Dt Individual Spain Form

What is the Dt Individual Spain

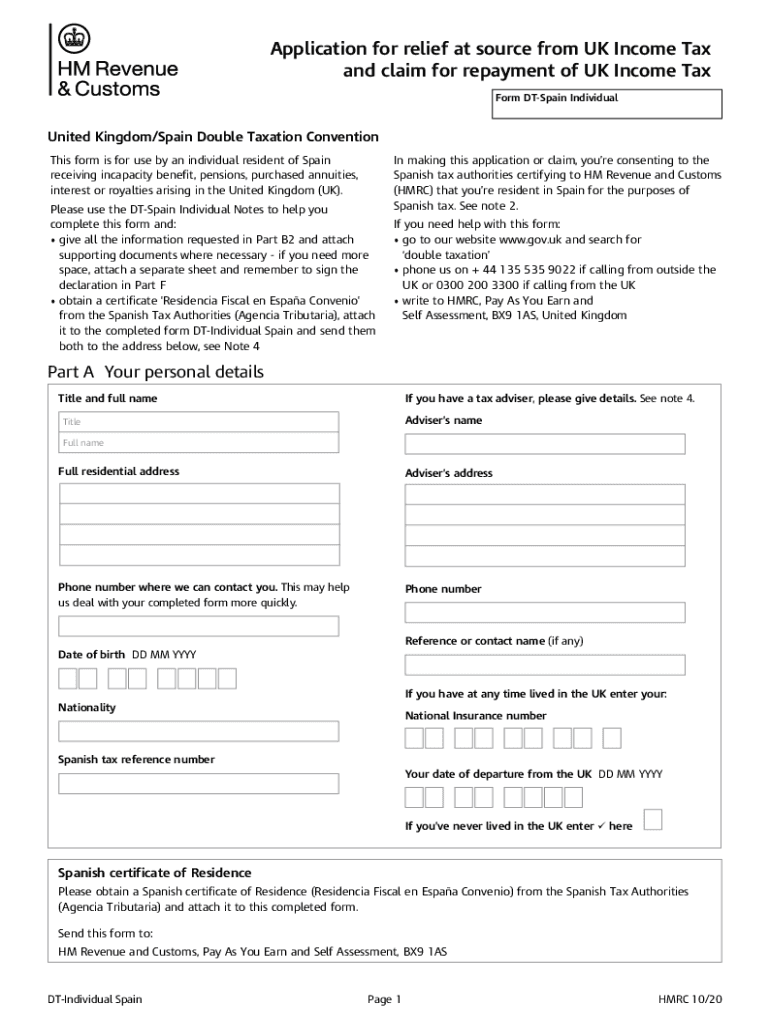

The Dt Individual Spain form is a tax-related document used by individuals residing in Spain to report their income and financial activities. This form is essential for compliance with local tax regulations and helps ensure that taxpayers accurately declare their earnings. It is particularly relevant for expatriates and those with income sources in Spain, as it outlines the necessary information regarding income, deductions, and tax obligations.

How to use the Dt Individual Spain

Using the Dt Individual Spain form involves several key steps to ensure accurate completion and submission. First, gather all relevant financial documents, including income statements, receipts for deductions, and any previous tax returns. Next, fill out the form by entering personal information, income details, and applicable deductions. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing a digital platform like signNow can streamline this process, allowing for easy eSignature and secure document management.

Steps to complete the Dt Individual Spain

Completing the Dt Individual Spain form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as income statements and deduction receipts.

- Access the Dt Individual Spain form through a reliable source.

- Fill in your personal information, including your name, address, and tax identification number.

- Report your income from various sources, ensuring all figures are accurate.

- Include any eligible deductions that apply to your situation.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the Dt Individual Spain

The legal use of the Dt Individual Spain form is governed by Spanish tax regulations. It is crucial for taxpayers to understand the legal implications of their submissions. Completing and submitting this form accurately is necessary to avoid penalties and ensure compliance with tax laws. Moreover, utilizing an eSignature solution like signNow ensures that the submission process adheres to legal standards, providing an added layer of security and validity to the document.

Required Documents

To successfully complete the Dt Individual Spain form, several documents are required. These typically include:

- Income statements from employers or clients.

- Receipts for deductible expenses, such as medical bills or educational costs.

- Previous tax returns, if applicable.

- Identification documents, such as a passport or national ID.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with tax regulations.

Form Submission Methods

The Dt Individual Spain form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission via the tax authority's official website, often requiring an eSignature for validation.

- Mailing a printed version of the completed form to the designated tax office.

- In-person submission at local tax offices, which may offer assistance for any questions regarding the form.

Choosing the right submission method can enhance the efficiency of the filing process.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Dt Individual Spain form can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, or even legal action for severe breaches. It is essential to file the form accurately and on time to avoid these consequences. Understanding the implications of non-compliance can motivate individuals to prioritize their tax obligations and utilize tools like signNow to ensure timely and secure submissions.

Quick guide on how to complete dt individual spain

Prepare Dt Individual Spain effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Dt Individual Spain on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The simplest way to edit and eSign Dt Individual Spain with ease

- Find Dt Individual Spain and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Dt Individual Spain and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is dt individual spain and how does it work with airSlate SignNow?

DT individual spain refers to the specialized service offered by airSlate SignNow for individuals in Spain, enabling them to easily send and eSign documents. This platform streamlines the signing process with user-friendly features and ensures that all documents are legally binding and secure.

-

How much does dt individual spain cost?

The pricing for dt individual spain varies depending on the plan you choose. airSlate SignNow offers competitive pricing, ensuring users get a cost-effective solution tailored to their needs. Check the official website for the latest pricing details and available plans.

-

What features are included in dt individual spain?

DT individual spain includes a range of features such as customizable templates, multi-party signing, and status tracking. Users benefit from a seamless experience that simplifies document management and enhances productivity. You can also access integration options with popular applications to streamline your workflow.

-

Can I integrate dt individual spain with other software?

Yes, dt individual spain can be seamlessly integrated with various software applications. airSlate SignNow supports integrations with popular platforms such as Google Drive, Dropbox, and CRM solutions, making it easier for individuals in Spain to manage their documents efficiently.

-

What are the benefits of using dt individual spain for document signing?

Using dt individual spain allows users to sign documents quickly and securely from anywhere. The platform reduces paperwork, saves time, and helps ensure compliance with legal standards. It enhances collaboration, as multiple parties can sign documents effortlessly.

-

Is dt individual spain suitable for both personal and professional use?

Absolutely! DT individual spain is designed to cater to both personal and professional needs. Whether you need to eSign a lease agreement or a business contract, airSlate SignNow provides the tools required for efficient and secure signing.

-

How secure is my data when using dt individual spain?

Data security is a top priority for airSlate SignNow, and dt individual spain utilizes advanced encryption methods to protect your information. Compliance with international security standards ensures that your documents remain confidential and secure throughout the signing process.

Get more for Dt Individual Spain

- If you do not speak or understand english form

- Original certificate of eligibility from the bureau of criminal identification bci form

- Special certificate saratoga springs form

- Fillable online request for hearing on petition for name change form

- Request for response by adult probation and parole form

- About adult probation and parole utah department of form

- Request to submit for decision form

- I am thepetitionerattorney for utah state courts form

Find out other Dt Individual Spain

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF