Ga 501x Form

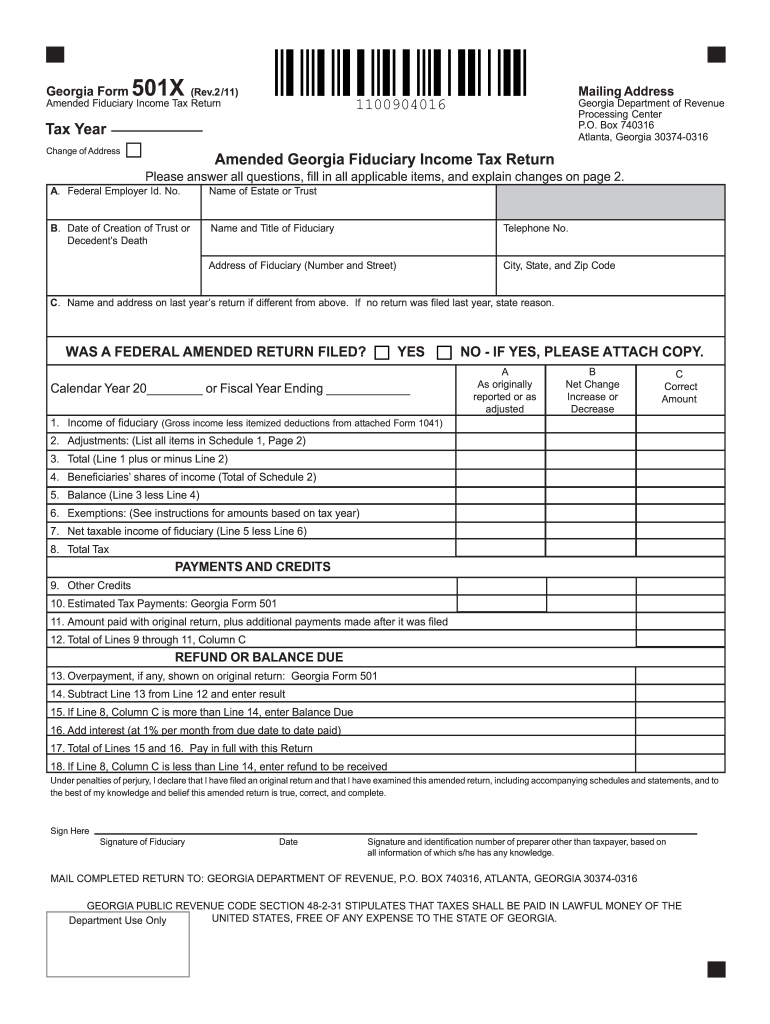

What is the GA 501X Form

The GA 501X form, also known as the Georgia Amended Individual Income Tax Return, is used by taxpayers in Georgia to amend their previously filed income tax returns. This form allows individuals to correct errors, claim additional deductions, or report changes in income that were not included in the original submission. Filing an amended return is essential for ensuring that your tax records are accurate and up to date, which can help avoid potential penalties or issues with the Georgia Department of Revenue.

How to Use the GA 501X Form

To use the GA 501X form effectively, start by gathering all relevant documents related to your original tax return. This includes your W-2s, 1099s, and any other income statements. Next, clearly indicate the changes you are making to your original return on the GA 501X. Be sure to provide a detailed explanation of why you are amending your return. After completing the form, review it for accuracy before submitting it to ensure all changes are properly documented.

Steps to Complete the GA 501X Form

Completing the GA 501X form involves several key steps:

- Obtain the GA 501X form from the Georgia Department of Revenue website or a tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the original return.

- List the changes you are making, including any additional income or deductions.

- Sign and date the form to certify the information is accurate.

- Submit the completed form to the Georgia Department of Revenue, either by mail or electronically, if applicable.

Legal Use of the GA 501X Form

The GA 501X form is legally recognized for amending tax returns in Georgia, provided it is completed accurately and submitted within the appropriate time frame. Taxpayers must adhere to the guidelines set forth by the Georgia Department of Revenue to ensure compliance with state tax laws. Proper use of this form can help mitigate the risk of audits or penalties associated with incorrect tax filings.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines when submitting the GA 501X form. Generally, amended returns must be filed within three years of the original due date of the return or within one year of the date you paid the tax, whichever is later. Keeping track of these deadlines ensures that you remain compliant and can avoid any late fees or penalties associated with late submissions.

Required Documents

When filing the GA 501X form, certain documents are necessary to support your amendments. These may include:

- Your original tax return (Form 500 or 500EZ).

- Any additional income statements, such as W-2s or 1099s.

- Documentation for any new deductions or credits you are claiming.

- Any correspondence from the Georgia Department of Revenue related to your original return.

Penalties for Non-Compliance

Failure to file the GA 501X form when necessary can lead to penalties imposed by the Georgia Department of Revenue. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is important to address any errors on your original return promptly by using the GA 501X to minimize the risk of these consequences.

Quick guide on how to complete ga 501x form

Effortlessly Complete Ga 501x Form on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed contracts, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Ga 501x Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Ga 501x Form with Ease

- Find Ga 501x Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your alterations.

- Choose how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ga 501x Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of filing a Georgia income tax return?

Filing a Georgia income tax return is essential to comply with state laws and avoid penalties. It allows residents to accurately report income, claim deductions, and determine taxable liabilities. Completing your Georgia income tax return timely also ensures you can receive any potential refunds.

-

How can airSlate SignNow assist in filing my Georgia income tax return?

airSlate SignNow streamlines the process of sending and eSigning documents, making it easier to gather necessary signatures for your Georgia income tax return. With its user-friendly platform, you can swiftly manage all your tax documents and stay organized throughout the filing process. This efficiency can save both time and effort, ensuring your returns are submitted accurately.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow features electronic signatures, document templates, and secure cloud storage, making it ideal for managing your Georgia income tax return documents. You can customize templates to fit your needs, ensuring all forms are up to date. The platform also provides tracking capabilities, so you know when documents are signed and submitted.

-

Are there any costs associated with using airSlate SignNow for my Georgia income tax return?

Yes, airSlate SignNow offers a range of pricing plans tailored to different user needs. The pricing is competitive, providing excellent value for the features offered, especially if you regularly handle tax-related documents. By utilizing airSlate SignNow for your Georgia income tax return, you can ensure a smooth and efficient filing process.

-

Can I use airSlate SignNow for other tax forms besides my Georgia income tax return?

Absolutely! airSlate SignNow is versatile and can be used for various tax forms beyond the Georgia income tax return. Whether you need to eSign federal tax documents or other state tax filings, the platform accommodates multiple types of documents, enhancing your document management efficiency.

-

Is my data safe when using airSlate SignNow for tax documents?

Yes, airSlate SignNow prioritizes data security by implementing robust encryption and security measures. Your personal and financial information related to your Georgia income tax return is protected, ensuring compliance with privacy regulations. You can trust that your sensitive documents are safe in the airSlate SignNow environment.

-

How does airSlate SignNow integrate with other tools for tax filing?

airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easier to manage your Georgia income tax return alongside your financial records. These integrations allow for a smoother workflow, enabling automatic data transfer between platforms. This ensures your tax documentation is consistently updated and eliminates manual entry errors.

Get more for Ga 501x Form

- Alaska legal 497295202 form

- Legal last will and testament form for married person with minor children alaska

- Ak will form

- Legal last will and testament form for divorced person not remarried with adult and minor children alaska

- Mutual wills package with last wills and testaments for married couple with adult children alaska form

- Mutual wills package with last wills and testaments for married couple with no children alaska form

- Mutual wills package with last wills and testaments for married couple with minor children alaska form

- Legal last will and testament form for married person with adult and minor children from prior marriage alaska

Find out other Ga 501x Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe