Living Trust Property Record Wisconsin Form

What is the Living Trust Property Record Wisconsin

The Living Trust Property Record in Wisconsin is a legal document that outlines the assets held in a living trust. This record serves to clarify ownership and facilitate the management of the trust's assets during the grantor's lifetime and after their passing. It is essential for estate planning, as it helps avoid probate and ensures that the grantor's wishes are honored regarding asset distribution. The record typically includes details about the trust, the grantor, and the specific properties or assets included within the trust.

How to use the Living Trust Property Record Wisconsin

Using the Living Trust Property Record involves several steps to ensure that the document accurately reflects the assets in the trust. First, gather all relevant information about the assets, including property descriptions, titles, and any associated documentation. Next, complete the record by filling in the required fields, which may include the trust's name, the grantor's details, and a list of assets. Once completed, the record should be signed and dated by the grantor, and in some cases, witnessed or notarized, depending on Wisconsin law.

Steps to complete the Living Trust Property Record Wisconsin

Completing the Living Trust Property Record requires careful attention to detail. Follow these steps:

- Gather necessary information about the trust and its assets.

- Fill out the record form, ensuring all required fields are completed accurately.

- Review the document for clarity and completeness.

- Sign and date the record in the presence of a notary or witnesses if required.

- Store the completed record in a safe place, accessible to the trustee and beneficiaries.

Legal use of the Living Trust Property Record Wisconsin

The Living Trust Property Record is legally recognized in Wisconsin, provided it meets specific criteria. It should be executed in accordance with state laws governing trusts and estates. This includes proper signing, witnessing, and notarization as necessary. The record can be presented in legal matters concerning the trust, such as during asset distribution or if disputes arise among beneficiaries. Maintaining an accurate and updated record is crucial for its legal validity.

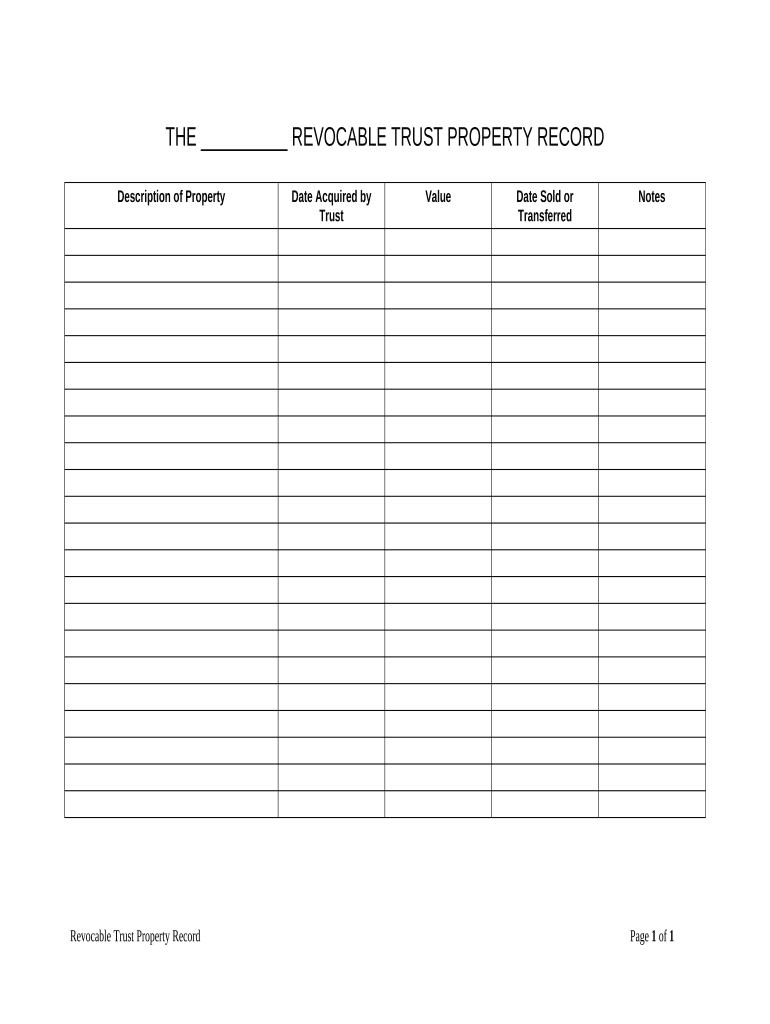

Key elements of the Living Trust Property Record Wisconsin

Key elements of the Living Trust Property Record include:

- Trust Name: The official name of the living trust.

- Grantor Information: Details about the individual who created the trust.

- Asset List: A comprehensive list of all properties and assets included in the trust.

- Signatures: Signatures of the grantor and any required witnesses or notaries.

- Date of Execution: The date when the record was completed and signed.

State-specific rules for the Living Trust Property Record Wisconsin

Wisconsin has specific rules governing the creation and use of Living Trust Property Records. These include requirements for notarization and witnessing, which may vary based on the type of assets held in the trust. It is essential to comply with Wisconsin statutes to ensure the trust is valid and enforceable. Additionally, understanding the implications of state laws on property transfer and tax obligations is crucial for effective estate planning.

Quick guide on how to complete living trust property record wisconsin

Complete Living Trust Property Record Wisconsin effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can conveniently locate the necessary form and safely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents swiftly without any hold-ups. Manage Living Trust Property Record Wisconsin on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest method to edit and electronically sign Living Trust Property Record Wisconsin without hassle

- Find Living Trust Property Record Wisconsin and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Living Trust Property Record Wisconsin and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Wisconsin?

A Living Trust Property Record in Wisconsin is a legal document that outlines how your property will be managed and distributed after your passing. It helps avoid probate and ensures your assets are transferred according to your wishes. Utilizing airSlate SignNow can streamline the creation and signing process of these records.

-

How can airSlate SignNow assist with Living Trust Property Records in Wisconsin?

airSlate SignNow provides an easy-to-use platform for drafting, sending, and eSigning Living Trust Property Records in Wisconsin. You can create documents quickly and manage your records securely online. Its user-friendly interface ensures that you can focus on your estate planning rather than the paperwork.

-

What are the benefits of using airSlate SignNow for Living Trust Property Records?

Using airSlate SignNow for Living Trust Property Records in Wisconsin offers numerous benefits, such as increased efficiency in document handling, enhanced security measures for your sensitive information, and reduced costs compared to traditional methods. You'll also have access to various templates and automation tools that simplify the process.

-

Is there a cost associated with creating a Living Trust Property Record with airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it remains a cost-effective solution compared to traditional legal services. Pricing plans vary, offering flexibility for individuals and businesses alike. You can easily manage your budget while ensuring your Living Trust Property Record in Wisconsin is professionally handled.

-

What features does airSlate SignNow offer for Living Trust Property Records?

airSlate SignNow offers a range of features tailored for Living Trust Property Records, including document templates, eSignature capabilities, secure storage, and workflow automation. These features simplify the process of creating and signing your records, allowing you to manage your estate planning efficiently.

-

Can I integrate airSlate SignNow with other tools for managing Living Trust Property Records?

Yes, airSlate SignNow supports integration with various third-party applications, enhancing your ability to manage Living Trust Property Records in Wisconsin. Integrations with platforms like Google Drive or Dropbox allow for seamless document sharing and storage. This connectivity helps streamline your workflow and keeps your records organized.

-

Is my information secure when using airSlate SignNow for Living Trust Property Records?

Absolutely! AirSlate SignNow takes data security seriously, employing encryption and various security protocols to protect your information. When creating Living Trust Property Records in Wisconsin, you can trust that your sensitive data is safeguarded, giving you peace of mind during the estate planning process.

Get more for Living Trust Property Record Wisconsin

- Assumed name certificate form lampasas county

- University lands wind lease form

- Trec form 9 13 ampquotunimproved property contractampquot texas

- Real estate 101 promulgated contract forms wo flashcards

- Real estate 101 promulgated contract forms wo quizlet

- New home insulation addendum form

- Trec no 16 5 buyers temporary residential lease solid realty form

- All cash assumption third party conventional or seller form

Find out other Living Trust Property Record Wisconsin

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple