address, and contact details of the borrower.

- Lender Information: Name and contact information of the lending institution.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage of interest charged on the loan.

- Repayment Terms: Details regarding the payment schedule and duration of the loan.

- Fees and Charges: Any additional costs associated with the mortgage.

State-specific rules for the Mortgage Wisconsin

Wisconsin has specific regulations governing mortgage agreements that borrowers should be aware of. These rules include disclosure requirements, interest rate limits, and foreclosure procedures. It is advisable for borrowers to familiarize themselves with these regulations to ensure compliance and protect their rights. Consulting with a legal expert or a real estate professional can provide further clarity on state-specific rules that may impact the mortgage process.

Quick guide on how to complete mortgage wisconsin

Effortlessly Prepare Mortgage Wisconsin on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly, without delays. Handle Mortgage Wisconsin on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Easiest Way to Edit and Electronically Sign Mortgage Wisconsin

- Obtain Mortgage Wisconsin and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important portions of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Mortgage Wisconsin to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Mortgage Wisconsin?

airSlate SignNow is an eSigning solution that empowers businesses to streamline document workflows, including those related to Mortgage Wisconsin transactions. With its user-friendly interface, it simplifies the process of sending and signing mortgage documents securely online.

-

How can airSlate SignNow benefit my Mortgage Wisconsin business?

airSlate SignNow offers numerous benefits for businesses in Mortgage Wisconsin, including faster document turnaround times and improved client satisfaction. By digitizing the signing process, you can reduce the amount of time it takes to finalize mortgage agreements and enhance overall efficiency.

-

What features does airSlate SignNow offer for Mortgage Wisconsin transactions?

The platform provides key features such as customizable templates, secure eSignature capabilities, and real-time tracking for Mortgage Wisconsin documents. These features help ensure that your mortgage documents are completed accurately and on schedule.

-

What is the pricing structure for airSlate SignNow in the context of Mortgage Wisconsin?

airSlate SignNow offers flexible pricing plans suited for various business sizes, making it a cost-effective solution for Mortgage Wisconsin professionals. You can choose from different tiers based on your specific needs, ensuring you only pay for what you use.

-

Is airSlate SignNow compliant with mortgage regulation in Wisconsin?

Yes, airSlate SignNow is designed to comply with industry standards and regulations relevant to Mortgage Wisconsin. This compliance ensures that your documents meet legal requirements while providing a secure and reliable signing experience for all parties involved.

-

Can airSlate SignNow integrate with other tools used in Mortgage Wisconsin?

Absolutely! airSlate SignNow seamlessly integrates with a variety of CRM systems, document management tools, and other applications commonly used in Mortgage Wisconsin. This integration helps create a smoother workflow, enabling you to manage documents more efficiently.

-

How does airSlate SignNow enhance client communication for Mortgage Wisconsin?

airSlate SignNow enhances client communication by providing real-time notifications and automatic reminders for documents needing signatures related to Mortgage Wisconsin. This helps keep clients informed and engaged throughout the mortgage process, improving their overall experience.

Get more for Mortgage Wisconsin

- Control number az p082 pkg form

- Identity theft repair kit arizona attorney general form

- Control number az p084 pkg form

- Imposter package form

- Control number az p086 pkg form

- Permission to travel out of state with a minor child form

- Control number az p088 pkg form

- Postnuptial property agreement arizonaus legal forms

Find out other Mortgage Wisconsin

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online