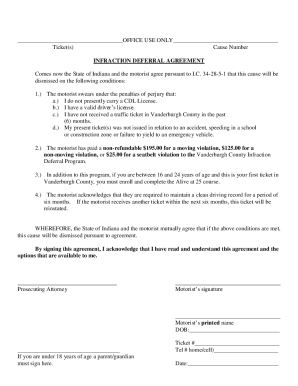

Deferral Program Form

What is the Deferral Program

The Indiana infraction deferral program is designed to provide individuals with an opportunity to resolve certain traffic violations without the immediate consequences of a conviction. This program allows eligible participants to defer their infraction for a specified period, during which they must comply with certain conditions. If successfully completed, the violation may be dismissed, preventing points from being added to the driver’s record and avoiding potential increases in insurance premiums.

Eligibility Criteria

To qualify for the Indiana traffic ticket deferral program, individuals must meet specific eligibility requirements. Generally, these may include:

- Having a valid driver’s license.

- Not having prior violations within a certain timeframe.

- Complying with any court-ordered conditions, such as attending traffic school.

It is important to check local regulations, as eligibility can vary by county, such as Vanderburgh or Lake County.

Steps to Complete the Deferral Program

Completing the infraction deferral program involves several key steps:

- Review the terms of the deferral program specific to your county.

- Submit the necessary application form, which may be available online or through the court.

- Pay any required fees associated with the program.

- Fulfill any conditions set by the court, such as attending traffic school or maintaining a clean driving record during the deferral period.

- Confirm the successful completion of the program with the court to ensure the violation is dismissed.

Legal Use of the Deferral Program

The legal framework surrounding the Indiana infraction deferral program ensures that participants can utilize electronic tools for form submission and compliance. Electronic signatures, when executed through a compliant platform, are considered legally binding under U.S. law. This means that using a reliable eSignature solution can streamline the process while maintaining compliance with regulations such as ESIGN and UETA.

Required Documents

When applying for the Indiana ticket deferral program, individuals may need to provide specific documents, including:

- A copy of the traffic citation.

- Proof of insurance.

- Any court documents related to prior violations.

Gathering these documents in advance can help facilitate a smoother application process.

Form Submission Methods

Participants can typically submit their application for the infraction deferral program through various methods, including:

- Online submission via the court’s website.

- Mailing the completed form to the appropriate court office.

- In-person submission at the courthouse.

Choosing the method that best suits your needs can help ensure timely processing of your application.

Quick guide on how to complete deferral program

Complete Deferral Program effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Deferral Program on any device with airSlate SignNow's Android or iOS applications and enhance any document-based activity today.

How to modify and electronically sign Deferral Program without any hassle

- Obtain Deferral Program and click on Get Form to commence.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether via email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Deferral Program and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Indiana infraction deferral program?

The Indiana infraction deferral program is a legal option that allows drivers to avoid points on their license and potential insurance increases by completing specific requirements after receiving a traffic citation. This program is designed to promote safe driving and reduce the burden on courts. By participating, drivers can maintain a clean record while fulfilling their obligations.

-

Who is eligible for the Indiana infraction deferral program?

Eligibility for the Indiana infraction deferral program generally includes individuals who have received certain traffic citations and have not previously participated in the program within a specified time frame. Additional eligibility criteria may depend on the nature of the infraction and the court's discretion. It's advisable to check with your local court for specific qualifications.

-

How can I apply for the Indiana infraction deferral program?

To apply for the Indiana infraction deferral program, you typically need to attend your court hearing and request participation from the judge. The court will provide you with the necessary guidelines and requirements to complete the program. Utilizing services like airSlate SignNow can help streamline document submission and make the application process easier.

-

What are the costs associated with the Indiana infraction deferral program?

Costs for the Indiana infraction deferral program can vary depending on the court and the specific infraction. Generally, you may need to pay a fee upon enrollment in the program, along with any additional costs for completing required courses or community service. It’s important to inquire about all potential fees to avoid unexpected expenses.

-

What benefits can I expect from using the Indiana infraction deferral program?

Participating in the Indiana infraction deferral program allows you to avoid points on your driving record, which can help maintain lower insurance premiums. Additionally, successful completion can provide drivers with peace of mind, avoiding legal repercussions. The program is an opportunity for education and improvement in driving habits.

-

Are there features of airSlate SignNow that can assist with the Indiana infraction deferral program?

Yes, airSlate SignNow offers features that can simplify the management of documents related to the Indiana infraction deferral program. Users can easily send and eSign necessary forms, track submission status, and maintain organized records. This user-friendly solution is perfect for individuals navigating the program's requirements.

-

Can I integrate airSlate SignNow with other tools to manage my infraction deferral process?

Absolutely, airSlate SignNow supports integration with various productivity and legal tools. This allows you to streamline your workflow while managing documents related to the Indiana infraction deferral program. Integrations with tools like CRM software can enhance your ability to track progress and deadlines efficiently.

Get more for Deferral Program

- Sex offender registration 497300437 form

- Instructions to discontinue sex offender registration for a colorado and non colorado conviction juvenile adjudication or form

- Colorado criminal form

- Hearing adjudication form

- Parental rights form

- Affidavit of presumptive paternity colorado form

- Colorado motion release form

- Consent for expedited relinquishment release of parental rights colorado form

Find out other Deferral Program

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself