Do Not Submit This Form If the Property is Not Your Principal Residence Andor Any of the Disqualifying Factors 2016

Understanding the Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

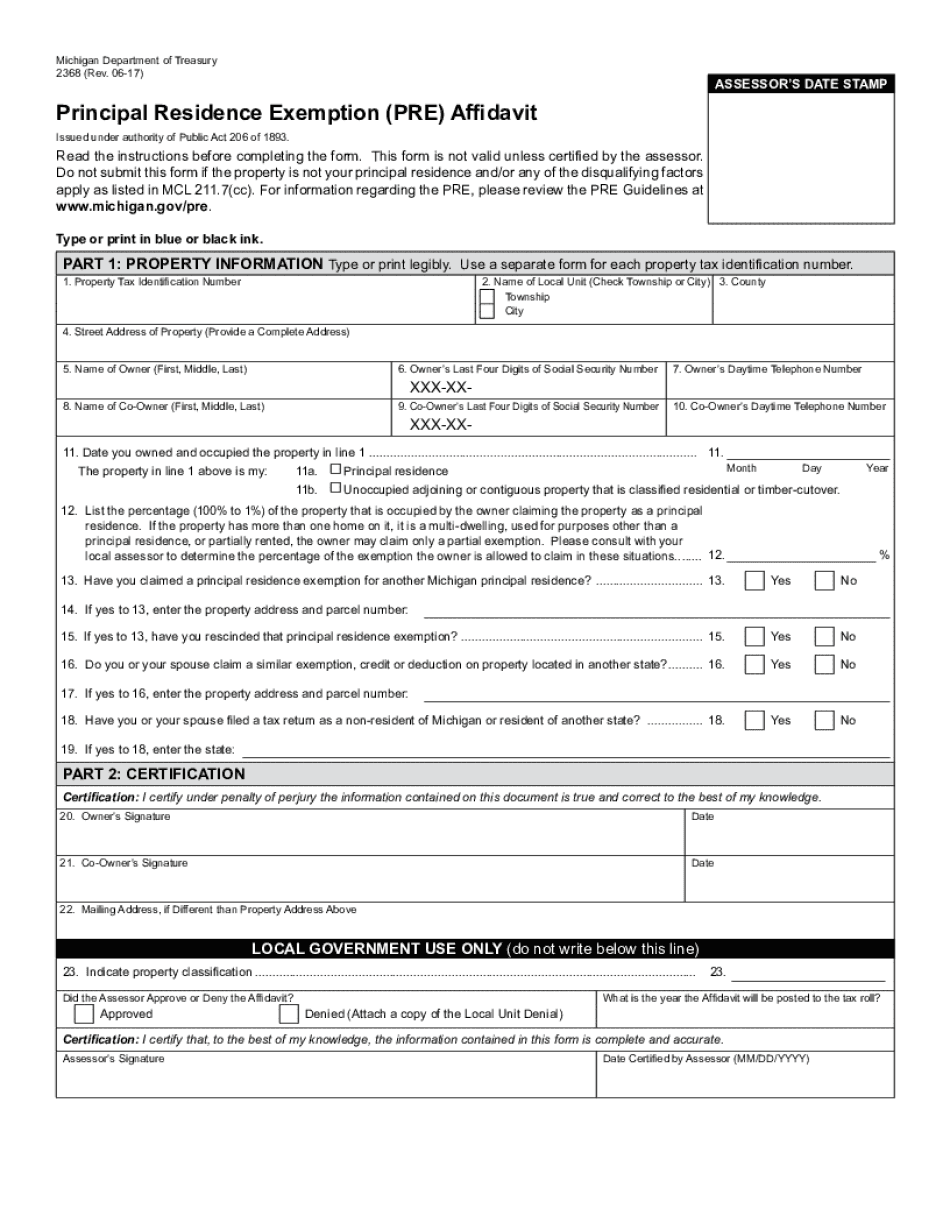

The form titled "Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors" is crucial for individuals who are applying for certain benefits or exemptions related to property ownership. This form typically applies to situations where the status of a property as a principal residence is necessary for eligibility. Understanding the implications of this form is essential to avoid potential legal issues or penalties.

Submitting this form incorrectly can lead to complications, including the denial of benefits or legal repercussions. Therefore, it is important to ensure that all criteria are met before submission, including verifying that the property in question is indeed your principal residence.

Steps to Complete the Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

Completing the form requires careful attention to detail to ensure compliance with all requirements. Here are the steps to follow:

- Gather necessary documentation that proves your residency status, such as utility bills, lease agreements, or tax returns.

- Carefully read the instructions provided with the form to understand the specific requirements and disqualifying factors.

- Fill out the form accurately, ensuring that all information is complete and truthful.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in-person, as specified in the instructions.

Legal Use of the Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

This form serves a legal purpose in confirming the status of a property as a principal residence. It is essential for compliance with various regulations that govern property taxes, homestead exemptions, and other related benefits. When used correctly, the form can protect the rights of property owners and ensure that they receive the appropriate benefits.

Failure to adhere to the guidelines associated with this form may result in legal consequences, including fines or the loss of eligibility for certain programs. Therefore, understanding the legal implications of the form is critical for all applicants.

Eligibility Criteria for the Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

To be eligible to submit this form, applicants must meet specific criteria. These typically include:

- The property must be the applicant's primary residence, meaning they live there for the majority of the year.

- The applicant must not have any disqualifying factors, such as ownership of multiple properties or failure to meet local residency requirements.

- All information provided must be accurate and verifiable, as false information can lead to penalties.

It is advisable to review local regulations to ensure compliance with any additional eligibility requirements that may apply.

Examples of Using the Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

Understanding practical applications of this form can help clarify its importance. Here are a few scenarios where this form is relevant:

- A homeowner applying for a property tax exemption must confirm that the property is their principal residence.

- A resident seeking a homestead exemption needs to prove that they live in the property as their primary home.

- An individual who has recently moved and is applying for benefits related to their new residence must ensure they meet the criteria outlined in the form.

These examples illustrate the necessity of accurately completing and submitting the form to avoid complications in obtaining benefits.

Form Submission Methods for the Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

Submitting the form can typically be done through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal, which often provides immediate confirmation of receipt.

- Mailing the completed form to the appropriate office, ensuring it is sent well before any deadlines.

- In-person submission at a local government office, which may allow for immediate feedback on the submission.

Choosing the correct submission method is important to ensure timely processing and compliance with any deadlines.

Quick guide on how to complete do not submit this form if the property is not your principal residence andor any of the disqualifying factors

Prepare Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors easily

- Obtain Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not submit this form if the property is not your principal residence andor any of the disqualifying factors

Create this form in 5 minutes!

People also ask

-

What does it mean to not submit this form if the property is not your principal residence?

When filling out the form, be aware that you should not submit it if the property doesn't serve as your primary residence. This is crucial because 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' affects the validity of your application.

-

What are the disqualifying factors I should be aware of?

Disqualifying factors may include properties that are not your principal residence or if they are used for commercial purposes. It's essential to thoroughly review these criteria before proceeding, as 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' helps ensure compliance with regulations.

-

Are there costs associated with using airSlate SignNow for signing documents?

Yes, airSlate SignNow has various pricing plans designed to suit different business needs. Regardless of the plan you choose, always remember: 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' for accurate processing.

-

What features does airSlate SignNow offer to its users?

AirSlate SignNow provides a user-friendly platform with features such as e-signatures, document templates, and team management tools. Always keep in mind that 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' while utilizing these features for property-related documents.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can streamline their document signing process, saving time and reducing paperwork. Make sure to follow guidelines like 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' for effective results.

-

Can I integrate airSlate SignNow with other applications?

Yes, you can seamlessly integrate airSlate SignNow with various applications, including CRM systems and cloud storage services. Always ensure compliance with requirements like 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' during your integrations.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, including small businesses, offering cost-effective solutions. Remember to adhere to guidelines such as 'Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors' for optimal use in property transactions.

Get more for Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

- Warning of default on residential lease massachusetts form

- Landlord tenant closing statement to reconcile security deposit massachusetts form

- Massachusetts name change form

- Name change notification form massachusetts

- Massachusetts commercial lease form

- Massachusetts legal documents form

- Massachusetts guardian form

- Bankruptcy chapters 7 form

Find out other Do Not Submit This Form If The Property Is Not Your Principal Residence Andor Any Of The Disqualifying Factors

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast