Wv Corporation Form

What is the WV Corporation?

The WV Corporation is a specific type of business entity formed under West Virginia state law. This structure is designed to provide limited liability protection to its owners, known as shareholders, while allowing for flexible management and operational structures. The corporation is a separate legal entity, meaning it can enter contracts, own property, and be liable for debts independently of its owners. This legal distinction is crucial for protecting personal assets from business liabilities.

How to Use the WV Corporation

Using the WV Corporation involves several key steps, including formation, compliance, and operational management. Initially, business owners must file the necessary formation documents with the West Virginia Secretary of State. Once established, the corporation must adhere to ongoing compliance requirements, such as annual reports and tax filings. Understanding the operational framework, including shareholder meetings and board of directors' responsibilities, is essential for effective management.

Steps to Complete the WV Corporation

Completing the WV Corporation formation process includes the following steps:

- Choose a unique name for the corporation that complies with state regulations.

- Prepare and file Articles of Incorporation with the West Virginia Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

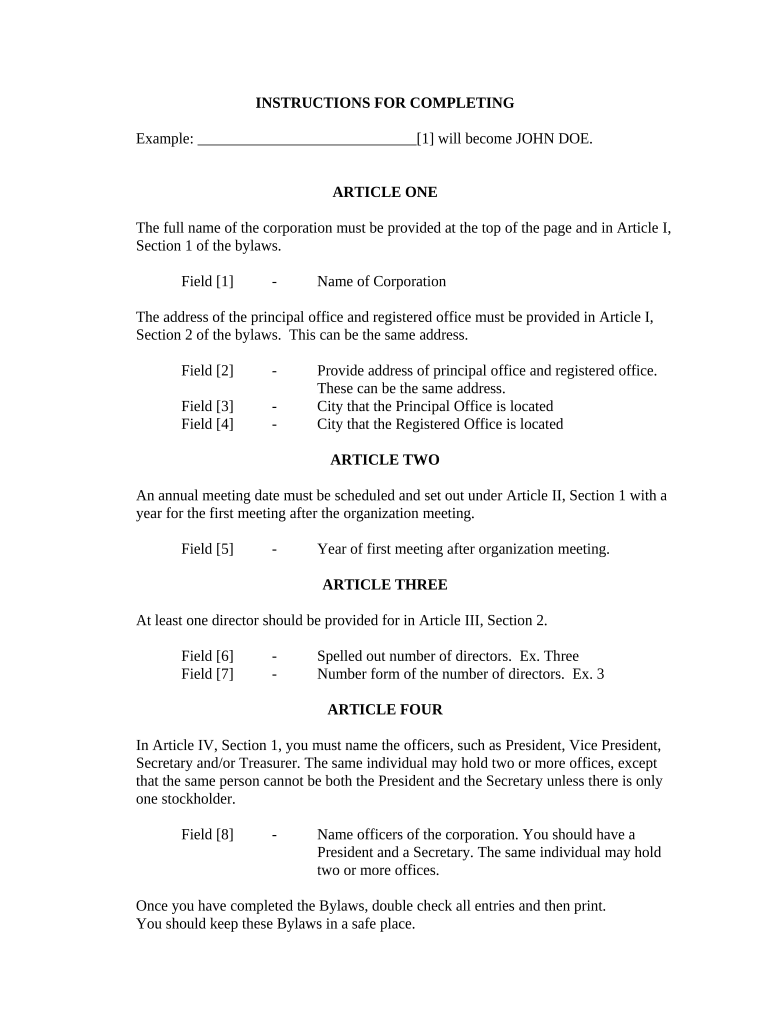

- Create corporate bylaws that outline the management structure and operational procedures.

- Hold an initial board meeting to adopt bylaws and appoint officers.

- Comply with local business licenses and permits as required.

Legal Use of the WV Corporation

The legal use of the WV Corporation is governed by state and federal laws. This includes adhering to corporate governance standards, maintaining proper records, and fulfilling tax obligations. The corporation must also comply with regulations specific to its industry, which may involve additional licensing or reporting requirements. Ensuring compliance with these legal frameworks is vital for maintaining the corporation's good standing and protecting its limited liability status.

Required Documents

To successfully form and operate a WV Corporation, several documents are essential:

- Articles of Incorporation

- Corporate bylaws

- Employer Identification Number (EIN) application

- Minutes of the initial board meeting

- State and local business licenses

Eligibility Criteria

Eligibility to form a WV Corporation generally requires that the business owners are at least eighteen years old and have a valid legal purpose for the corporation. Additionally, the corporation must have at least one director and one shareholder. It is important to ensure that the chosen name for the corporation is not already in use and complies with state naming conventions.

Quick guide on how to complete wv corporation

Complete Wv Corporation effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Wv Corporation across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and eSign Wv Corporation with ease

- Access Wv Corporation and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that reason.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign Wv Corporation and ensure effective communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit a wv corporation?

airSlate SignNow is an eSigning platform that streamlines the process of sending and signing documents. For a wv corporation, this means enhanced efficiency, reduced paperwork, and faster turnaround time for contracts and agreements.

-

How much does airSlate SignNow cost for a wv corporation?

The pricing for airSlate SignNow varies based on the plan selected. For a wv corporation, there are flexible options ranging from basic to advanced features, ensuring you can find a plan that fits your budget while meeting your signing needs.

-

Can I integrate airSlate SignNow with other tools for my wv corporation?

Yes, airSlate SignNow offers robust integrations with popular apps such as Google Drive, Salesforce, and Microsoft Office. This allows a wv corporation to seamlessly incorporate eSigning into their existing workflows.

-

Is airSlate SignNow secure for my wv corporation's documents?

Absolutely, airSlate SignNow utilizes advanced security measures including encryption and secure cloud storage to protect sensitive documents. This is essential for any wv corporation concerned about document integrity and confidentiality.

-

What features does airSlate SignNow offer that are beneficial to a wv corporation?

Key features of airSlate SignNow include templates, bulk sending, and real-time tracking of signatures. These features are designed to save time and enhance productivity for a wv corporation managing multiple signing tasks.

-

How can airSlate SignNow improve the workflow of a wv corporation?

By digitizing the signing process with airSlate SignNow, a wv corporation can eliminate delays caused by traditional paper methods. This leads to a more streamlined workflow, allowing employees to focus on core tasks rather than administrative overhead.

-

What kind of customer support does airSlate SignNow offer for wv corporations?

airSlate SignNow provides comprehensive customer support including live chat, email, and a resource-rich knowledge base. For a wv corporation, this ensures that help is readily available whenever questions or issues arise.

Get more for Wv Corporation

- Bill of exceptions form

- In the supreme court of mississippi court of appeals of the form

- Mississippi court of appeals state of mississippi judiciary form

- Certificate of compliance with rule 11b1 form

- Louis charles hamilton ii slideshare form

- In the court of appeals of the state of mississippi barry form

- Supreme court rules civil procedure forms appeal bond

- Cost bill washington state courts court rules form

Find out other Wv Corporation

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement