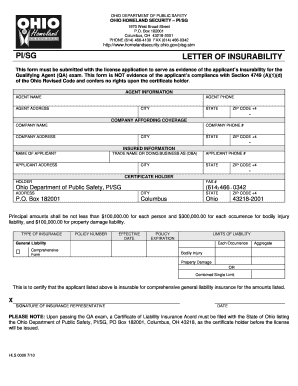

Letter of Insurability Sample Form

What is the letter of insurability sample

A letter of insurability sample serves as a formal document that provides evidence of an individual's eligibility for insurance coverage. This document typically includes personal information, health history, and any relevant details that may affect the underwriting process. Insurers use this letter to assess risk and determine the terms of coverage. It is essential for individuals applying for life insurance, health insurance, or other types of coverage to provide accurate and complete information in this letter.

How to use the letter of insurability sample

Using a letter of insurability sample involves several straightforward steps. First, gather all necessary personal and health information that may be required by the insurer. Next, refer to the sample to understand the format and content needed. Fill out the document with your details, ensuring accuracy and clarity. After completing the letter, review it for any errors before submitting it to the insurance provider. This ensures that your application process is smooth and that the insurer has the correct information to evaluate your coverage.

Key elements of the letter of insurability sample

The key elements of a letter of insurability sample include personal identification details, such as name, address, and date of birth. Additionally, it should contain a comprehensive health history, including any pre-existing conditions, medications, and previous insurance coverage. It may also include lifestyle information, like smoking status and occupation, which can impact insurance premiums. Providing these elements accurately helps ensure that the insurer can make an informed decision regarding your application.

Steps to complete the letter of insurability sample

Completing a letter of insurability sample involves a systematic approach:

- Gather necessary documents and information, including medical records and personal identification.

- Review the sample to understand the required format and content.

- Fill in your personal details, ensuring all information is accurate and up-to-date.

- Detail your health history, including any relevant medical conditions and treatments.

- Double-check the completed letter for errors or omissions.

- Submit the letter to your insurance provider as part of your application.

Legal use of the letter of insurability sample

The legal use of a letter of insurability sample is crucial in the insurance application process. It must be completed truthfully and accurately, as any misrepresentation can lead to denial of coverage or claims in the future. The document acts as a binding agreement between the applicant and the insurer, making it essential to comply with all legal requirements. Ensuring that the letter meets the standards set by relevant regulations, such as the ESIGN Act, can further solidify its legal standing.

Who issues the form

The letter of insurability sample is typically issued by insurance companies or underwriters as part of their application process. When applying for insurance, the insurer will provide a template or guidelines for completing the letter. It is important to use the specific format required by the insurer to ensure that the application is processed correctly and efficiently.

Quick guide on how to complete letter of insurability sample

Easily Prepare Letter Of Insurability Sample on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage Letter Of Insurability Sample on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Letter Of Insurability Sample Effortlessly

- Find Letter Of Insurability Sample and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Letter Of Insurability Sample while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter of insurability and why is it important?

A letter of insurability is a document that confirms your eligibility for insurance coverage based on the information you provide. It is essential because it can affect your premiums, coverage options, and the overall process of obtaining insurance. Understanding the letter of insurability can help you make informed decisions regarding your insurance needs.

-

How can airSlate SignNow help with the submission of a letter of insurability?

airSlate SignNow streamlines the process of submitting a letter of insurability by allowing you to electronically sign and send documents securely. This eliminates the need for printing, scanning, or mailing, ensuring that your letter of insurability signNowes the insurance company promptly. With our user-friendly interface, you can manage documents efficiently.

-

Are there any costs associated with using airSlate SignNow to manage my letter of insurability?

Yes, airSlate SignNow offers flexible pricing plans to suit various business needs. Whether you’re sending a single letter of insurability or multiple documents, our pricing is designed to be cost-effective and provide excellent value for businesses of all sizes. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for handling letters of insurability?

airSlate SignNow provides features such as electronic signatures, document templates, and workflow automation specifically designed for managing letters of insurability. These features help you save time and ensure compliance by automating routine tasks, making the entire signing process more efficient.

-

Can I integrate airSlate SignNow with other software for managing letters of insurability?

Absolutely! airSlate SignNow offers integrations with various third-party applications like CRM systems, cloud storage solutions, and project management tools. This makes it easy to include your letter of insurability within your existing workflows and keep everything organized and accessible.

-

What are the benefits of using airSlate SignNow for a letter of insurability?

Using airSlate SignNow for your letter of insurability provides benefits including increased speed in document processing, enhanced security for sensitive information, and the convenience of electronic signature collection. These advantages streamline the insurance application process, helping you to get coverage faster.

-

Is my data secure when using airSlate SignNow for a letter of insurability?

Yes, airSlate SignNow prioritizes data security with robust encryption and secure storage measures. When you submit a letter of insurability through our platform, you can be confident that your information is protected against unauthorized access. We comply with industry standards to ensure your data remains confidential.

Get more for Letter Of Insurability Sample

- Employmentagreement 2 employment agreement this form

- Employment agreement between the company and merouane bencherif form

- Form of stock option agreement early exercise

- Covad communications group inc form s 1a received 0119

- Wiline service agreement terms and conditions form

- Internet access agreement level 3 communications llc and form

- Sec info directv broadband inc ipo s 1a on 32800 form

- Telocity delaware inc form 424b4 received 03292000

Find out other Letter Of Insurability Sample

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now