Www Irs Govaffordable Care Actaffordable CareAffordable Care Act Tax Provisions Questions and Answers 2018-2026

Understanding the Florida Affordable Care Act

The Florida Affordable Care Act (ACA) is a crucial piece of legislation aimed at expanding healthcare access and affordability for residents. This act includes provisions to ensure that individuals and families can obtain health insurance coverage without facing prohibitive costs. It also mandates that insurance companies cannot deny coverage based on pre-existing conditions, which is vital for many Floridians seeking care.

Key Elements of the Florida Affordable Care Act

Several key elements define the Florida Affordable Care Act, including:

- Medicaid Expansion: This provision allows more low-income individuals to qualify for Medicaid, increasing access to healthcare services.

- Health Insurance Marketplace: The ACA established a marketplace where residents can compare and purchase health insurance plans, often with subsidies based on income.

- Essential Health Benefits: All plans must cover a set of essential health benefits, including preventive services, maternity care, and mental health services.

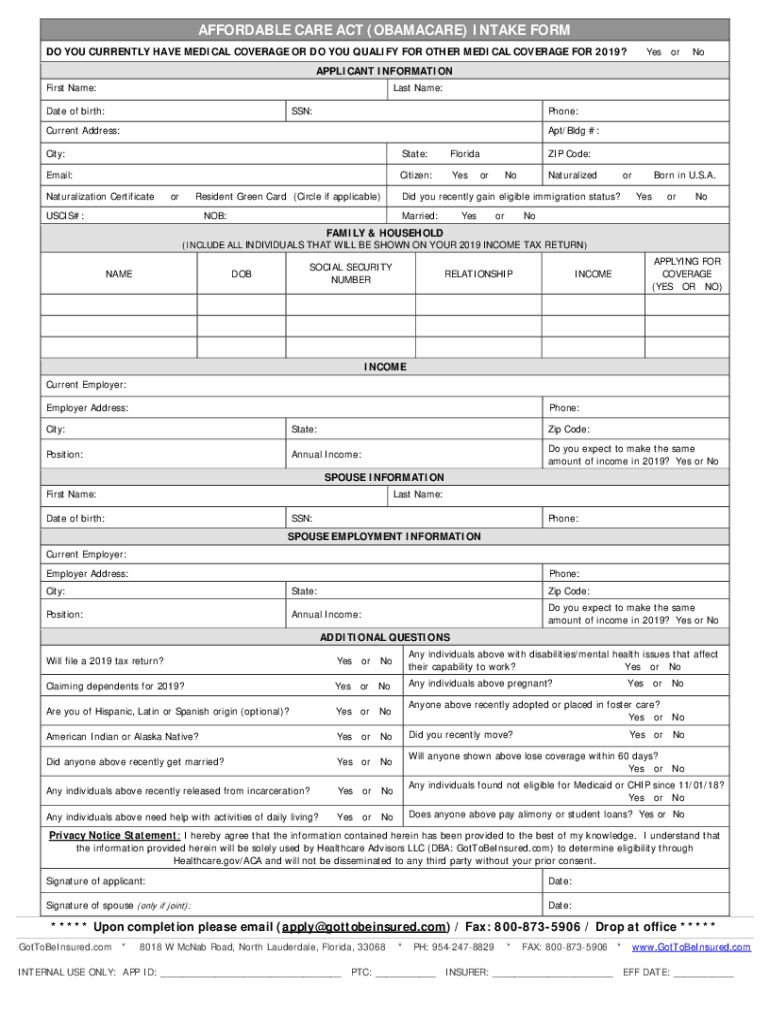

Steps to Complete the Florida Affordable Care Act Application

Applying for coverage under the Florida Affordable Care Act involves several steps:

- Gather necessary documents, such as proof of income and residency.

- Visit the Health Insurance Marketplace website to create an account.

- Complete the application form, providing accurate information about your household and income.

- Review available plans and select one that meets your needs.

- Submit your application and await confirmation of your coverage.

Eligibility Criteria for the Florida Affordable Care Act

Eligibility for coverage under the Florida Affordable Care Act is determined by several factors:

- Residency in Florida.

- Income level, which must fall within specific federal poverty guidelines.

- Age and family size, as these can affect coverage options and costs.

Legal Use of the Florida Affordable Care Act Forms

When filling out forms related to the Florida Affordable Care Act, it is essential to ensure legal compliance. This includes:

- Providing truthful and accurate information to avoid penalties.

- Understanding the implications of your submissions, as they can affect your eligibility for benefits.

- Using secure methods for submitting forms, such as digital signatures through reliable platforms.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for maintaining coverage under the Florida Affordable Care Act. Key dates include:

- Open enrollment period, which typically occurs annually.

- Deadlines for submitting applications for Medicaid and other assistance programs.

- Renewal deadlines for existing policies to ensure continuous coverage.

Quick guide on how to complete wwwirsgovaffordable care actaffordable careaffordable care act tax provisions questions and answers

Complete Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

How to modify and eSign Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers without hassle

- Obtain Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers and then click Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in a few clicks from any device you choose. Modify and eSign Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovaffordable care actaffordable careaffordable care act tax provisions questions and answers

Create this form in 5 minutes!

People also ask

-

What is the Florida Affordable Care Act and how does it impact businesses?

The Florida Affordable Care Act (ACA) plays a crucial role in providing healthcare coverage to individuals and families in Florida. It mandates that businesses extend healthcare benefits, ensuring that employees have access to essential medical services. Understanding the Florida Affordable Care Act is vital for businesses to comply with regulations and support their workforce.

-

How can airSlate SignNow help with compliance regarding the Florida Affordable Care Act?

airSlate SignNow simplifies the process of managing documentation related to the Florida Affordable Care Act. With its easy-to-use interface, businesses can send and eSign important compliance documents securely. This enhances efficiency and ensures that all necessary documents are properly managed to meet ACA requirements.

-

What are the pricing options for airSlate SignNow in relation to the Florida Affordable Care Act?

airSlate SignNow offers competitive pricing plans tailored to fit the needs of businesses navigating the Florida Affordable Care Act. These plans provide cost-effective solutions for document management, allowing businesses to choose a package that aligns with their size and requirements. Investing in airSlate SignNow can lead to better compliance at an affordable cost.

-

What features of airSlate SignNow support the Florida Affordable Care Act processes?

Key features of airSlate SignNow include the ability to create, send, and eSign documents securely and efficiently, making it easier for businesses to comply with the Florida Affordable Care Act. Additionally, the platform offers templates for ACA-related documents, ensuring that businesses can streamline their compliance processes. These features signNowly enhance the workflow and reduce processing time.

-

Are there integrations available with airSlate SignNow to streamline ACA-related tasks?

Yes, airSlate SignNow provides various integrations with other tools that businesses may already be using for ACA-related tasks. These integrations allow for seamless data transfer and document management, enhancing overall productivity. Leveraging these integrations can support businesses in staying compliant with the Florida Affordable Care Act more easily.

-

What benefits does airSlate SignNow offer for small businesses under the Florida Affordable Care Act?

For small businesses, airSlate SignNow offers an efficient and cost-effective solution to manage documentation associated with the Florida Affordable Care Act. The platform provides user-friendly features that simplify the signing and storage of essential compliance forms. Small businesses can save time and resources while ensuring they meet ACA requirements.

-

How does eSigning with airSlate SignNow meet the legal requirements of the Florida Affordable Care Act?

eSigning with airSlate SignNow meets the legal requirements of the Florida Affordable Care Act by providing a secure and legally binding way to sign documents. The platform complies with electronic signature laws, allowing businesses to ensure that their contracts and ACA documents are executed properly. This security and compliance help businesses navigate the complexities of the ACA smoothly.

Get more for Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers

- Arizona legal documents form

- Arizona bankruptcy form

- Bill of sale with warranty by individual seller arizona form

- Bill of sale with warranty for corporate seller arizona form

- Bill of sale without warranty by individual seller arizona form

- Bill of sale without warranty by corporate seller arizona form

- Verification of creditors matrix arizona form

- Correction statement and agreement arizona form

Find out other Www irs govaffordable care actaffordable careAffordable Care Act Tax Provisions Questions And Answers

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free