Earnings Garnishment Answer Wisconsin Form

What is the Earnings Garnishment Answer Wisconsin

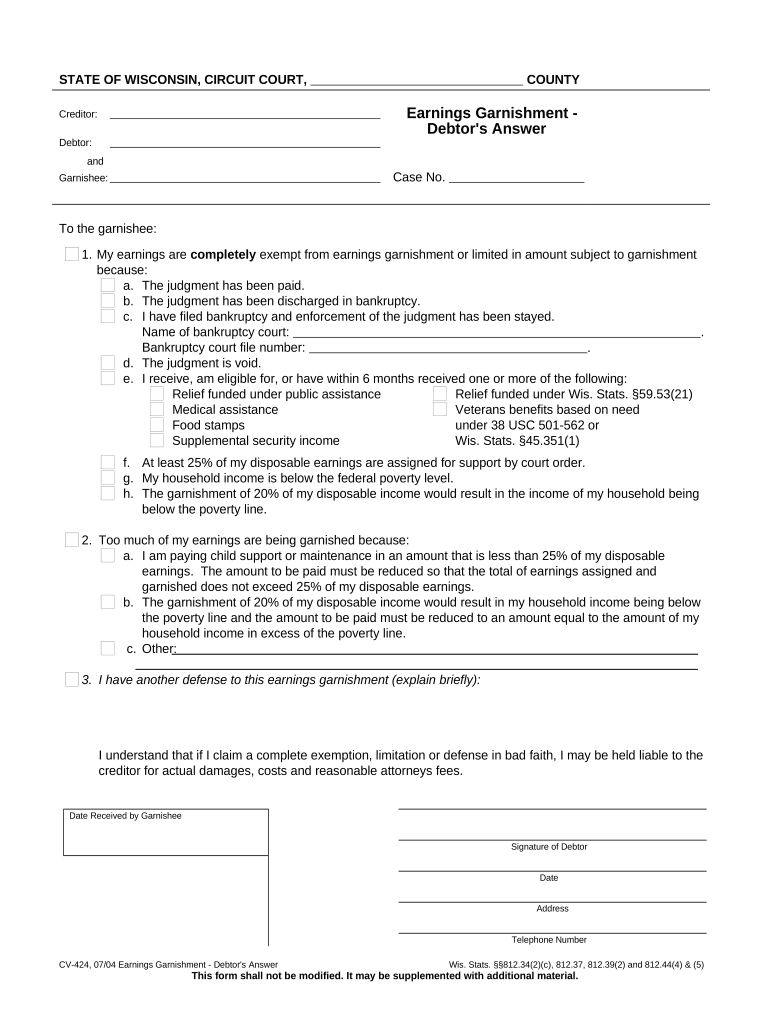

The Earnings Garnishment Answer Wisconsin is a legal document that individuals must complete when they receive a garnishment order against their wages. This form allows the debtor to respond to the garnishment, detailing their income, expenses, and any exemptions that may apply. It is crucial for the debtor to understand the implications of this form, as it can affect their financial situation significantly. By providing accurate information, the debtor can ensure that their rights are protected and that any potential disputes regarding the garnishment are addressed appropriately.

Steps to Complete the Earnings Garnishment Answer Wisconsin

Completing the Earnings Garnishment Answer involves several important steps:

- Review the garnishment order carefully to understand the details and requirements.

- Gather necessary financial information, including income, expenses, and any applicable exemptions.

- Fill out the form accurately, ensuring that all required sections are completed.

- Sign and date the form to validate your response.

- Submit the completed form to the appropriate court or agency as indicated in the garnishment order.

Following these steps can help ensure that the response is processed correctly and that the debtor's interests are represented.

Legal Use of the Earnings Garnishment Answer Wisconsin

The Earnings Garnishment Answer Wisconsin serves a vital legal purpose. It is designed to protect the rights of debtors by allowing them to contest the garnishment or claim exemptions. This form must be completed and submitted within a specific timeframe, as dictated by state law. Failure to respond appropriately can result in default judgments, leading to further financial consequences. Understanding the legal implications of this form is essential for anyone facing wage garnishment.

Key Elements of the Earnings Garnishment Answer Wisconsin

Several key elements must be included in the Earnings Garnishment Answer to ensure its validity:

- Personal information of the debtor, including name, address, and contact details.

- Details of the garnishment order, such as the case number and the creditor's name.

- A comprehensive breakdown of income and expenses to assess the debtor's financial situation.

- Any claims for exemptions, supported by relevant documentation.

Including these elements not only strengthens the response but also helps in presenting a clear picture of the debtor’s financial circumstances.

Filing Deadlines / Important Dates

Timeliness is critical when submitting the Earnings Garnishment Answer Wisconsin. Debtors typically have a limited period, often around twenty days from the date of the garnishment order, to file their response. Missing this deadline can result in adverse legal consequences, including the continuation of wage garnishment without the opportunity to contest it. It is advisable for debtors to mark important dates on their calendar to ensure compliance with these deadlines.

Form Submission Methods

The Earnings Garnishment Answer can be submitted through various methods, depending on the court's requirements:

- Online submission via the court's electronic filing system, if available.

- Mailing the completed form to the appropriate court or agency.

- In-person submission at the court clerk's office.

Choosing the correct submission method is important to ensure that the form is received and processed in a timely manner.

Quick guide on how to complete earnings garnishment answer wisconsin

Complete Earnings Garnishment Answer Wisconsin effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documentation, allowing you to access the required forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Earnings Garnishment Answer Wisconsin on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Earnings Garnishment Answer Wisconsin with ease

- Obtain Earnings Garnishment Answer Wisconsin and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select your preferred method to share your form, be it via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Earnings Garnishment Answer Wisconsin and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an earnings debtor?

An earnings debtor refers to an individual or entity that is obligated to pay a debt through their earnings or income. Understanding the role of an earnings debtor is crucial for businesses engaging in financial agreements or obligations. airSlate SignNow facilitates the documentation process for contracts involving earnings debtors, ensuring compliance and clarity.

-

How does airSlate SignNow help with documentation for earnings debtors?

airSlate SignNow offers an intuitive platform to create, send, and eSign documents related to earnings debtors. By streamlining the signing process, businesses can efficiently manage contracts and agreements that involve payments from earnings debtors. This enhances overall productivity and reduces errors in documentation.

-

What pricing plans does airSlate SignNow offer for businesses working with earnings debtors?

airSlate SignNow provides a range of pricing plans designed to suit various business needs, including those dealing with earnings debtors. These plans are competitively priced to ensure that you have access to essential tools without overspending. With features tailored to your requirements, you can choose the plan that fits best.

-

What features does airSlate SignNow include for managing earnings debtor agreements?

Key features of airSlate SignNow for managing earnings debtor agreements include easy document creation, customizable templates, and secure eSigning capabilities. Additionally, our platform supports real-time tracking and notifications, allowing you to stay updated on the status of your documents. This makes managing earnings debtor agreements efficient and straightforward.

-

Can airSlate SignNow integrate with other tools related to earnings debtors?

Yes, airSlate SignNow seamlessly integrates with a variety of applications that facilitate processes involving earnings debtors, such as CRM systems and accounting software. These integrations help businesses manage their earnings debtor documents more effectively and maintain accurate financial records. This flexibility enhances overall productivity.

-

What are the benefits of using airSlate SignNow for businesses dealing with earnings debtors?

Using airSlate SignNow offers multiple benefits for businesses managing earnings debtors, including improved efficiency and reduced paperwork. The platform ensures that all documentation is securely signed and stored, minimizing the risk of disputes. Furthermore, it simplifies communication between parties involved in the agreements with earnings debtors.

-

Is airSlate SignNow user-friendly for businesses new to managing earnings debtors?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those new to managing earnings debtors. The platform features an intuitive interface that simplifies document preparation and eSigning processes. Comprehensive support resources and guidance are also available to assist users as they navigate the system.

Get more for Earnings Garnishment Answer Wisconsin

- Know all men by these presents that name title representing form

- Affidavit of service on corpdoc form

- Superior court of the district of columbia civil dc courts form

- Building b 510 4th street n form

- Fillable online telephone 202 879 1133 fax email print form

- Fillable online mrchenwelten fairytale poster exhibition fax form

- District of columbia small claims court information

- Foreign estate proceeding fep district of columbia courts form

Find out other Earnings Garnishment Answer Wisconsin

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors