Piw Form

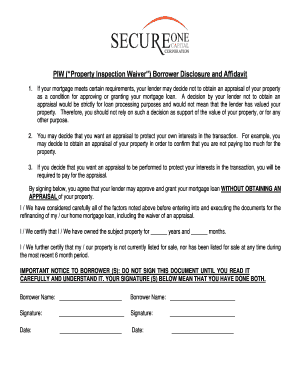

What is the PIW Form

The Property Inspection Waiver (PIW) form is a document used primarily in the mortgage industry. It allows lenders to waive the requirement for a physical property inspection during the mortgage underwriting process. This form is particularly beneficial for borrowers who have a strong credit profile and are seeking to expedite their loan approval process. By utilizing the PIW, lenders can streamline operations and reduce costs, while borrowers may enjoy faster access to funds.

How to Use the PIW Form

Using the PIW form involves several steps that ensure compliance with lender requirements. First, borrowers should confirm their eligibility for the waiver, typically based on their creditworthiness and the property's value. Once eligibility is established, the borrower must complete the PIW form accurately, providing necessary details such as loan amount and property address. After filling out the form, it should be submitted to the lender as part of the mortgage application package.

Steps to Complete the PIW Form

Completing the PIW form involves a straightforward process:

- Gather necessary information, including personal details, property information, and loan specifics.

- Access the PIW form, which can often be found on the lender's website or requested directly from them.

- Fill out the form, ensuring all fields are completed accurately to avoid delays.

- Review the completed form for errors or omissions.

- Submit the form to your lender along with any other required documentation.

Legal Use of the PIW Form

The PIW form is legally binding when completed and submitted in accordance with lender guidelines. It is essential that borrowers understand the implications of waiving a property inspection. While the form can expedite the loan process, it may also carry risks if the property has undisclosed issues. Therefore, borrowers should ensure they are fully informed about the condition of the property before proceeding with the waiver.

Key Elements of the PIW Form

Several key elements must be included in the PIW form to ensure its validity:

- Borrower Information: Full names, addresses, and contact details of all borrowers.

- Property Details: Address, type of property, and any relevant identification numbers.

- Loan Information: Desired loan amount and purpose of the loan.

- Signature: All borrowers must sign the form to validate the waiver request.

Examples of Using the PIW Form

There are various scenarios where the PIW form is applicable. For instance, a borrower purchasing a home with a strong credit score may qualify for a PIW, allowing them to skip the inspection process. Similarly, homeowners refinancing their existing mortgage may also utilize the PIW if they meet the necessary criteria. Understanding these examples can help borrowers determine if the PIW is suitable for their specific situation.

Quick guide on how to complete piw form

Complete Piw Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documentation, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Manage Piw Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Piw Form with ease

- Obtain Piw Form and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about missing or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choice. Edit and eSign Piw Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a piw form and how is it used in airSlate SignNow?

A piw form is a digital document that simplifies data collection and signing processes. In airSlate SignNow, it can be utilized to create, customize, and send forms for electronic signatures, making it easier for businesses to gather important information seamlessly.

-

How much does it cost to use the piw form feature in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the piw form feature. Depending on the chosen plan, users can leverage this functionality at an affordable rate, allowing businesses of all sizes to benefit from electronic signatures and form management.

-

What are the key benefits of using a piw form in airSlate SignNow?

The key benefits of using a piw form in airSlate SignNow include increased efficiency, reduced paperwork, and simplified workflow. By utilizing electronic signatures, businesses can save time and enhance their operational processes with minimal hassle.

-

Can I integrate the piw form feature with other applications?

Yes, airSlate SignNow allows for seamless integration of the piw form with various applications, enhancing your workflow. This flexibility ensures that you can incorporate the piw forms into your existing systems, optimizing your document management processes.

-

Is it easy to create a piw form in airSlate SignNow?

Creating a piw form in airSlate SignNow is straightforward and user-friendly. The intuitive interface allows users to design forms quickly, including adding fields for signatures and information collection, making the setup process efficient.

-

What types of documents can I use the piw form for?

The piw form can be utilized for a wide range of documents, including contracts, consent forms, and registration sheets in airSlate SignNow. This versatility makes it suitable for various industries and use cases, enhancing your document management strategy.

-

Are piw forms secure in airSlate SignNow?

Absolutely! Piw forms in airSlate SignNow are protected with advanced encryption and security measures. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Piw Form

- Insulation contractor package colorado form

- Paving contractor package colorado form

- Site work contractor package colorado form

- Siding contractor package colorado form

- Refrigeration contractor package colorado form

- Drainage contractor package colorado form

- Tax free exchange package colorado form

- Landlord tenant sublease package colorado form

Find out other Piw Form

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast