AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE 2021

What is the AR1000RC5 Arkansas Individual Income Tax Certificate

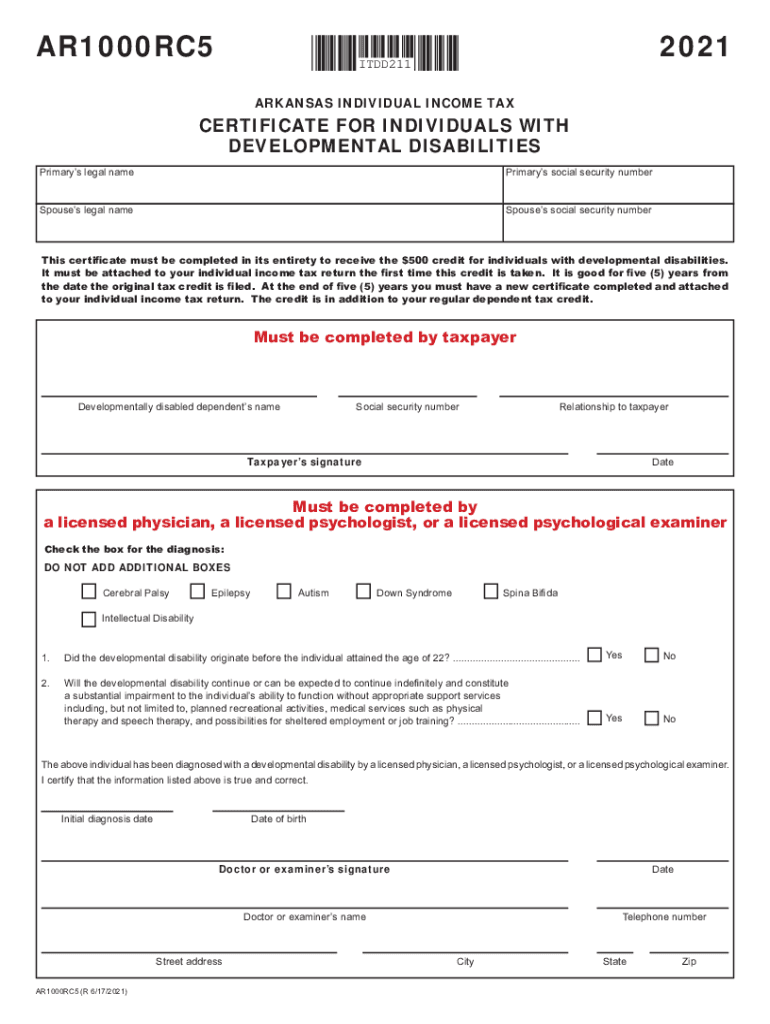

The AR1000RC5 is an essential form used in Arkansas for individual income tax purposes. This certificate serves as a verification document for taxpayers who are seeking a refund or credit for overpaid taxes. It is particularly relevant for individuals who have experienced changes in their tax situation, such as adjustments in income or deductions. By accurately completing this form, taxpayers can ensure they receive the appropriate credits or refunds they are entitled to under Arkansas tax law.

How to use the AR1000RC5 Arkansas Individual Income Tax Certificate

Using the AR1000RC5 involves several straightforward steps. First, gather all necessary documentation, including previous tax returns and any relevant income statements. Next, fill out the form with accurate information regarding your income, deductions, and any applicable credits. Once completed, the form can be submitted either online or via mail to the appropriate state tax authority. It is important to retain a copy for your records, as this can serve as proof of your filing and assist in any future inquiries regarding your tax status.

Steps to complete the AR1000RC5 Arkansas Individual Income Tax Certificate

Completing the AR1000RC5 requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the form from the Arkansas Department of Finance and Administration website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income sources and any deductions you qualify for.

- Double-check all entries for accuracy to avoid delays in processing.

- Sign and date the form to validate your submission.

Legal use of the AR1000RC5 Arkansas Individual Income Tax Certificate

The AR1000RC5 form is legally recognized as a valid document for tax purposes in Arkansas. To ensure its legal standing, it must be completed in accordance with state tax regulations. This includes providing truthful information and adhering to filing deadlines. Failure to comply with these requirements can lead to penalties or delays in processing your tax refund. Utilizing a reliable eSignature solution can further enhance the legal validity of your submission by providing a secure method for signing the document electronically.

Filing Deadlines / Important Dates

Filing deadlines for the AR1000RC5 are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is advisable to check with the Arkansas Department of Finance and Administration for any updates or changes to these deadlines. Timely submission is essential to avoid penalties and ensure that any refunds are processed without delay.

Required Documents

When completing the AR1000RC5, several documents are necessary to support your claims. These may include:

- Previous year’s tax returns to reference income and deductions.

- W-2 forms or 1099 statements reflecting your earnings.

- Documentation for any tax credits or deductions you are claiming.

- Identification documents, such as a driver’s license or Social Security card.

Having these documents ready will streamline the process and help ensure that your form is filled out accurately.

Who Issues the Form

The AR1000RC5 is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for managing tax collection and ensuring compliance with Arkansas tax laws. They provide resources and assistance for taxpayers to understand their obligations and rights regarding income tax filings. For any questions or clarifications regarding the form, taxpayers can reach out to the department directly for guidance.

Quick guide on how to complete ar1000rc5 arkansas individual income tax 2006 certificate

Complete AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents since you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE with ease

- Locate AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of missing or lost files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar1000rc5 arkansas individual income tax 2006 certificate

Create this form in 5 minutes!

People also ask

-

What is ar1000rc5 and how does it enhance document signing?

The ar1000rc5 is a powerful tool within airSlate SignNow that streamlines the document signing process. This feature allows users to easily send and eSign documents, signNowly improving efficiency and reducing turnaround times. With ar1000rc5, businesses can manage their documents seamlessly.

-

What pricing options are available for ar1000rc5?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including options that include the ar1000rc5 feature. The plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from comprehensive eSigning solutions. You can find detailed pricing information on the SignNow website.

-

What features does ar1000rc5 provide?

The ar1000rc5 offers a range of robust features, including customizable workflows, template management, and real-time tracking. These features enable users to streamline their document processes and enhance collaboration among teams. With the capabilities of ar1000rc5, businesses can elevate their document management strategies.

-

How does ar1000rc5 benefit businesses in document management?

Using ar1000rc5 can signNowly reduce the time and effort spent on document management. With its user-friendly interface and automated workflows, businesses can improve their operational efficiency and reduce the risk of errors. This leads to faster business processes and improved customer satisfaction.

-

Can ar1000rc5 integrate with other software applications?

Yes, ar1000rc5 is designed to integrate with various software applications, enhancing its versatility in business operations. The integration capabilities allow for seamless data transfer and workflow automation across platforms. This makes it easier for businesses to utilize their existing tools alongside the ar1000rc5.

-

Is the ar1000rc5 suitable for a small business?

Absolutely! The ar1000rc5 is tailored to support businesses of all sizes, including small enterprises. Its cost-effective nature and simplicity make it an ideal solution for startups looking to streamline their document signing process without signNow upfront investment.

-

What types of documents can be signed using ar1000rc5?

ar1000rc5 supports a wide variety of document types, including contracts, agreements, and forms. This versatility allows businesses to manage all their signing needs within a single platform. Whether it's legal documents or internal approvals, ar1000rc5 can handle it efficiently.

Get more for AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE

- Letter from landlord to tenant as notice of default on commercial lease hawaii form

- Residential or rental lease extension agreement hawaii form

- Commercial rental lease application questionnaire hawaii form

- Apartment lease rental application questionnaire hawaii form

- Residential rental lease application hawaii form

- Salary verification form for potential lease hawaii

- Tenant alterations 497304499 form

- Notice of default on residential lease hawaii form

Find out other AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF