481 2 Form

What is the 481 2

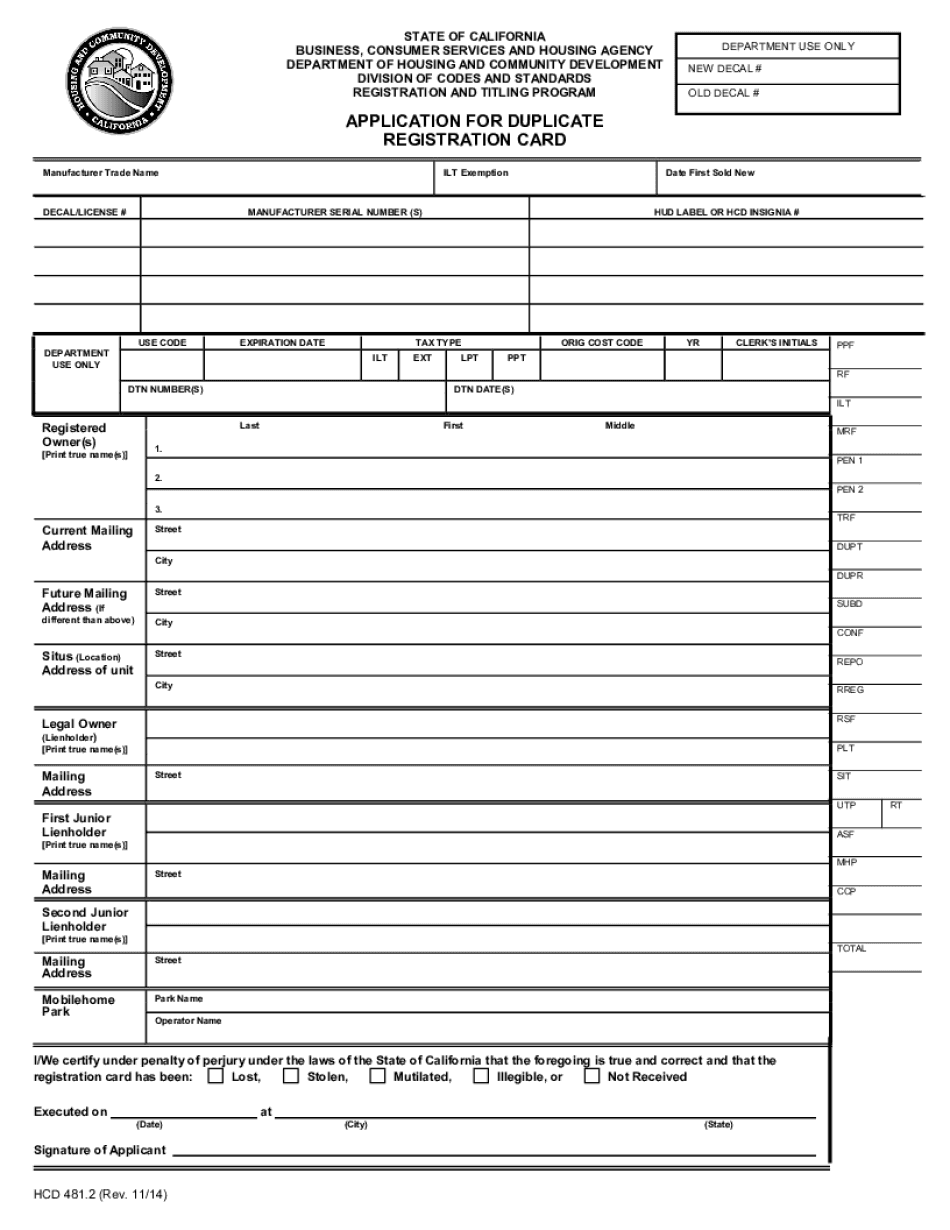

The 481 2 form, also known as the HCD 481 2, is a document utilized primarily in the housing sector. It is often required for various applications related to housing assistance or compliance with housing regulations. This form is significant for individuals and organizations seeking to navigate the complexities of housing documentation in the United States. Understanding its purpose and requirements is essential for ensuring proper completion and submission.

How to use the 481 2

Using the 481 2 form involves a few straightforward steps. First, identify the specific purpose for which the form is required, such as applying for housing assistance or reporting changes in housing status. Next, gather all necessary information and documentation that supports your application. This may include personal identification, financial information, and any relevant housing details. Finally, complete the form accurately, ensuring that all sections are filled out as required, and submit it according to the instructions provided.

Steps to complete the 481 2

Completing the 481 2 form requires careful attention to detail. Follow these steps for a successful submission:

- Read the instructions thoroughly to understand the requirements.

- Gather necessary documentation, including identification and financial records.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the 481 2

The legal use of the 481 2 form is governed by specific regulations that ensure its validity and compliance with housing laws. When completed correctly, the form serves as a legally binding document that can be used in various housing-related transactions. It is important to adhere to all legal stipulations associated with the form, including proper signatures and submission methods, to avoid any potential legal issues.

Key elements of the 481 2

Several key elements are essential for the proper completion of the 481 2 form. These include:

- Personal information: Full name, address, and contact details.

- Housing details: Information about current housing status and any changes.

- Financial information: Income details and other financial disclosures as required.

- Signatures: Required signatures to validate the form.

Form Submission Methods

The 481 2 form can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate office.

- In-person submission at local housing offices or designated locations.

Quick guide on how to complete 481 2

Accomplish 481 2 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 481 2 on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric workflow today.

The easiest method to modify and eSign 481 2 with ease

- Locate 481 2 and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign 481 2 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 481 2 and how does it relate to airSlate SignNow?

481 2 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows by automating document processes, making it easy to send and sign important documents electronically.

-

How much does airSlate SignNow cost for using the 481 2 feature?

The pricing for airSlate SignNow depends on the plan selected, but it offers competitive rates that include access to the 481 2 feature. Users can choose from various tiers to find a solution that fits their budget while still benefiting from the efficiency provided by 481 2.

-

What are the key benefits of using airSlate SignNow with 481 2?

Using airSlate SignNow with 481 2 allows businesses to save time and reduce costs associated with traditional document workflows. The 481 2 feature facilitates quick eSignatures and secure document management, ultimately enhancing productivity and business operations.

-

Can I integrate airSlate SignNow's 481 2 with other applications?

Yes, airSlate SignNow offers robust integrations with various applications that can enhance the functionality of the 481 2 feature. This allows businesses to connect their existing software tools seamlessly, improving workflow efficiency and document handling.

-

Is there a mobile app for accessing 481 2 on airSlate SignNow?

Absolutely! airSlate SignNow has a mobile app that enables users to access the 481 2 feature on the go. This ensures that you can send, sign, and manage documents from anywhere, making document handling more flexible and convenient.

-

How secure is the 481 2 feature within airSlate SignNow?

The 481 2 feature on airSlate SignNow prioritizes security with encryption and compliance measures in place. This ensures that all documents sent and signed are protected against unauthorized access, keeping your business and client information safe.

-

Can I track the status of documents sent with the 481 2 feature?

Yes, airSlate SignNow allows you to track the status of documents sent using the 481 2 feature in real-time. This includes notifications on document views and eSignatures, providing complete transparency and control over your document workflows.

Get more for 481 2

Find out other 481 2

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online