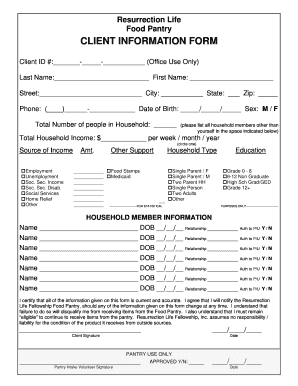

Food Pantry CLIENT INFORMATION FORM Resurrection Life

What is the Food Pantry Client Information Form for Resurrection Life?

The Food Pantry Client Information Form for Resurrection Life is a crucial document designed to collect essential data from individuals seeking assistance from the pantry. This form helps the organization understand the needs of its clients and ensures that the services provided are tailored to those needs. Information typically gathered includes personal details, household composition, income levels, and specific dietary requirements. By completing this form, clients enable Resurrection Life to offer targeted support and resources effectively.

Steps to Complete the Food Pantry Client Information Form for Resurrection Life

Completing the Food Pantry Client Information Form is a straightforward process that involves several key steps:

- Begin by gathering necessary documentation, such as identification and proof of income.

- Fill out personal information, including name, address, and contact details.

- Provide details about household members, including their ages and relationships to you.

- Indicate your monthly income and any additional financial support you receive.

- Specify any dietary restrictions or preferences to help the pantry meet your needs.

- Review the completed form for accuracy before submission.

How to Obtain the Food Pantry Client Information Form for Resurrection Life

The Food Pantry Client Information Form can be obtained through various means to ensure accessibility for all clients. It is typically available at the Resurrection Life Food Pantry location during operational hours. Additionally, clients may request the form via phone or email, allowing for a convenient process. Some organizations also provide the form on their official website, enabling individuals to download and print it from home. This flexibility ensures that everyone can access the necessary resources without difficulty.

Legal Use of the Food Pantry Client Information Form for Resurrection Life

The Food Pantry Client Information Form is used in compliance with applicable laws and regulations governing food assistance programs. This includes adherence to privacy laws that protect client information. The data collected is used solely for the purpose of providing support and resources to clients in need. Resurrection Life ensures that all information is handled confidentially and securely, in line with legal requirements. Clients can trust that their personal information will be safeguarded throughout the assistance process.

Eligibility Criteria for the Food Pantry Client Information Form for Resurrection Life

Eligibility for assistance from Resurrection Life's food pantry is determined based on several criteria outlined in the Client Information Form. Generally, individuals must demonstrate a need for food assistance, which may include low income, unemployment, or other financial hardships. Specific eligibility requirements can vary based on local regulations and available resources. It is essential for clients to provide accurate information on the form to ensure their eligibility is assessed correctly.

Examples of Using the Food Pantry Client Information Form for Resurrection Life

Clients may use the Food Pantry Client Information Form in various scenarios to receive assistance. For instance, a family experiencing temporary financial hardship due to job loss may fill out the form to access food resources. Similarly, individuals facing medical challenges that limit their ability to work might seek support through the pantry. By providing comprehensive information on the form, clients can ensure they receive appropriate assistance tailored to their unique situations.

Quick guide on how to complete food pantry client information form resurrection life

Complete Food Pantry CLIENT INFORMATION FORM Resurrection Life effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Handle Food Pantry CLIENT INFORMATION FORM Resurrection Life on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly modify and eSign Food Pantry CLIENT INFORMATION FORM Resurrection Life without any hassle

- Find Food Pantry CLIENT INFORMATION FORM Resurrection Life and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your preference. Modify and eSign Food Pantry CLIENT INFORMATION FORM Resurrection Life and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does airSlate SignNow offer for calculating tax total?

airSlate SignNow simplifies the process of managing documents related to tax total calculations. Our platform enables users to create, send, and eSign documents with features that help ensure accurate calculations and compliance. This efficiency helps businesses maintain smooth operations during tax season.

-

How can I integrate airSlate SignNow with my existing tax software?

Integrating airSlate SignNow with your tax software is seamless through our API and available integrations. This allows you to automatically manage documents that involve tax total calculations, minimizing manual entry and reducing errors. By syncing your systems, you can enhance your workflow and save time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes. Each plan includes features that can help streamline processes involving tax total management, ensuring that you're getting the best value for your investment. Explore our pricing page to find the plan that fits your needs.

-

Can airSlate SignNow help with compliance related to tax total?

Yes, airSlate SignNow is designed to assist businesses with compliance regarding tax total documentation. Our platform offers secure and legally binding eSignatures, making it easy to keep your tax-related documents organized and compliant with regulations. This ensures your business minimizes risks during audits.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides signNow advantages, including faster turnaround times and enhanced accuracy in your tax total calculations. Our user-friendly interface allows for quick drafting and signing of important documents, which helps businesses stay on top of their tax obligations. This streamlined approach can lead to increased efficiency.

-

How secure is airSlate SignNow when dealing with tax-related information?

Security is a top priority at airSlate SignNow, especially when handling sensitive tax total information. Our platform employs robust encryption and compliance measures to protect your data. You can confidently eSign and manage tax documents, knowing that your information is safeguarded.

-

Is there a mobile application for airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows users to manage tax-related documents on the go. This functionality ensures you can send and eSign documents related to tax total calculations anytime, anywhere. The mobile app makes it easy to stay responsive and organized, even when you're not at your desk.

Get more for Food Pantry CLIENT INFORMATION FORM Resurrection Life

Find out other Food Pantry CLIENT INFORMATION FORM Resurrection Life

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online