Co Deed Form

What is the Colorado Beneficiary Deed Form

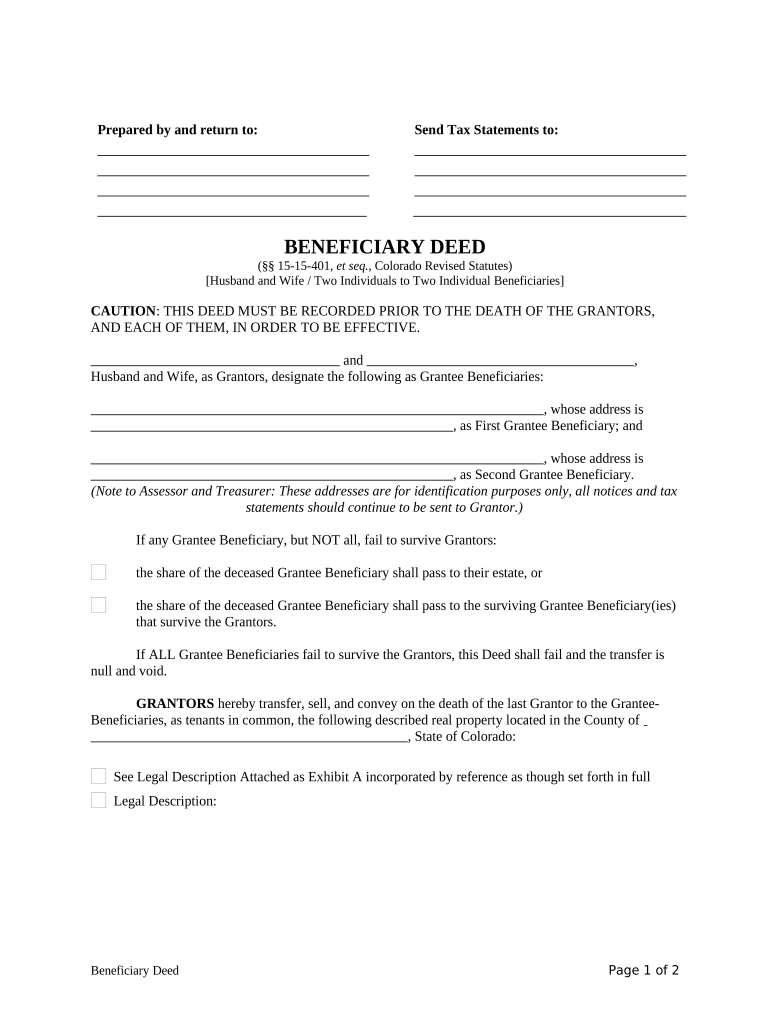

The Colorado beneficiary deed form is a legal document that allows property owners to designate beneficiaries who will inherit their real estate upon their death, without the need for probate. This form is particularly useful for individuals looking to simplify the transfer of property, ensuring that their heirs receive the property directly. It is important to note that the beneficiary deed only takes effect after the property owner's death, and the owner retains full control of the property during their lifetime.

How to Use the Colorado Beneficiary Deed Form

Using the Colorado beneficiary deed form involves a few straightforward steps. First, the property owner must fill out the form with accurate information, including the legal description of the property and the names of the beneficiaries. Once completed, the form must be signed in the presence of a notary public. After notarization, it should be filed with the county clerk and recorder's office where the property is located. This filing ensures that the deed is part of the public record, making the transfer of property effective upon the owner's death.

Key Elements of the Colorado Beneficiary Deed Form

The key elements of the Colorado beneficiary deed form include the following:

- Grantor Information: The full name and address of the property owner.

- Beneficiary Details: The names and addresses of the designated beneficiaries.

- Property Description: A legal description of the property being transferred.

- Notary Section: A space for the notary public to sign and seal the document.

Each of these components must be accurately completed to ensure the deed's legality and effectiveness.

Steps to Complete the Colorado Beneficiary Deed Form

Completing the Colorado beneficiary deed form involves several essential steps:

- Obtain the beneficiary deed form from a reliable source.

- Fill out the form with the required information, ensuring accuracy.

- Sign the form in front of a notary public to validate it.

- File the notarized form with the county clerk and recorder's office.

Following these steps carefully helps ensure that the deed is legally binding and effective.

Legal Use of the Colorado Beneficiary Deed Form

The legal use of the Colorado beneficiary deed form is governed by state law. It is essential for property owners to understand that this form allows them to transfer property outside of probate, which can save time and costs associated with the probate process. However, property owners should also be aware that they can revoke or change the beneficiaries at any time during their lifetime by executing a new beneficiary deed.

State-Specific Rules for the Colorado Beneficiary Deed Form

In Colorado, specific rules apply to the use of the beneficiary deed form. For instance, the form must comply with Colorado Revised Statutes, and it must be filed in the appropriate county office. Additionally, the beneficiaries must be clearly identified, and the property description must be precise to avoid any future disputes. Understanding these state-specific rules is crucial for the proper execution of the deed.

Quick guide on how to complete co deed form

Easily Prepare Co Deed Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed forms, as you can easily find the necessary template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Co Deed Form on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The Easiest Way to Edit and eSign Co Deed Form Effortlessly

- Find Co Deed Form and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Co Deed Form to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado beneficiary deed form?

A Colorado beneficiary deed form is a legal document that allows property owners to transfer real estate to designated beneficiaries upon their death, avoiding probate. This form is particularly beneficial for simplifying estate planning in Colorado. By utilizing a Colorado beneficiary deed form, you ensure a smooth transition of property ownership.

-

How do I fill out a Colorado beneficiary deed form using airSlate SignNow?

Filling out a Colorado beneficiary deed form with airSlate SignNow is straightforward. You can upload your existing form or create a new one using our intuitive editing tools. Once you have completed the form, you can easily send it for eSignature, ensuring your document is secure and legally binding.

-

What are the costs associated with the Colorado beneficiary deed form on airSlate SignNow?

airSlate SignNow offers competitive pricing for using its platform, including the creation and eSignature of a Colorado beneficiary deed form. We provide various subscription plans to meet your needs, with options for individuals and businesses. This makes it a cost-effective solution for managing your important legal documents.

-

Can I integrate airSlate SignNow with other applications for my Colorado beneficiary deed form?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, allowing you to streamline your workflow while managing your Colorado beneficiary deed form. Integrations with platforms like Google Drive, Dropbox, and CRM systems help ensure that your processes are efficient and connected.

-

What are the benefits of using a Colorado beneficiary deed form?

The Colorado beneficiary deed form offers several advantages, such as avoiding the probate process and simplifying property transfer after death. This is particularly beneficial for families looking to save time and money during estate transitions. By utilizing this form with airSlate SignNow, you can ensure that the process is efficient and professional.

-

Is the Colorado beneficiary deed form legally binding?

Yes, when properly executed, a Colorado beneficiary deed form is legally binding. It must be signed and signNowd as per Colorado state laws, which airSlate SignNow can facilitate through eSignature and notarization features. This ensures legality and the proper transfer of property to beneficiaries.

-

Can I save my Colorado beneficiary deed form for future use?

Absolutely! With airSlate SignNow, you can easily save your completed Colorado beneficiary deed form to your account for future use. This feature allows you to quickly access or modify your documents as needed without having to start from scratch.

Get more for Co Deed Form

- Income taxable form

- Form nyc 210 claim for new york city school tax credit tax year 2021

- Form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1022

- Form indiana department of revenue mailingcontact information ivt 1

- About form 2106 employee business expensesinternal revenue service

- Gettingattentionorgform 990 schedule b donorform 990 schedule b ampamp donor disclosures whats required

- Instructions for schedule b form 941 rev june 2022 instructions for schedule b form 941 report of tax liability for semiweekly

- 2022 publication 15 circular e employers tax guide form

Find out other Co Deed Form

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer