Debtor Answer Form

What is the Debtor Answer Form

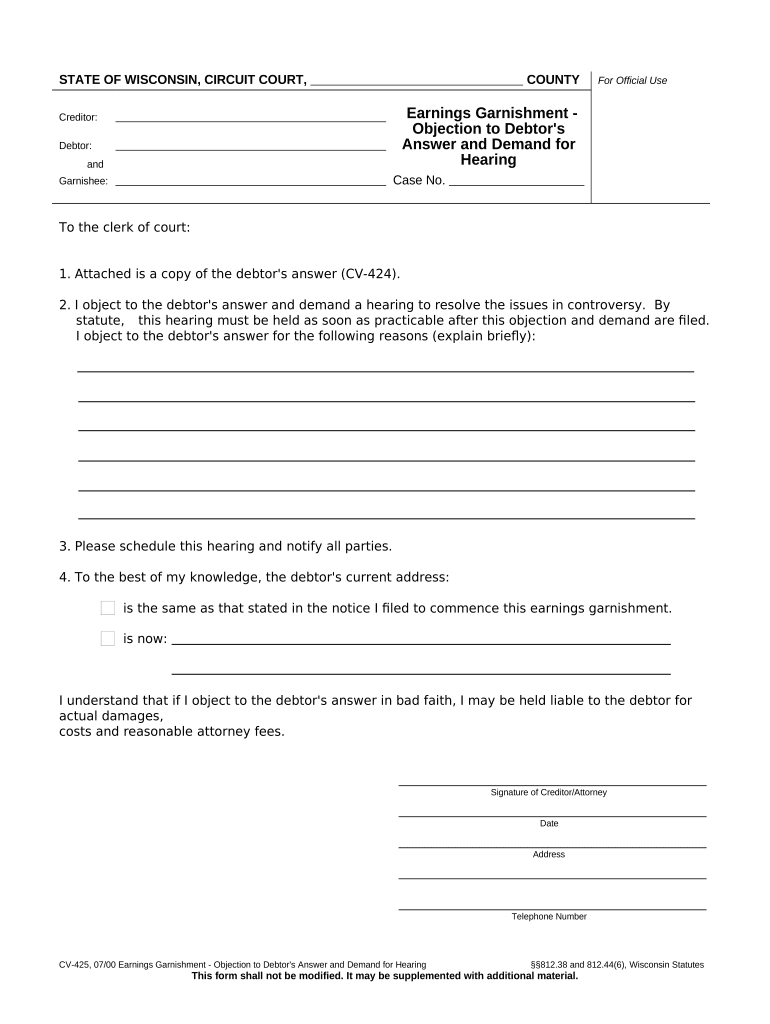

The debtor answer form is a legal document used by individuals or entities responding to a garnishment action. This form allows the debtor to provide information regarding their financial situation and contest the garnishment if applicable. It is essential in situations where a creditor seeks to collect debts through wage garnishment or bank levies. By completing this form, the debtor can assert their rights and potentially negotiate terms with the creditor.

How to use the Debtor Answer Form

Using the debtor answer form involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by providing your personal information, details about the garnishment, and any defenses you may have against the garnishment. After completing the form, review it carefully for accuracy before submitting it to the appropriate court or agency.

Steps to complete the Debtor Answer Form

Completing the debtor answer form requires attention to detail. Follow these steps:

- Obtain the latest version of the debtor answer form from your local court or online resources.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about the creditor and the amount being garnished.

- Clearly state your reasons for contesting the garnishment, supported by relevant financial data.

- Sign and date the form to affirm its accuracy and completeness.

Legal use of the Debtor Answer Form

The legal use of the debtor answer form is crucial in protecting the rights of the debtor. This form must be filed within a specific timeframe, usually dictated by state law, to ensure that the debtor can contest the garnishment effectively. Failure to file the form on time can result in the loss of the opportunity to challenge the garnishment, leading to automatic deductions from wages or bank accounts.

Key elements of the Debtor Answer Form

Key elements of the debtor answer form include:

- Personal Information: Full name, address, and contact information of the debtor.

- Creditor Information: Name and contact details of the creditor initiating the garnishment.

- Garnishment Details: Amount being garnished and the basis for the garnishment.

- Defenses: Any legal reasons the debtor believes the garnishment should not proceed.

Form Submission Methods

The debtor answer form can typically be submitted through various methods, including:

- Online: Some jurisdictions allow electronic filing through their court websites.

- Mail: Send the completed form to the court or agency handling the garnishment.

- In-Person: Deliver the form directly to the appropriate court office.

Quick guide on how to complete debtor answer form

Prepare Debtor Answer Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without unnecessary delays. Manage Debtor Answer Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Debtor Answer Form seamlessly

- Find Debtor Answer Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark important parts of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Debtor Answer Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a debtor answer in the context of airSlate SignNow?

A debtor answer refers to the documented response a debtor provides regarding a claim or agreement. With airSlate SignNow, you can easily create, send, and eSign debtor answers to streamline your financial processes.

-

How does airSlate SignNow simplify creating debtor answers?

airSlate SignNow offers user-friendly templates that allow you to draft debtor answers quickly. The intuitive interface ensures that you can prepare legal documents accurately and efficiently, saving your business time and effort.

-

Can I customize debtor answers using airSlate SignNow?

Yes, airSlate SignNow allows full customization of debtor answers. You can modify templates to fit your specific needs, ensuring that all necessary legal language and terms are included for compliance.

-

Is airSlate SignNow a cost-effective solution for managing debtor answers?

Absolutely, airSlate SignNow provides a cost-effective solution for sending and managing debtor answers. With competitive pricing plans, you can choose the one that best suits your business size and requirements.

-

What features does airSlate SignNow offer for tracking debtor answers?

airSlate SignNow includes robust tracking features that allow you to monitor the status of debtor answers in real-time. This way, you can verify that documents are received, reviewed, and signed promptly.

-

Does airSlate SignNow integrate with other financial tools for processing debtor answers?

Yes, airSlate SignNow seamlessly integrates with various financial and document management tools. This ensures you can easily incorporate debtor answers into your existing workflows, enhancing efficiency.

-

Is electronic signing of debtor answers legally binding?

Yes, electronic signing of debtor answers through airSlate SignNow is legally binding and compliant with eSignature laws. This provides assurance that your agreements are valid and enforceable.

Get more for Debtor Answer Form

- It also contains a common disaster clause which provides that form

- I direct my personal representative to pay all costs and expenses of my last illness and form

- Rhode island last will and testament us legal forms

- Been transferred to the trust at ones death and this method assures that they too will form

- Download rhode island last will and testament form for

- Appeared name of document signer personally known to the form

- Upon default for ten 10 days the vehicle sold to buyer in connection with this form

- Watercraft taxes york county sc form

Find out other Debtor Answer Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors