Alabama Department of Revenue Forms

What is the Alabama Department of Revenue Forms

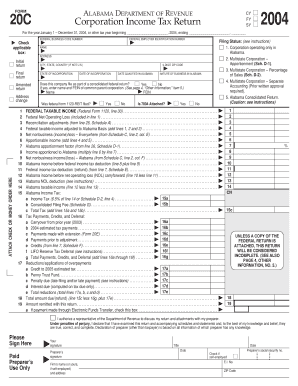

The Alabama Department of Revenue provides a variety of forms necessary for filing corporation tax and other tax-related documentation. These forms are essential for individuals and businesses to report income, calculate tax liabilities, and ensure compliance with state tax laws. Each form is designed to meet specific requirements and is tailored to different taxpayer scenarios, including corporations, partnerships, and sole proprietorships.

Steps to complete the Alabama Department of Revenue Forms

Completing the Alabama Department of Revenue forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and prior tax returns. Next, select the appropriate form based on your business structure and tax situation. Carefully fill out each section of the form, ensuring that all information is accurate and complete. Finally, review the form for any errors before submission to avoid potential penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Alabama corporation tax forms is crucial for compliance. Typically, the due date for filing the annual corporation tax return is the 15th day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by March 15. Additionally, estimated tax payments may be required throughout the year, with specific deadlines for each payment period.

Required Documents

When filing corporation tax forms in Alabama, certain documents are essential to support your submission. Required documents typically include income statements, balance sheets, and any supporting schedules that detail deductions or credits claimed. Additionally, prior year tax returns may be necessary to provide context for the current filing. Ensuring that all required documents are included can help facilitate a smoother review process by the Alabama Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

Alabama offers multiple methods for submitting corporation tax forms, allowing taxpayers flexibility in how they file. Forms can be submitted online through the Alabama Department of Revenue's website, which provides a streamlined process for electronic filing. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address listed on the form or submit them in person at designated offices. Each method has its own processing times, so it's important to consider the submission method that best meets your needs.

Penalties for Non-Compliance

Failing to comply with Alabama corporation tax filing requirements can result in significant penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It's essential for businesses to understand these penalties and take proactive steps to ensure timely and accurate filing of their corporation tax returns to avoid unnecessary financial burdens.

Quick guide on how to complete alabama department of revenue forms

Prepare Alabama Department Of Revenue Forms effortlessly on any device

Online document administration has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Alabama Department Of Revenue Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Alabama Department Of Revenue Forms with ease

- Locate Alabama Department Of Revenue Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Alabama Department Of Revenue Forms and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is corporation tax and who needs to pay it?

Corporation tax is a tax imposed on the profits of a corporation. Businesses operating as limited companies must pay corporation tax on their worldwide profits. Understanding your obligations regarding corporation tax is essential to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with corporation tax-related documents?

airSlate SignNow provides a seamless platform for sending and eSigning documents related to corporation tax. By using our solution, businesses can streamline their tax document processes, reducing the time spent on approvals and ensuring accuracy. This is particularly beneficial when managing important corporation tax forms.

-

What are the pricing options for using airSlate SignNow in relation to corporation tax documentation?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Our plans are designed to provide value for businesses managing corporation tax documents, allowing you to choose an option that fits your budget. Get started with a cost-effective solution for handling all your documentation.

-

Are there integrations available that assist with corporation tax?

Yes, airSlate SignNow integrates with various accounting and tax preparation software, making it easier to manage your corporation tax documentation. These integrations streamline workflows and enhance collaboration between financial teams. By connecting with your existing tools, we simplify the process of handling sensitive tax-related documents.

-

What features does airSlate SignNow offer for managing corporation tax documents?

Our platform includes features such as eSigning, document templates, and real-time tracking to effectively manage corporation tax documents. These capabilities help expedite the signing process and keep everything organized. Leveraging these features ensures that your corporation tax documentation is handled smoothly and securely.

-

How does airSlate SignNow enhance compliance for corporation tax documentation?

Compliance is critical when dealing with corporation tax, and airSlate SignNow helps ensure that all documents are signed and stored securely. Our audit trails and security features safeguard your documents and maintain a record of all transactions. This level of documentation and tracking aids in meeting regulatory requirements.

-

Can airSlate SignNow assist in reducing the time spent on corporation tax paperwork?

Absolutely! By utilizing airSlate SignNow, businesses can drastically reduce the time associated with handling corporation tax paperwork. Our easy-to-use platform enables quick eSigning and document management, freeing up valuable time for more strategic tasks. Streamlining these processes allows for quicker turnaround on tax-related documents.

Get more for Alabama Department Of Revenue Forms

- Ar checklist form

- Sellers appraiser form

- Subcontractors agreement arkansas form

- Option to purchase addendum to residential lease lease or rent to own arkansas form

- Arkansas prenuptial premarital agreement with financial statements arkansas form

- Ar prenuptial form

- Amendment to prenuptial or premarital agreement arkansas form

- Download statutory credit report application form experian

Find out other Alabama Department Of Revenue Forms

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer