Wisconsin Annual Report Form

What is the Wisconsin Annual Report

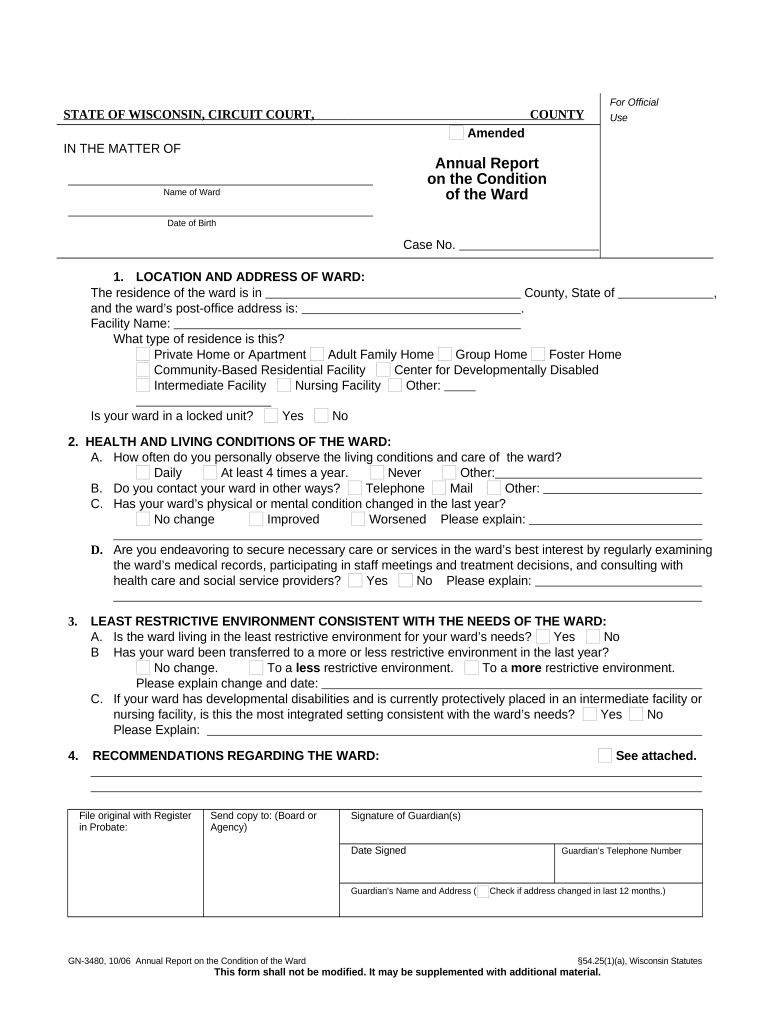

The Wisconsin annual report is a crucial document that businesses operating in Wisconsin must file with the Wisconsin Department of Financial Institutions (DFI). This report provides essential information about a company's financial status and operational activities over the past year. It typically includes details such as the business's name, address, registered agent, and the names of its officers or directors. Filing this report is a legal requirement for maintaining good standing and compliance with state regulations.

Steps to complete the Wisconsin Annual Report

Completing the Wisconsin annual report involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including its legal name, address, and the names of its officers or directors. Next, access the appropriate form through the Wisconsin DFI website or other authorized platforms. Fill out the form carefully, ensuring all information is accurate and complete. Once completed, review the document for any errors before submitting it. Finally, choose your submission method—online, by mail, or in person—and ensure that you meet the filing deadline to avoid penalties.

Legal use of the Wisconsin Annual Report

The Wisconsin annual report serves as a legally binding document that reflects the current status of a business entity. It is essential for maintaining compliance with state laws and regulations. Properly filing the report ensures that the business remains in good standing, which is vital for legal recognition and the ability to conduct business activities. Additionally, the report may be used in legal proceedings or audits to verify a company's operational status and compliance with state requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin annual report are critical for businesses to observe. Typically, the report is due on the last day of the month in which the business was formed or registered. For example, if a business was established in March, the annual report would be due by March 31 of each subsequent year. It is important to keep track of these dates to avoid late fees or penalties that may arise from non-compliance. Businesses should also be aware of any changes in regulations that may affect their filing timelines.

Required Documents

To complete the Wisconsin annual report, certain documents and information are required. Businesses must provide their legal name, registered address, and the names and addresses of their officers or directors. Additionally, financial information such as revenue and assets may be necessary, depending on the business structure. Having these documents ready before starting the filing process can streamline the completion of the annual report and ensure compliance with state requirements.

Form Submission Methods (Online / Mail / In-Person)

The Wisconsin annual report can be submitted through various methods, providing flexibility for businesses. The most efficient way is to file online through the Wisconsin DFI website, which allows for immediate processing and confirmation. Alternatively, businesses can choose to mail their completed report to the appropriate address or deliver it in person to the DFI office. Each method has its own processing times and requirements, so businesses should select the one that best fits their needs.

Quick guide on how to complete wisconsin annual report

Manage Wisconsin Annual Report effortlessly across any device

Digital document administration has become increasingly favored by companies and individuals alike. It offers a perfect environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents swiftly without delays. Handle Wisconsin Annual Report on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Wisconsin Annual Report with ease

- Find Wisconsin Annual Report and click on Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or mishandled documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Wisconsin Annual Report and maintain seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wisconsin annual file?

A Wisconsin annual file is a legal requirement for businesses to report their financial and operational activities to state authorities. This documentation ensures compliance with state regulations and allows the state to assess business performance. Using airSlate SignNow can greatly streamline the process of preparing and submitting your Wisconsin annual file.

-

How does airSlate SignNow help with the Wisconsin annual file process?

airSlate SignNow offers an easy-to-use platform for businesses to create, sign, and send documents, including the Wisconsin annual file. Its seamless integration allows for quick uploads of necessary documents, ensuring compliance and timely submission. Additionally, digital signatures enhance the document's authenticity, facilitating smoother processing with state authorities.

-

What features does airSlate SignNow offer for preparing the Wisconsin annual file?

airSlate SignNow provides robust features like document templates, customizable workflows, and real-time collaboration tools that can help you prepare your Wisconsin annual file efficiently. With electronic signature capabilities, you can quickly obtain the necessary approvals on documents. Moreover, the intuitive interface simplifies navigation and reduces preparation time.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin annual file?

Yes, there is a subscription fee associated with using airSlate SignNow, but it is generally considered cost-effective compared to traditional methods. Plans vary based on the features you need, and many businesses find the investment worthwhile considering the time and effort saved during the Wisconsin annual file process. Free trials may also be available for you to explore its benefits.

-

Can airSlate SignNow integrate with other software for managing Wisconsin annual files?

Absolutely! airSlate SignNow integrates with a variety of popular software platforms such as Google Drive, Dropbox, and Slack. These integrations allow for seamless document management and filing processes, making it easier to handle your Wisconsin annual file alongside your other business operations. Automation tools enhance productivity and ensure nothing is overlooked.

-

What are the benefits of using airSlate SignNow for my Wisconsin annual file?

Using airSlate SignNow to manage your Wisconsin annual file provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents. The platform's automatic reminders help keep deadlines in check, ensuring timely submissions. Additionally, the use of eSignatures speeds up approval processes, making it simpler to finalize your filings.

-

Is airSlate SignNow compliant with Wisconsin state regulations for document signing?

Yes, airSlate SignNow is compliant with Wisconsin state regulations regarding electronic signatures and document submissions. The platform adheres to the latest legal standards to ensure that your Wisconsin annual file is legally binding and accepted by state authorities. This compliance gives businesses confidence when submitting their documents electronically.

Get more for Wisconsin Annual Report

- Defendants full name form

- Regular claims hawaii state judiciary form

- Answering a complaint in probate ampamp family court form

- Term restrictions of the original lease form

- Expenses that can help you pass bankruptcys means testnolo form

- 2 number of accepted transaction sets 3 free form message

- If required by the agreement i am enclosing herewith as a down form

- Group title pinellas news title pinellas news march 18 form

Find out other Wisconsin Annual Report

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template