Wisconsin Income Expense Statement Form

What is the Wisconsin Income Expense Statement

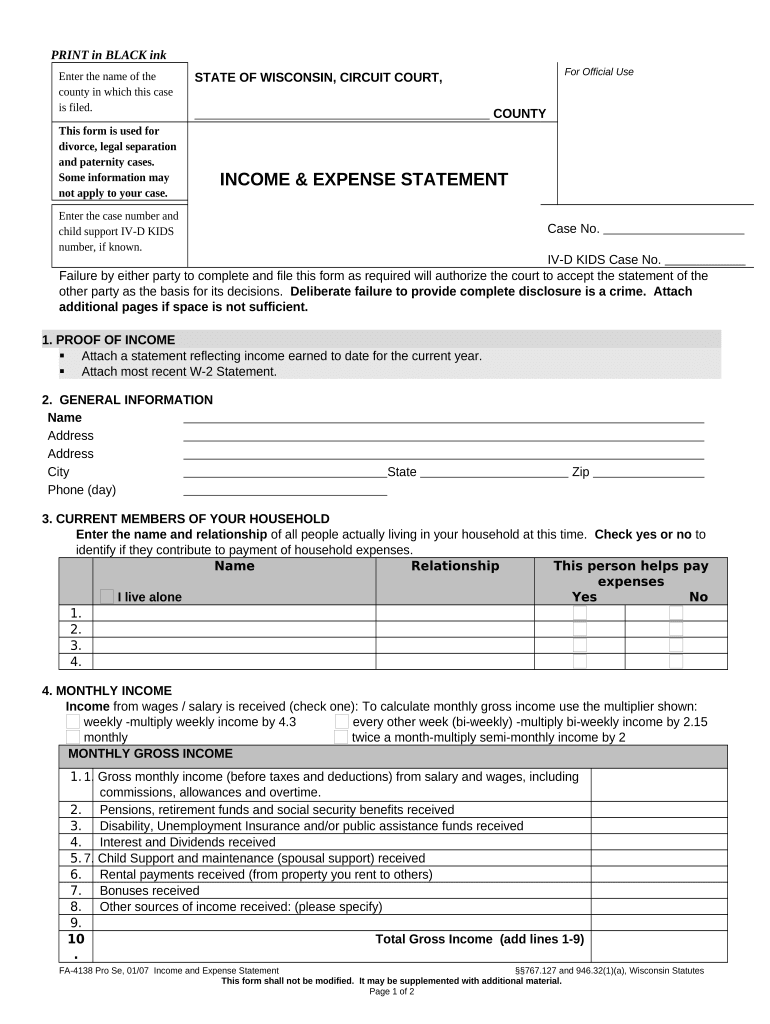

The Wisconsin Income Expense Statement is a crucial document used by individuals and businesses in Wisconsin to report their income and expenses for tax purposes. This form helps in calculating the taxable income and determining the overall financial standing of the filer. It is particularly important for self-employed individuals, small business owners, and those who need to provide proof of income for various applications, such as loans or government assistance. The statement typically includes details about various income sources, deductible expenses, and other relevant financial information.

How to use the Wisconsin Income Expense Statement

Using the Wisconsin Income Expense Statement involves several steps to ensure accurate reporting of financial information. First, gather all necessary documentation, including receipts, invoices, and bank statements, that reflect your income and expenses. Next, fill out the form with precise details, categorizing income and expenses appropriately. It is essential to double-check figures for accuracy before submission. Once completed, the statement can be submitted electronically or printed for physical submission, depending on your preference and the requirements of the filing process.

Steps to complete the Wisconsin Income Expense Statement

Completing the Wisconsin Income Expense Statement requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, including income statements and expense receipts.

- Download the Wisconsin Income Expense Statement form in PDF format from an official source.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Detail all income sources, ensuring to categorize them accurately.

- List all deductible expenses, providing supporting documentation where necessary.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or print it for mailing, following the guidelines provided by the Wisconsin Department of Revenue.

Legal use of the Wisconsin Income Expense Statement

The Wisconsin Income Expense Statement serves as a legally recognized document for reporting income and expenses. It must be completed accurately and submitted according to state regulations to avoid penalties. The form is often required for various legal and financial processes, including tax filings and loan applications. Ensuring compliance with state laws when using this statement is vital, as inaccuracies can lead to legal repercussions or financial penalties.

Key elements of the Wisconsin Income Expense Statement

Several key elements must be included in the Wisconsin Income Expense Statement to ensure it is complete and compliant. These elements include:

- Personal Information: Name, address, and taxpayer identification number.

- Income Sources: Detailed listing of all income, including wages, business income, and other earnings.

- Expense Categories: Breakdown of expenses, such as operating costs, supplies, and other deductions.

- Signatures: Required signatures to validate the document, affirming that the information provided is accurate.

Examples of using the Wisconsin Income Expense Statement

There are various scenarios in which the Wisconsin Income Expense Statement is utilized. For instance, a self-employed individual may use the statement to report income from freelance work and deduct business-related expenses. Similarly, small business owners can use the form to track their financial performance over a specific period, providing essential information for tax filings. Additionally, individuals applying for loans may be required to submit this statement to demonstrate their income stability and financial responsibility.

Quick guide on how to complete wisconsin income expense statement

Execute Wisconsin Income Expense Statement seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and store it safely online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Wisconsin Income Expense Statement on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to edit and eSign Wisconsin Income Expense Statement effortlessly

- Locate Wisconsin Income Expense Statement and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Wisconsin Income Expense Statement and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of tracking wi income expense?

Tracking wi income expense is crucial for businesses to maintain accurate financial records and ensure compliance with tax regulations. By keeping a close eye on these expenses, companies can make informed decisions regarding budgeting and spending. Moreover, it helps in identifying potential areas for cost savings.

-

How can airSlate SignNow help manage wi income expense documentation?

airSlate SignNow allows businesses to efficiently send and eSign documents related to their wi income expense. With its user-friendly interface, you can streamline the documentation process, ensuring that all expenses are properly documented and easily accessible. This enhances organization and accountability in financial management.

-

What features does airSlate SignNow offer for tracking wi income expense?

airSlate SignNow offers features such as customizable templates and real-time collaboration tools that simplify tracking of wi income expense. Users can create and manage expense reports and ensure all relevant documents are signed and saved securely. These features enhance productivity and accuracy in expense management.

-

Is airSlate SignNow cost-effective for managing wi income expense?

Yes, airSlate SignNow is a cost-effective solution for managing wi income expense as it offers various pricing plans to fit different budgets. With its comprehensive features, businesses can reduce their operational costs while efficiently managing their documentation needs. The value provided by SignNow often exceeds expectations, given its pricing.

-

Can airSlate SignNow integrate with other financial tools for wi income expense tracking?

Absolutely! airSlate SignNow easily integrates with a variety of financial tools, allowing for seamless tracking of wi income expense. By connecting with platforms like QuickBooks and Xero, users can ensure that their expense documentation syncs accurately with their accounting software. This integration enhances workflow efficiency and reduces the margin for error.

-

What are the benefits of using eSignature for wi income expense documents?

Using eSignatures for wi income expense documents streamlines the approval process, enabling quicker transactions and compliance. It eliminates the need for paper, hence reducing operational costs and environmental impact. Moreover, eSignature provides a legal and secure way to manage financial documents.

-

How does airSlate SignNow ensure the security of wi income expense documents?

airSlate SignNow prioritizes the security of your wi income expense documents by employing advanced encryption techniques and secure cloud storage. Users benefit from multi-factor authentication and comprehensive access controls, ensuring that only authorized personnel can access sensitive information. This level of security helps maintain the integrity of your financial records.

Get more for Wisconsin Income Expense Statement

- Florida statutes those who work on your property or provide form

- Failed to pay form

- Required to provide you with a written release of lien from any form

- To protect yourself you should stipulate in this form

- Person or company that has provided to you a notice to owner form

- Contract that before any payment is made your contractor is form

- Recommended that you consult an attorney form

- Floridas construction lien law is complex and it is form

Find out other Wisconsin Income Expense Statement

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will