Form UC 018 Form UC 020 Unemployment Tax and Wage Report

What is the Form UC 018 and Form UC 020 Unemployment Tax and Wage Report

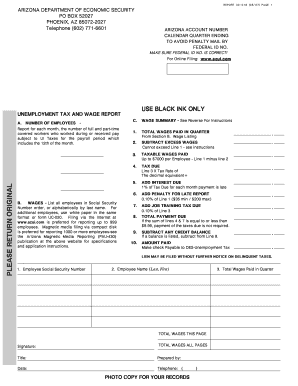

The Form UC 018 and Form UC 020 are essential documents used in Arizona for reporting unemployment tax and wages. These forms are designed for employers to report their wage information and calculate their unemployment tax liability. The UC 018 focuses on the detailed wage report, while the UC 020 serves as the unemployment tax report. Both forms are critical for maintaining compliance with state regulations and ensuring that unemployment benefits are adequately funded.

Steps to Complete the Form UC 018 and Form UC 020 Unemployment Tax and Wage Report

Completing the Form UC 018 and Form UC 020 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including employee wages, hours worked, and any applicable deductions. Follow these steps:

- Fill out the employer information section, including your business name, address, and identification number.

- For Form UC 018, list all employees and their respective wages for the reporting period.

- On Form UC 020, calculate the total unemployment tax based on the reported wages.

- Review all entries for accuracy, ensuring that all figures are correctly calculated and reported.

- Sign and date the forms to validate the information provided.

Legal Use of the Form UC 018 and Form UC 020 Unemployment Tax and Wage Report

The legal use of the Form UC 018 and Form UC 020 is governed by state unemployment laws. These forms must be completed accurately and submitted on time to avoid penalties. Employers are required to maintain these records as part of their tax obligations. Failure to comply with the legal requirements can result in fines or increased tax rates. It is essential to understand the legal implications of these forms to ensure proper adherence to state regulations.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines for the Form UC 018 and Form UC 020 to maintain compliance. Typically, these forms are due on a quarterly basis, with deadlines falling at the end of the month following the close of each quarter. For example, the forms for the first quarter, which ends in March, are generally due by April 30. It is crucial to keep track of these deadlines to avoid late penalties and ensure timely reporting.

Form Submission Methods

The Form UC 018 and Form UC 020 can be submitted through various methods to accommodate different employer preferences. Employers may choose to submit these forms online through the Arizona Department of Economic Security's website, ensuring a quick and efficient process. Alternatively, forms can be mailed directly to the appropriate state office or submitted in person. Each submission method has its advantages, and employers should select the one that best fits their operational needs.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form UC 018 and Form UC 020 can result in significant penalties for employers. These penalties may include fines, interest on unpaid taxes, and potential increases in unemployment tax rates. It is essential for employers to understand the consequences of failing to file these forms accurately and on time. Regular training and updates on compliance requirements can help mitigate these risks.

Quick guide on how to complete form uc 018 form uc 020 unemployment tax and wage report

Effortlessly Prepare Form UC 018 Form UC 020 Unemployment Tax And Wage Report on Any Device

Digital document management has gained immense popularity among companies and individuals alike. It presents an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Form UC 018 Form UC 020 Unemployment Tax And Wage Report on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Form UC 018 Form UC 020 Unemployment Tax And Wage Report with Ease

- Locate Form UC 018 Form UC 020 Unemployment Tax And Wage Report and click on Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from your preferred device. Adjust and electronically sign Form UC 018 Form UC 020 Unemployment Tax And Wage Report, ensuring exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the az wage and how does it relate to airSlate SignNow?

The az wage refers to the average wage rates applicable to employees in Arizona. Understanding the az wage is crucial for businesses using airSlate SignNow to ensure compliance with local labor laws when sending employment-related documents.

-

How does airSlate SignNow help businesses comply with az wage requirements?

airSlate SignNow provides customizable templates that ensure all employment documents meet Arizona's az wage regulations. This helps businesses maintain compliance while streamlining the hiring and onboarding processes.

-

What features does airSlate SignNow offer for managing documents related to az wage?

airSlate SignNow includes features such as document templates, e-signatures, and compliance tracking. These tools simplify the creation and management of documents necessary for adhering to az wage standards.

-

Is there a free trial available for airSlate SignNow users focusing on az wage compliance?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its features for managing documents associated with az wage compliance. This trial gives businesses firsthand experience with the platform before committing to a subscription.

-

Can I integrate airSlate SignNow with other HR tools for tracking az wage information?

Absolutely! airSlate SignNow seamlessly integrates with various HR and payroll systems, allowing businesses to centralize their az wage tracking. This integration helps ensure that all documentation and data are aligned for efficient compliance management.

-

What are the benefits of using airSlate SignNow with az wage-related documents?

Using airSlate SignNow for az wage-related documents increases efficiency and reduces errors by automating the signing process. Additionally, it enhances record-keeping and ensures that all documents are legally compliant and easily accessible.

-

How secure is the information I send related to az wage through airSlate SignNow?

Security is a top priority for airSlate SignNow. With advanced encryption and secure cloud storage, any information related to az wage that you send or store is protected to safeguard your business and employee data.

Get more for Form UC 018 Form UC 020 Unemployment Tax And Wage Report

Find out other Form UC 018 Form UC 020 Unemployment Tax And Wage Report

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter