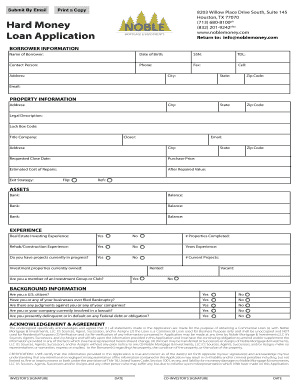

Hard Money Loan Application Noble Mortgage Form

What is the Hard Money Loan Application Noble Mortgage

The Hard Money Loan Application for noble mortgage is a specialized form used by borrowers seeking short-term financing secured by real estate. Unlike traditional loans, hard money loans are often provided by private lenders or investors and are based on the value of the property rather than the borrower's creditworthiness. This application typically requires detailed information about the property, the borrower's financial situation, and the intended use of the funds. It serves as a crucial first step in securing a hard money loan, allowing lenders to assess the risk and potential return on their investment.

Steps to Complete the Hard Money Loan Application Noble Mortgage

Completing the Hard Money Loan Application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including proof of income, property details, and any existing liens. Next, fill out the application form, providing clear and concise information about your financial status and the property in question. Once completed, review the application for any errors or omissions. Finally, submit the application to the lender, either online or via mail, as per their submission guidelines. Each step is essential for a smooth application process and timely approval.

Key Elements of the Hard Money Loan Application Noble Mortgage

The Hard Money Loan Application includes several critical elements that lenders evaluate. Key components typically consist of:

- Borrower Information: Personal details, including name, address, and contact information.

- Property Details: Information about the property being used as collateral, including its location, type, and current market value.

- Loan Amount Requested: The specific amount of financing needed for the project.

- Purpose of the Loan: A clear explanation of how the funds will be used, such as for renovations or purchasing new property.

- Financial Information: Details about the borrower's income, assets, and liabilities to assess repayment capability.

Legal Use of the Hard Money Loan Application Noble Mortgage

The legal use of the Hard Money Loan Application is governed by various regulations to ensure compliance and protect both borrowers and lenders. In the United States, eSignature laws such as the ESIGN Act and UETA provide a framework for the validity of electronic signatures on loan applications. This means that as long as the application is completed and signed in accordance with these laws, it is legally binding. It is essential for borrowers to understand their rights and obligations under these laws to avoid potential disputes.

Eligibility Criteria for the Hard Money Loan Application Noble Mortgage

Eligibility for a hard money loan through the noble mortgage application typically involves specific criteria that borrowers must meet. These criteria may include:

- Property Value: The property must have sufficient equity to secure the loan.

- Credit History: While hard money loans are less dependent on credit scores, a basic review may still be conducted.

- Income Verification: Borrowers may need to provide proof of income to demonstrate their ability to repay the loan.

- Loan Purpose: The intended use of the funds must align with the lender's policies, such as property renovation or investment.

How to Obtain the Hard Money Loan Application Noble Mortgage

Obtaining the Hard Money Loan Application for noble mortgage is a straightforward process. Interested borrowers can typically access the application through the lender's website or by contacting them directly. Many lenders offer digital versions of the application that can be filled out and submitted online, streamlining the process. It is advisable to review the lender's requirements and guidelines before obtaining the application to ensure all necessary information is prepared in advance, facilitating a smoother application experience.

Quick guide on how to complete hard money loan application noble mortgage

Complete Hard Money Loan Application Noble Mortgage effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, adjust, and eSign your documents swiftly without delays. Manage Hard Money Loan Application Noble Mortgage on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric task today.

The easiest way to modify and eSign Hard Money Loan Application Noble Mortgage effortlessly

- Find Hard Money Loan Application Noble Mortgage and click Get Form to initiate the process.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you'd like to deliver your form, via email, SMS, an invite link, or download it to your computer.

Forget about missing or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Hard Money Loan Application Noble Mortgage and facilitate excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is noble mortgage, and how does it work?

Noble mortgage refers to a trustworthy lending option that helps individuals finance their homes. It typically involves an application process where borrowers provide financial information to determine their eligibility. Comparing noble mortgage offerings can help you find a solution that fits your needs.

-

What are the benefits of using noble mortgage?

The benefits of noble mortgage include competitive interest rates, flexible repayment options, and personalized customer service. This type of mortgage can help you manage your finances more efficiently while making homeownership accessible. Additionally, a noble mortgage can be tailored to your financial situation for better ease of use.

-

How does airSlate SignNow enhance the noble mortgage application process?

AirSlate SignNow empowers users to streamline the noble mortgage application process by allowing them to electronically sign and send documents easily. This eliminates the need for physical paperwork and speeds up the approval process. With advanced security features, your information remains protected during the transaction.

-

What features should I look for in a noble mortgage?

When considering a noble mortgage, look for features such as fixed or adjustable rates, loan term flexibility, and low closing costs. Additionally, assess whether the mortgage provider offers online account management and responsive customer support. These features can signNowly enhance your borrowing experience.

-

What is the cost of a noble mortgage?

The cost of a noble mortgage varies based on factors like interest rates, loan amounts, and the borrower's creditworthiness. It's essential to request quotes from multiple lenders to compare pricing. Budgeting for additional costs such as closing fees and insurance can also help you manage your finances better.

-

Are there any integrations with airSlate SignNow available for noble mortgage applicants?

Yes, airSlate SignNow offers integrations with various financial institutions and mortgage platforms to streamline the noble mortgage application process. By connecting your existing systems, you can enhance productivity and ensure smooth communication between all parties involved. This allows for better tracking and management of your mortgage documentation.

-

How can I ensure I get the best rates on a noble mortgage?

To secure the best rates on a noble mortgage, maintain a good credit score and shop around for multiple offers. Consider working with a mortgage broker who can provide insights into various lenders' products. Additionally, being prepared with documentation can help facilitate a faster and more favorable lending experience.

Get more for Hard Money Loan Application Noble Mortgage

- Trim carpenter contract for contractor alabama form

- Fencing contract 497295298 form

- Hvac contract for contractor alabama form

- Landscape contract for contractor alabama form

- Commercial contract for contractor alabama form

- Excavator contract for contractor alabama form

- Renovation contract for contractor alabama form

- Concrete mason contract for contractor alabama form

Find out other Hard Money Loan Application Noble Mortgage

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form