Form IL 4562, Special Depreciation

What is the Form IL 4562, Special Depreciation

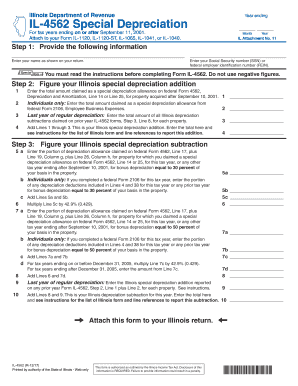

The Form IL 4562 is a crucial document used by taxpayers in Illinois to claim special depreciation allowances on qualifying property. This form is specifically designed for businesses that have acquired new or used property and wish to take advantage of the special depreciation provisions outlined in the Illinois tax code. The special depreciation allowance allows for a significant deduction in the year the property is placed in service, which can greatly reduce the overall tax burden for businesses. Understanding the purpose and application of this form is essential for maximizing tax benefits and ensuring compliance with state regulations.

Steps to Complete the Form IL 4562, Special Depreciation

Completing the Form IL 4562 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the property for which you are claiming depreciation. This includes purchase invoices, asset descriptions, and any previous depreciation schedules. Next, fill out the form by providing information such as the type of property, date placed in service, and the amount of depreciation being claimed. It is important to follow the instructions carefully, as errors can lead to delays or penalties. Finally, review the completed form for accuracy before submission to ensure that all information is correct and complete.

Key Elements of the Form IL 4562, Special Depreciation

The Form IL 4562 consists of several key elements that taxpayers must understand to complete it correctly. These include:

- Property Information: Details about the property being depreciated, including its type and cost.

- Depreciation Method: The method of depreciation being used, such as straight-line or declining balance.

- Placed in Service Date: The date when the property was put into use, which is critical for determining the applicable depreciation period.

- Special Depreciation Allowance: The specific amount of depreciation being claimed for the current tax year.

Each of these elements plays a vital role in accurately reporting depreciation and ensuring that the taxpayer receives the appropriate tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 4562 are crucial for taxpayers to adhere to in order to avoid penalties. Generally, the form must be submitted along with the Illinois income tax return by the due date of the return, which is typically April 15 for most taxpayers. However, if an extension is filed for the tax return, the deadline for submitting the Form IL 4562 may also be extended. It is important to stay informed about any changes to deadlines or specific requirements that may arise from year to year to ensure timely compliance.

Legal Use of the Form IL 4562, Special Depreciation

The legal use of the Form IL 4562 is governed by state tax regulations that outline the eligibility criteria for claiming special depreciation. Taxpayers must ensure that the property meets specific qualifications, such as being used in a trade or business and not being acquired for resale. Additionally, maintaining accurate records and documentation is essential for substantiating claims made on the form. Failure to comply with legal requirements can result in disallowed claims and potential penalties, making it vital for businesses to understand their responsibilities when using this form.

Who Issues the Form IL 4562

The Form IL 4562 is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to help individuals and businesses understand their tax obligations, including the proper use of forms like the IL 4562. Taxpayers can access the form and related instructions through the Illinois Department of Revenue’s official website or by contacting their offices directly for assistance.

Quick guide on how to complete what is special depreciation allowance

Effortlessly Prepare what is special depreciation allowance on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage il 4562 instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign il 4562 without Hassle

- Obtain il form 4562 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such tasks.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign il 4562 instructions 2024 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs special depreciation

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Related searches to illinois bonus depreciation 2017

Create this form in 5 minutes!

How to create an eSignature for the illinois bonus depreciation

How to create an eSignature for the 2017 Form Il 4562 Special Depreciation online

How to generate an eSignature for your 2017 Form Il 4562 Special Depreciation in Chrome

How to create an electronic signature for putting it on the 2017 Form Il 4562 Special Depreciation in Gmail

How to generate an eSignature for the 2017 Form Il 4562 Special Depreciation from your smart phone

How to generate an eSignature for the 2017 Form Il 4562 Special Depreciation on iOS devices

How to generate an electronic signature for the 2017 Form Il 4562 Special Depreciation on Android devices

People also ask il form 4562 instructions 2019

-

What is special depreciation allowance?

What is special depreciation allowance? It refers to a tax benefit that enables businesses to recover the costs of certain qualifying assets more quickly. By allowing an additional percentage of the asset's cost to be deducted in the first year, companies can improve their cash flow and reinvest in growth.

-

How does airSlate SignNow relate to what is special depreciation allowance?

AirSlate SignNow, by simplifying document signing and eSigning processes, can help businesses take advantage of these financial incentives. Utilizing a cost-effective document solution can enhance efficiency, allowing companies to focus on claiming benefits like what is special depreciation allowance without getting bogged down in paperwork.

-

What assets qualify for the special depreciation allowance?

Assets such as new machinery, equipment, and certain software often qualify for the special depreciation allowance. Understanding these qualifications is crucial for businesses leveraging airSlate SignNow to manage their asset documentation smoothly while optimizing tax benefits.

-

How can I easily document my assets for special depreciation allowance using airSlate SignNow?

AirSlate SignNow allows businesses to quickly create, send, and store electronic documents needed for claiming what is special depreciation allowance. With templates and seamless eSigning, you can ensure all necessary paperwork is accurate and readily available for your tax filings.

-

Is there a cost associated with using airSlate SignNow for eSigning documents?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans are designed to ensure you have access to essential features while easily managing documents related to tax benefits like what is special depreciation allowance.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can streamline your document management and signing processes, saving time and reducing errors. Moreover, with a focus on efficiency, businesses can focus on important matters like understanding what is special depreciation allowance and leveraging it effectively.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! AirSlate SignNow integrates seamlessly with various business tools, enhancing your workflow efficiency. By integrating these tools, you can simplify the documentation process related to what is special depreciation allowance and improve overall operational productivity.

Get more for special depreciation allowance

- How to become a participating employer under the wisconsin public employers group life insurance program etf wisconsin form

- Long form affidavit florida electronic

- Ahca background screening application for exemption 2013 form

- Dbpr hr 7007 form

- Florida tax application editable 2011 form

- Florida medicaid acs inc form

- Form cs es51i

- Dr 309639 2014 form

Find out other il form 4562 instructions 2018

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template