Itr Dd Form Download 2010

What is the Itr Dd Form Download

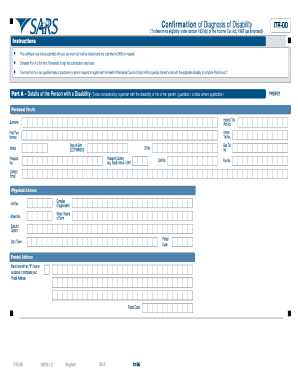

The Itr Dd form, often referred to as the Itr Dd PDF, is a crucial document used for tax purposes in the United States. This form is typically utilized by taxpayers to report specific types of income or deductions. Understanding its purpose is essential for ensuring compliance with tax regulations. It serves as a formal declaration of financial information, which the Internal Revenue Service (IRS) requires for accurate tax assessment.

How to Obtain the Itr Dd Form Download

To obtain the Itr Dd form download, taxpayers can visit the official IRS website or authorized tax preparation services. The form is usually available in PDF format, allowing for easy access and printing. Users should ensure they are downloading the most recent version to comply with current tax laws. It is advisable to check for any updates or changes in the form before filling it out.

Steps to Complete the Itr Dd Form Download

Completing the Itr Dd form involves several key steps:

- Download the form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Provide details regarding your income and deductions as required.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the Itr Dd Form Download

The Itr Dd form is legally binding when completed and submitted according to IRS guidelines. It is essential for taxpayers to ensure that all information provided is truthful and accurate to avoid potential legal issues. Failure to comply with the legal requirements associated with this form may result in penalties or audits by the IRS.

Key Elements of the Itr Dd Form Download

Several key elements must be included in the Itr Dd form to ensure its validity:

- Personal Information: Accurate identification details of the taxpayer.

- Income Reporting: A comprehensive account of all income sources.

- Deductions: Any applicable deductions that the taxpayer is claiming.

- Signature: The taxpayer's signature is required to validate the form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Itr Dd form to avoid late penalties. Typically, the deadline for submitting tax forms is April 15 of each year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes in deadlines announced by the IRS.

Quick guide on how to complete itr dd form download

Effortlessly Complete Itr Dd Form Download on Any Device

Managing documents online has become a trend among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Itr Dd Form Download on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and eSign Itr Dd Form Download Without Stress

- Locate Itr Dd Form Download and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or black out sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from a device of your choice. Edit and eSign Itr Dd Form Download while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct itr dd form download

Create this form in 5 minutes!

People also ask

-

What is an ITR DD PDF and how can airSlate SignNow help?

An ITR DD PDF refers to the Income Tax Return Differentiated Document PDF used in tax filing. With airSlate SignNow, you can easily create, edit, and eSign your ITR DD PDF documents efficiently, making your tax return process smoother and quicker.

-

How much does it cost to use airSlate SignNow for managing ITR DD PDFs?

airSlate SignNow offers a cost-effective solution, with various pricing plans starting affordably. Depending on your business needs, you can choose a plan that allows unlimited eSignatures for your ITR DD PDFs without breaking the bank.

-

What features does airSlate SignNow offer for ITR DD PDF management?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and easy document sharing, which are ideal for managing ITR DD PDFs. These features ensure that you can handle your tax documents efficiently while maintaining compliance and security.

-

Can I integrate airSlate SignNow with my existing tools for ITR DD PDFs?

Yes, airSlate SignNow offers integration with various popular tools and software, simplifying your workflow with ITR DD PDFs. You can connect it seamlessly with applications like Google Drive, Dropbox, and more to enhance your document management experience.

-

Is the eSigning process for ITR DD PDFs secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect your ITR DD PDFs and personal information. You can trust that your documents are securely signed and stored.

-

How does airSlate SignNow improve the efficiency of handling ITR DD PDFs?

By utilizing airSlate SignNow, you streamline the process of managing ITR DD PDFs with its user-friendly interface and automated workflows. This efficiency allows you to spend less time on paperwork and more time focusing on your business goals.

-

Can I access my ITR DD PDFs on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage your ITR DD PDFs from anywhere at any time. This flexibility ensures you can handle your documents even while on the go.

Get more for Itr Dd Form Download

- Insulation contract 497302612 form

- Paving contract for contractor florida form

- Site work contract for contractor florida form

- Siding contract for contractor florida form

- Refrigeration contract for contractor florida form

- Drainage contract for contractor florida form

- Florida contract contractor form

- Plumbing contract for contractor florida form

Find out other Itr Dd Form Download

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word