Comptroller Texas GovtaxesformsMiscellaneous Texas Tax Forms

Understanding the Texas Direct Deposit Form

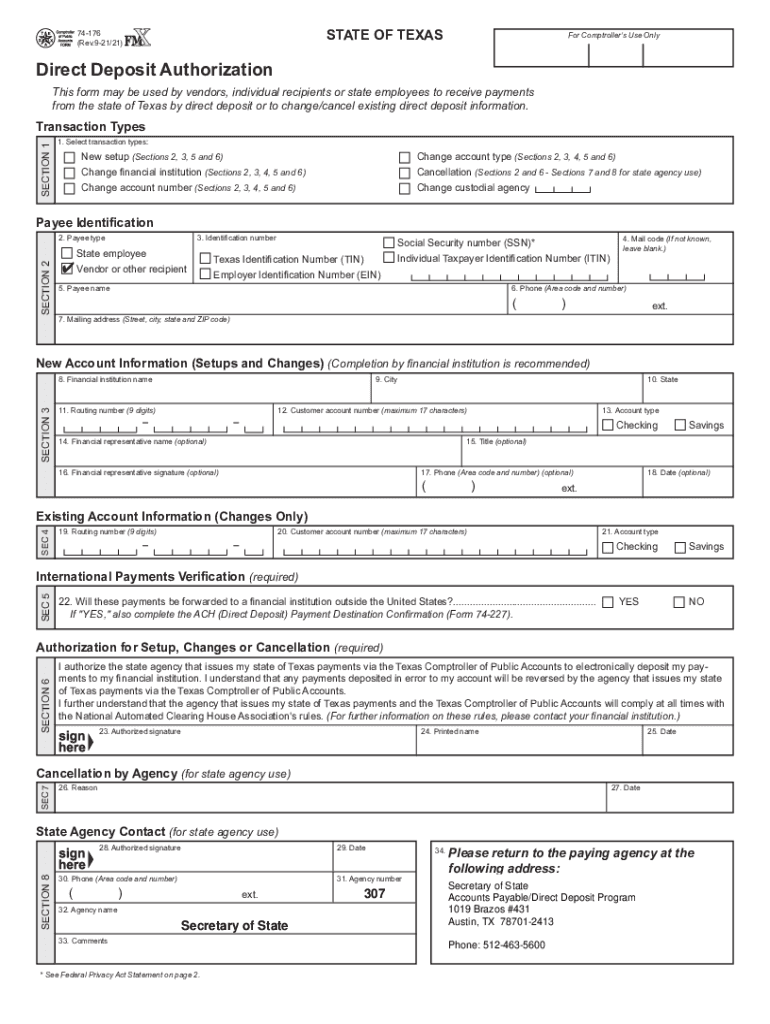

The Texas direct deposit form, also known as the 74 176 direct deposit authorization form, is a crucial document for employees and vendors who wish to receive payments directly into their bank accounts. This form is issued by the Texas Comptroller and is used to authorize the state to deposit funds electronically. By completing this form, individuals can ensure timely and secure payments without the need for physical checks.

Steps to Complete the Texas Direct Deposit Form

Filling out the Texas direct deposit form involves several straightforward steps:

- Obtain the form from the Texas Comptroller’s website or through your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide your bank account details, including the bank name, account number, and routing number.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or the appropriate state agency.

Legal Use of the Texas Direct Deposit Form

The Texas direct deposit form is legally binding once it is signed and submitted. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which ensures that electronic signatures are recognized as valid. This legal framework protects both the signer and the state, making it essential to complete the form accurately and securely.

Required Documents for Submission

When submitting the Texas direct deposit form, you may need to provide additional documentation to verify your identity and banking information. Commonly required documents include:

- A government-issued photo ID, such as a driver's license or passport.

- Bank statements or a voided check to confirm your account details.

- Any additional forms required by your employer or the state agency.

Form Submission Methods

The Texas direct deposit form can be submitted through various methods, depending on your employer or the agency's requirements. Common submission methods include:

- Online submission through the employer's or agency's secure portal.

- Mailing the completed form to the designated office.

- In-person delivery at the employer's or agency's location.

Eligibility Criteria for Direct Deposit

To be eligible for direct deposit in Texas, individuals typically need to meet certain criteria, which may include:

- Being an employee or vendor of the state of Texas.

- Having an active bank account that accepts electronic deposits.

- Completing the Texas direct deposit form accurately and submitting it on time.

Quick guide on how to complete comptrollertexasgovtaxesformsmiscellaneous texas tax forms

Complete Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without interruptions. Manage Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms without any hassle

- Locate Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your document: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from your chosen device. Edit and eSign Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas direct deposit form?

A Texas direct deposit form is a document that allows you to authorize your employer or financial institution to deposit your paycheck directly into your bank account. This form ensures that your funds are transferred securely and conveniently, eliminating the need for paper checks. Using a Texas direct deposit form simplifies the payment process and helps you manage your finances more efficiently.

-

How can airSlate SignNow help with Texas direct deposit forms?

airSlate SignNow allows you to easily create, send, and eSign Texas direct deposit forms electronically. Our platform simplifies the signature process and ensures that your documents are securely stored and easily accessible. This saves you time and effort, allowing for smooth payroll management.

-

Is there a cost associated with using airSlate SignNow for Texas direct deposit forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features for managing Texas direct deposit forms and other document types. You can choose a plan that best fits your budget and requirements without sacrificing the quality of service.

-

What are the benefits of using airSlate SignNow for Texas direct deposit forms?

Using airSlate SignNow for Texas direct deposit forms offers numerous benefits, including time savings, enhanced security, and seamless tracking of documents. Our intuitive platform ensures that you can manage multiple forms efficiently, while eSigning reduces the need for physical paperwork. You'll appreciate the convenience and reliability of our solution.

-

Are Texas direct deposit forms customizable with airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize Texas direct deposit forms to meet your specific needs. Whether you require additional fields or specific instructions, our platform allows for easy modifications, ensuring that your forms are tailored to your requirements for maximum effectiveness.

-

Can I integrate airSlate SignNow with other applications for managing Texas direct deposit forms?

Yes, airSlate SignNow provides various integrations with popular applications and platforms. This allows you to streamline your processes by automatically populating Texas direct deposit forms with data from other systems. Integrations enhance workflow efficiency, making it easier to manage documents and minimize manual entry.

-

How secure is the information provided in Texas direct deposit forms using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for Texas direct deposit forms, your information is protected with advanced encryption and compliance with industry standards. You can trust that your sensitive data is handled safely, providing peace of mind for both you and your employees.

Get more for Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms

- Notice hearing template form

- Hawaii quitclaim deed 497304362 form

- Warranty deed from husband and wife to corporation hawaii form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form hawaii

- Hawaii notice 497304366 form

- Quitclaim deed from husband and wife to llc hawaii form

- Warranty deed from husband and wife to llc hawaii form

- Hawaii judgment form

Find out other Comptroller texas govtaxesformsMiscellaneous Texas Tax Forms

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe