Fillable Online Revenue Ky All Kentucky Wage Earners Are Form

Understanding the Kentucky Withholding Form

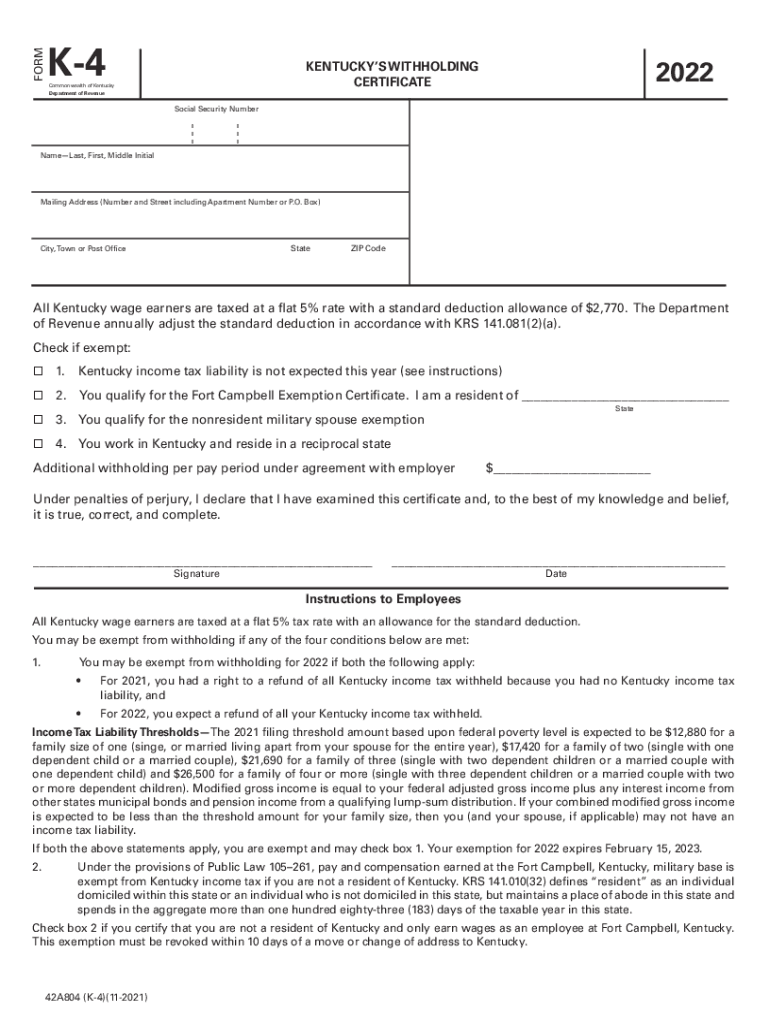

The Kentucky withholding form, commonly referred to as the Kentucky K-4, is essential for all wage earners in the state. This form allows employees to specify the amount of state income tax to be withheld from their paychecks. Understanding its purpose is crucial for ensuring compliance with state tax regulations and for managing personal finances effectively.

Steps to Complete the Kentucky Withholding Form

Filling out the Kentucky K-4 form involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Specify the number of allowances you wish to claim. This number affects the amount withheld from your paycheck.

- Sign and date the form to validate your submission.

Once completed, the form should be submitted to your employer for processing.

Legal Use of the Kentucky Withholding Form

The Kentucky K-4 is legally binding when filled out correctly. It ensures that the appropriate amount of state income tax is withheld from your earnings. Employers are required to keep this form on file for their records and to ensure compliance with state tax laws. Failure to submit a completed form may result in higher withholding rates, which could affect your take-home pay.

Filing Deadlines and Important Dates

It is important to be aware of key deadlines related to the Kentucky withholding form:

- New employees should submit their K-4 form on or before their first payday.

- Any changes to your withholding allowances should be reported as soon as possible to avoid discrepancies in tax withholdings.

- Review your withholding status annually, especially before the tax filing season, to ensure it aligns with your financial situation.

Form Submission Methods

The Kentucky withholding form can be submitted through various methods:

- Online: Some employers may offer electronic submission options through their payroll systems.

- Mail: You can also print the completed form and mail it directly to your employer.

- In-Person: Submitting the form in person is another option, allowing for immediate confirmation of receipt.

Key Elements of the Kentucky Withholding Form

Understanding the key elements of the Kentucky K-4 form is vital for accurate completion:

- Personal Information: Accurate details are necessary for proper identification.

- Filing Status: This affects your tax rate and withholding amount.

- Allowances: The number of allowances claimed will determine how much tax is withheld.

Quick guide on how to complete fillable online revenue ky all kentucky wage earners are

Effortlessly prepare Fillable Online Revenue Ky All Kentucky Wage Earners Are on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documentation, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Fillable Online Revenue Ky All Kentucky Wage Earners Are on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centered procedure today.

How to edit and electronically sign Fillable Online Revenue Ky All Kentucky Wage Earners Are effortlessly

- Obtain Fillable Online Revenue Ky All Kentucky Wage Earners Are and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fillable Online Revenue Ky All Kentucky Wage Earners Are and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kentucky withholding form?

The Kentucky withholding form is a document required by the state of Kentucky for employers to report and withhold state income taxes from employee wages. It ensures that proper taxes are deducted and submitted on behalf of employees. Using airSlate SignNow allows businesses to streamline the process of collecting and managing these forms electronically.

-

How can airSlate SignNow help with Kentucky withholding forms?

airSlate SignNow simplifies the process of preparing, sending, and signing Kentucky withholding forms. With our user-friendly interface, businesses can easily create custom forms and obtain electronic signatures from employees. This not only saves time but also ensures compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for Kentucky withholding forms?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. Our plans are competitive and include features that facilitate the completion of Kentucky withholding forms and other documents. You can choose the right plan based on your organization's size and requirements.

-

Can I integrate airSlate SignNow with other software for managing Kentucky withholding forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications such as payroll systems and HR platforms. This integration allows businesses to manage their Kentucky withholding forms efficiently, ensuring that all tax-related documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for Kentucky withholding forms?

Using airSlate SignNow for Kentucky withholding forms offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform provides an easy way to track document status and ensure timely submissions. Additionally, electronic signatures help to speed up the process and reduce delays.

-

How secure is the information submitted via airSlate SignNow for Kentucky withholding forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect sensitive information, including Kentucky withholding forms. Our platform complies with industry standards to ensure that your data remains safe and confidential.

-

Can individuals use airSlate SignNow to fill out their Kentucky withholding forms?

Yes, individuals can use airSlate SignNow to fill out their Kentucky withholding forms. Our platform is designed for both businesses and individuals, providing a simple way to complete, sign, and submit documents. This empowers employees to manage their withholding information efficiently.

Get more for Fillable Online Revenue Ky All Kentucky Wage Earners Are

- Quitclaim deed trust to individual hawaii form

- Hawaii quitclaim deed 497304332 form

- Special warranty deed individual to husband and wife hawaii form

- Quitclaim deed from individual to two individuals in joint tenancy hawaii form

- Hawaii disclaimer 497304335 form

- Notice of mechanics and materialmans lien and demand for payment hawaii form

- Quitclaim deed by two individuals to husband and wife hawaii form

- Warranty deed from two individuals to husband and wife hawaii form

Find out other Fillable Online Revenue Ky All Kentucky Wage Earners Are

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template