Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Wisconsin Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Wisconsin

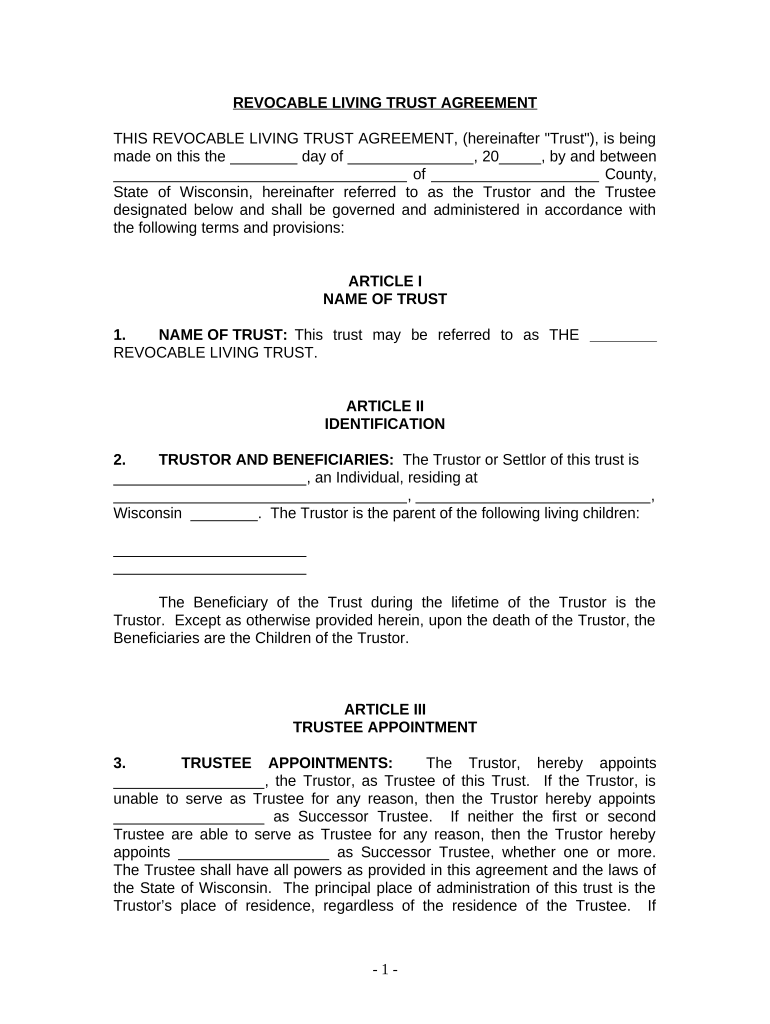

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed with children in Wisconsin, a living trust can provide a way to ensure that their children are cared for and that their wishes are honored regarding asset distribution. This type of trust can help avoid probate, making the transfer of assets smoother and more efficient. It also allows for flexibility in managing assets, as the individual can alter the trust terms as their circumstances change.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Wisconsin

Using a living trust involves several steps. First, the individual must create the trust document, which outlines the terms and conditions of the trust. This includes naming a trustee, who will manage the trust, and specifying the beneficiaries, typically the children. Once the trust is established, the individual should transfer assets into the trust, such as real estate, bank accounts, and investments. This transfer of ownership is crucial for the trust to be effective. After these steps, the trustee will manage the assets according to the trust's terms, ensuring that the beneficiaries receive their inheritance as intended.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Wisconsin

Completing a living trust involves a series of straightforward steps:

- Determine the assets to be included in the trust.

- Draft the trust document, ideally with the assistance of a legal professional.

- Name a trustee who will manage the trust.

- Specify the beneficiaries, typically the children.

- Transfer ownership of the chosen assets into the trust.

- Review and update the trust as needed to reflect any changes in circumstances.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Wisconsin

Several key elements are essential for a living trust to be effective:

- Trust Document: This legal document outlines the terms of the trust.

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: Those who will receive assets from the trust after the individual's death.

- Asset Transfer: The process of transferring ownership of assets into the trust.

- Revocability: Most living trusts can be altered or revoked by the individual during their lifetime.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Wisconsin

Wisconsin has specific laws governing living trusts that individuals should be aware of. These include requirements for the trust document to be in writing and signed by the individual creating the trust. Additionally, while Wisconsin does not require a living trust to be recorded, it is advisable to keep the trust document in a safe place. Understanding state laws can help ensure that the trust is valid and enforceable, providing peace of mind regarding asset distribution.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in Wisconsin

The legal use of a living trust in Wisconsin allows individuals to manage their assets effectively while ensuring that their wishes are followed after their passing. It is legally binding and can be enforced in court if necessary. The trust must comply with Wisconsin state laws to be considered valid. This includes proper drafting, execution, and asset transfer. By adhering to legal requirements, individuals can safeguard their children's future and streamline the estate settlement process.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children wisconsin

Prepare Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, since you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin on any device using the airSlate SignNow Android or iOS apps and enhance any document-centric workflow today.

The easiest way to edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin without hassle

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs within just a few clicks from any device you prefer. Modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust helps in avoiding probate, making the transition smoother for your beneficiaries.

-

How much does it cost to establish a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin?

The cost to establish a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin can vary based on complexity, attorney fees, and additional services. Typically, you can expect costs to range from a few hundred to a couple of thousand dollars, depending on your specific circumstances.

-

What are the benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin?

The benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin include avoiding probate, maintaining privacy, and ensuring that your assets are managed according to your wishes. Additionally, it can provide immediate access to your assets for your children and streamline the distribution process.

-

Can I modify my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin?

Yes, one of the key features of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin is that it is revocable. This allows you to make changes or updates as your circumstances or intentions change, ensuring that your trust remains aligned with your current wishes.

-

How does a Living Trust impact taxes for me and my children in Wisconsin?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin generally does not change how income or estate taxes are handled. However, upon your passing, the trust can facilitate more efficient asset transfer, which can minimize estate taxes for your beneficiaries.

-

Does a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin protect my assets from creditors?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin does not provide asset protection from creditors during your lifetime, as you still retain control over it. However, certain provisions can offer protections for your heirs after your passing, depending on how the trust is structured.

-

What happens if I move out of Wisconsin after creating a Living Trust?

If you move out of Wisconsin after establishing a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Wisconsin, the trust typically remains valid, but it may be beneficial to consult with an attorney in your new state. Different states have various laws regarding trusts, so reviewing your options is always wise.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Wisconsin

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement