Oregon W4 Form

What is the Oregon W4

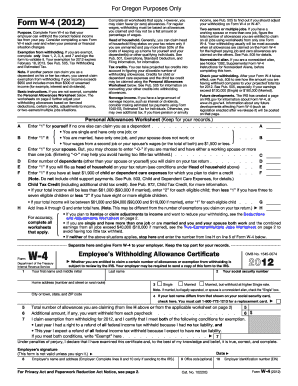

The Oregon W4 is a withholding form used by employees in Oregon to determine the amount of state income tax to be withheld from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted based on individual circumstances, such as personal allowances and exemptions. Completing the Oregon W4 accurately helps employees avoid underpayment or overpayment of taxes throughout the year.

Steps to complete the Oregon W4

Filling out the Oregon W4 involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Indicate your filing status, which may include options like single, married, or head of household.

- Determine the number of allowances you are claiming. This affects the amount of tax withheld.

- Complete any additional sections for specific situations, such as claiming exemption from withholding.

- Sign and date the form to validate your information.

Legal use of the Oregon W4

The Oregon W4 is legally binding once completed and submitted to your employer. It is important to ensure that the information provided is accurate and truthful, as discrepancies may lead to penalties. Employers are responsible for using the information on the W4 to calculate the appropriate withholding amounts. Adhering to the guidelines set forth by the Oregon Department of Revenue is crucial for compliance.

How to obtain the Oregon W4

The Oregon W4 form can be obtained from various sources:

- Visit the Oregon Department of Revenue website to download the latest version of the form.

- Request a physical copy from your employer or human resources department.

- Access the form through tax preparation software that includes state-specific forms.

Key elements of the Oregon W4

Several key elements are critical to the Oregon W4:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options that determine tax rates.

- Allowances: Number of allowances claimed impacts withholding amounts.

- Signature: Required to validate the form.

Form Submission Methods

The Oregon W4 can be submitted to your employer through various methods:

- Online: Many employers allow electronic submissions through payroll systems.

- Mail: Send a printed copy directly to your employer’s payroll department.

- In-Person: Deliver the completed form to your employer or HR representative.

Quick guide on how to complete oregon w4

Effortlessly prepare Oregon W4 on any device

The management of online documents has become increasingly common among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Administer Oregon W4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to change and electronically sign Oregon W4 with ease

- Obtain Oregon W4 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or wrongly placed files, frustrating form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Oregon W4 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the oregon w4 2025 and why is it important?

The oregon w4 2025 is a state tax form used by employees in Oregon to determine the amount of state income tax withholding from their paychecks. It's important because accurate withholding helps prevent tax liabilities or overpayment when filing your state taxes.

-

How can airSlate SignNow help me manage the oregon w4 2025 form?

airSlate SignNow offers an intuitive platform for businesses to easily create, send, and eSign the oregon w4 2025 form. With our document automation features, you can ensure that your employees complete their forms correctly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the oregon w4 2025?

Yes, airSlate SignNow provides various pricing plans tailored to fit business needs. Our competitive pricing ensures that you can manage the oregon w4 2025 and other essential documents without overspending.

-

What features does airSlate SignNow offer for handling the oregon w4 2025?

airSlate SignNow includes features such as easy document sharing, secure eSigning, and automated reminders specifically for the oregon w4 2025. These features streamline the process and enhance compliance without added complexity.

-

Can I integrate airSlate SignNow with other software for the oregon w4 2025?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions such as HR platforms and payroll systems, making it easier to handle the oregon w4 2025 alongside your other business processes.

-

What are the benefits of using airSlate SignNow for the oregon w4 2025?

Using airSlate SignNow for the oregon w4 2025 provides businesses with a cost-effective, user-friendly solution to manage tax forms. Enhanced security, compliance, and streamlined workflows are just a few of the benefits our platform offers.

-

Is airSlate SignNow secure for my oregon w4 2025 documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and secure access controls for your oregon w4 2025 documents. Your sensitive information is protected, ensuring compliance with privacy regulations.

Get more for Oregon W4

- Foundation contractor package idaho form

- Plumbing contractor package idaho form

- Brick mason contractor package idaho form

- Roofing contractor package idaho form

- Electrical contractor package idaho form

- Sheetrock drywall contractor package idaho form

- Flooring contractor package idaho form

- Trim carpentry contractor package idaho form

Find out other Oregon W4

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA