Business Loan Application Sun Savings Bank Sunsavings Form

What is the Business Loan Application for Sun Savings Bank?

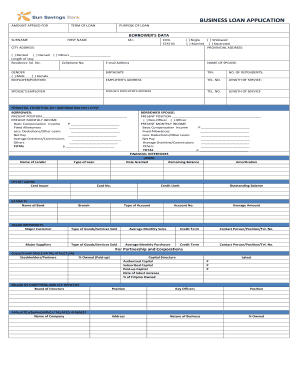

The Business Loan Application for Sun Savings Bank is a formal request that businesses submit to obtain financing. This application is essential for those looking to secure funds for various purposes, such as expansion, equipment purchase, or operational costs. It typically requires detailed information about the business, including financial statements, business plans, and personal information of the owners. Understanding the purpose and requirements of the application is crucial for a successful submission.

Steps to Complete the Business Loan Application for Sun Savings Bank

Completing the Business Loan Application involves several important steps to ensure accuracy and compliance. First, gather all necessary documents, such as tax returns, financial statements, and business plans. Next, fill out the application form with precise information regarding your business's financial health and funding needs. It is vital to review the application thoroughly for any errors before submission. Finally, submit the application through the preferred method, whether online, by mail, or in person, and keep a copy for your records.

Key Elements of the Business Loan Application for Sun Savings Bank

The Business Loan Application includes several key elements that lenders assess to evaluate the request. These elements typically consist of:

- Business Information: Name, address, and type of business entity.

- Financial Statements: Recent balance sheets and income statements.

- Loan Purpose: A clear explanation of how the funds will be used.

- Owner Information: Personal financial details of the business owners.

Providing comprehensive and accurate information in these sections can significantly impact the approval process.

Eligibility Criteria for the Business Loan Application at Sun Savings Bank

To qualify for a business loan through Sun Savings Bank, applicants must meet specific eligibility criteria. Generally, businesses should have a solid credit history and demonstrate the ability to repay the loan. Additionally, the business should be operational for a certain period, often at least two years, and provide adequate financial documentation. Meeting these criteria increases the likelihood of approval and favorable loan terms.

Legal Use of the Business Loan Application for Sun Savings Bank

The legal use of the Business Loan Application is governed by various regulations and standards. It is essential for applicants to ensure that the information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. Furthermore, the application must comply with federal and state lending laws, including those related to privacy and data protection. Utilizing a trusted platform for submission can help maintain compliance with these legal requirements.

Form Submission Methods for the Business Loan Application at Sun Savings Bank

Businesses can submit the Business Loan Application through various methods, providing flexibility for applicants. Common submission methods include:

- Online Submission: Completing and submitting the application via the bank's secure online portal.

- Mail: Printing the application, filling it out, and sending it to the bank's address.

- In-Person: Visiting a local branch to submit the application directly to a bank representative.

Choosing the right submission method can streamline the application process and ensure timely consideration.

Quick guide on how to complete business loan application sun savings bank sunsavings

Prepare Business Loan Application Sun Savings Bank Sunsavings effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Business Loan Application Sun Savings Bank Sunsavings on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Business Loan Application Sun Savings Bank Sunsavings without any hassle

- Locate Business Loan Application Sun Savings Bank Sunsavings and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in a few clicks from any device of your choice. Edit and eSign Business Loan Application Sun Savings Bank Sunsavings and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the sun savings bank and how does it work with airSlate SignNow?

The sun savings bank is a financial service provider that can streamline your banking processes. By integrating airSlate SignNow, users can easily prepare, send, and eSign essential documents related to banking transactions, enhancing efficiency and security.

-

What are the pricing plans for using airSlate SignNow with sun savings bank?

AirSlate SignNow offers a variety of pricing plans that can cater to businesses working with sun savings bank. Each plan is designed to provide different levels of document management features, making it affordable for both small businesses and larger enterprises.

-

What features does airSlate SignNow offer that benefit sun savings bank customers?

AirSlate SignNow includes features like customizable templates, secure eSignatures, and automated workflows. These tools help sun savings bank customers streamline their document processes, reducing turnaround times and minimizing errors.

-

How can airSlate SignNow improve the efficiency of transactions at sun savings bank?

By using airSlate SignNow, sun savings bank can simplify the signing process for documents requiring customer agreements. This leads to faster processing times and a reduction in the need for physical paperwork, allowing transactions to happen more smoothly.

-

Does airSlate SignNow integrate with other software commonly used by sun savings bank?

Yes, airSlate SignNow offers integrations with various financial and management software solutions that sun savings bank customers may already be using. This ensures a seamless workflow and enhances the overall user experience by connecting disparate systems.

-

What security measures does airSlate SignNow have in place for sun savings bank customers?

AirSlate SignNow prioritizes security, employing advanced encryption protocols and secure storage solutions for all documents. Sun savings bank customers can trust that their sensitive information remains protected throughout the eSigning process.

-

Can I access airSlate SignNow from my mobile device while working with sun savings bank?

Absolutely! AirSlate SignNow is mobile-friendly and allows sun savings bank customers to access and manage their documents on the go. This flexibility ensures that users can respond promptly to signing requests from anywhere.

Get more for Business Loan Application Sun Savings Bank Sunsavings

Find out other Business Loan Application Sun Savings Bank Sunsavings

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe