Living Trust for Husband and Wife with One Child Wisconsin Form

What is the Living Trust For Husband And Wife With One Child Wisconsin

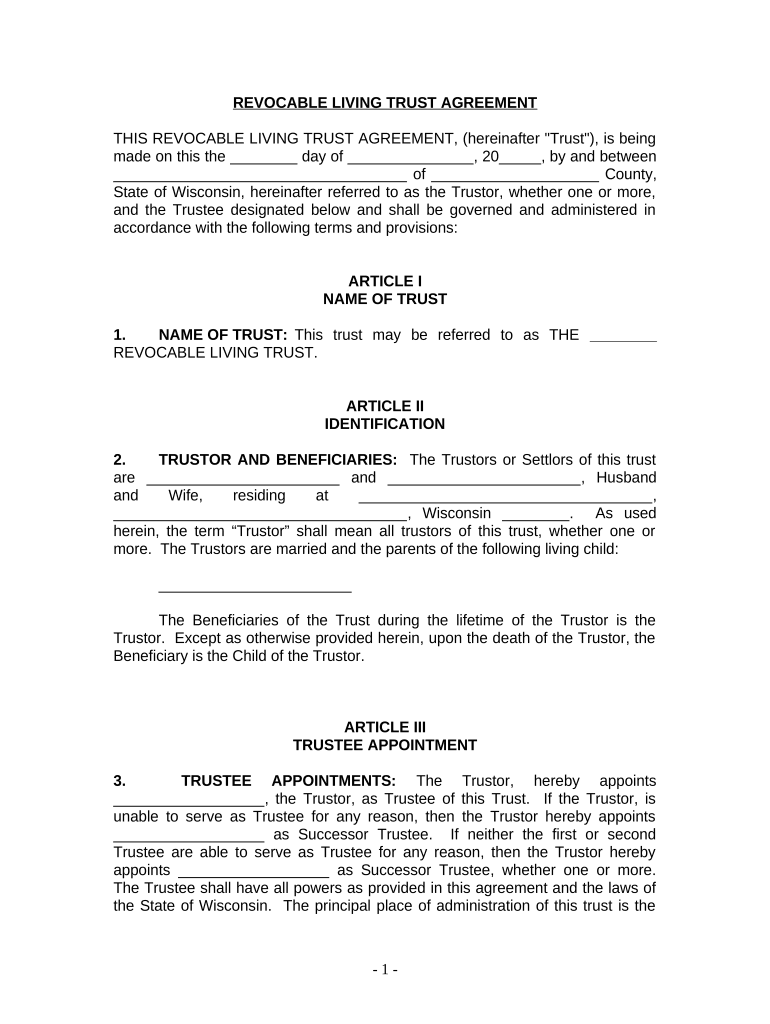

A living trust for husband and wife with one child in Wisconsin is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust can help avoid probate, streamline the transfer of assets, and provide clarity regarding the couple's wishes for their child. The trust is established while both spouses are alive and can be modified or revoked as needed. It typically includes provisions for the couple’s child, ensuring that their needs are met according to the parents' wishes.

How to use the Living Trust For Husband And Wife With One Child Wisconsin

Using a living trust involves several steps. First, the couple must identify the assets they wish to include in the trust, such as real estate, bank accounts, and investments. Next, they will need to draft the trust document, which outlines the terms of the trust, including the beneficiaries and the management of the assets. Once the trust is created, the couple must transfer ownership of their assets into the trust. This process often requires changing titles and account names to reflect the trust as the new owner. Finally, it is essential to review and update the trust periodically to reflect any changes in circumstances or wishes.

Steps to complete the Living Trust For Husband And Wife With One Child Wisconsin

Completing a living trust involves a series of steps:

- Determine the assets to include in the trust.

- Draft the living trust document, specifying terms and beneficiaries.

- Sign the trust document in accordance with Wisconsin laws.

- Transfer ownership of assets into the trust, updating titles and accounts.

- Review the trust regularly and make updates as necessary.

Legal use of the Living Trust For Husband And Wife With One Child Wisconsin

The legal use of a living trust in Wisconsin is governed by state laws that outline the requirements for creating and managing trusts. A living trust must be in writing and signed by the grantors, who are the individuals establishing the trust. It is crucial that the trust document clearly states the intentions of the grantors regarding asset distribution and management. The trust becomes effective immediately upon creation, allowing the couple to manage their assets as specified in the document. Additionally, a properly executed living trust can provide legal protection against probate and ensure that the couple's wishes are honored after their passing.

State-specific rules for the Living Trust For Husband And Wife With One Child Wisconsin

Wisconsin has specific rules regarding the creation and management of living trusts. These include:

- The trust must be written and signed by the grantors.

- Wisconsin law allows for revocable living trusts, meaning they can be altered or revoked by the grantors at any time.

- Trusts must comply with state tax laws, which may affect how assets are treated for tax purposes.

- It is advisable to have the trust document reviewed by a legal professional to ensure compliance with state regulations.

Key elements of the Living Trust For Husband And Wife With One Child Wisconsin

Key elements of a living trust for husband and wife with one child include:

- Grantors: The couple establishing the trust.

- Trustee: The individual or entity responsible for managing the trust assets, which can be one of the spouses or a third party.

- Beneficiaries: The couple's child, along with any other individuals or entities designated to receive assets from the trust.

- Terms of Distribution: Clear instructions on how and when the assets will be distributed to the beneficiaries.

- Revocation Clause: A provision allowing the grantors to modify or revoke the trust at any time while they are alive.

Quick guide on how to complete living trust for husband and wife with one child wisconsin

Complete Living Trust For Husband And Wife With One Child Wisconsin smoothly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents rapidly without delays. Handle Living Trust For Husband And Wife With One Child Wisconsin on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Living Trust For Husband And Wife With One Child Wisconsin effortlessly

- Obtain Living Trust For Husband And Wife With One Child Wisconsin and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Living Trust For Husband And Wife With One Child Wisconsin and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Wisconsin?

A Living Trust for Husband and Wife with One Child in Wisconsin is a legal document that allows you to manage and distribute your assets during your lifetime and after your death. This type of trust provides flexibility while ensuring that your child is taken care of when it comes to asset distribution. It helps avoid probate, making the process smoother for your loved ones.

-

How much does a Living Trust for Husband and Wife with One Child in Wisconsin cost?

The cost of creating a Living Trust for Husband and Wife with One Child in Wisconsin can vary signNowly based on the complexity of your estate and the services you choose. Generally, legal fees can range from a few hundred to several thousand dollars. Utilizing airSlate SignNow can help streamline the process at a cost-effective rate.

-

What are the benefits of having a Living Trust for Husband and Wife with One Child in Wisconsin?

A Living Trust for Husband and Wife with One Child in Wisconsin offers several benefits, including the ability to manage assets without court intervention. It provides privacy for your estate plan and can help minimize estate taxes. Additionally, it ensures a smoother transition of assets to your child, safeguarding their financial future.

-

How do I set up a Living Trust for Husband and Wife with One Child in Wisconsin?

Setting up a Living Trust for Husband and Wife with One Child in Wisconsin involves defining the trust terms, selecting a trustee, and transferring your assets into the trust. It's advisable to consult an estate planning attorney to ensure that your trust is legally valid and meets your specific needs. Alternatively, using airSlate SignNow can simplify document preparation and execution.

-

Can I change or revoke my Living Trust for Husband and Wife with One Child in Wisconsin?

Yes, you can change or revoke your Living Trust for Husband and Wife with One Child in Wisconsin at any time, as long as you are alive and have the capacity to do so. This flexibility allows you to adapt to changes in your circumstances or wishes. Ensure that any amendments are documented properly to maintain legal enforceability.

-

What happens to my assets in a Living Trust for Husband and Wife with One Child in Wisconsin upon my death?

Upon your death, the assets held in your Living Trust for Husband and Wife with One Child in Wisconsin are transferred directly to your designated beneficiaries without going through probate. This facilitates a faster and more private distribution of your estate. Your child will benefit from this seamless transition, ensuring their financial security.

-

Are there specific requirements for creating a Living Trust for Husband and Wife with One Child in Wisconsin?

Yes, to create a valid Living Trust for Husband and Wife with One Child in Wisconsin, you must be of legal age and have a sound mind. Additionally, the trust document must comply with state laws, including clear identification of grantors, trustees, and beneficiaries. Consulting with a legal expert or using a reliable service like airSlate SignNow can help ensure compliance.

Get more for Living Trust For Husband And Wife With One Child Wisconsin

- Individual to two individuals with form

- Individual to living trust form

- This instrument was acknowledged before me on date form

- The property herein conveyed form

- Homestead of grantors form

- Control number tx 081 78 form

- Control number tx 082 78 form

- Legacy05 royalty owner forms oil ampamp gas legal forms

Find out other Living Trust For Husband And Wife With One Child Wisconsin

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later