Dor Sc Govforms SiteFormsSTATE of SOUTH CAROLINA SC8857 DEPARTMENT of REVENUE REQUEST 2022-2026

What is the SC8857 form?

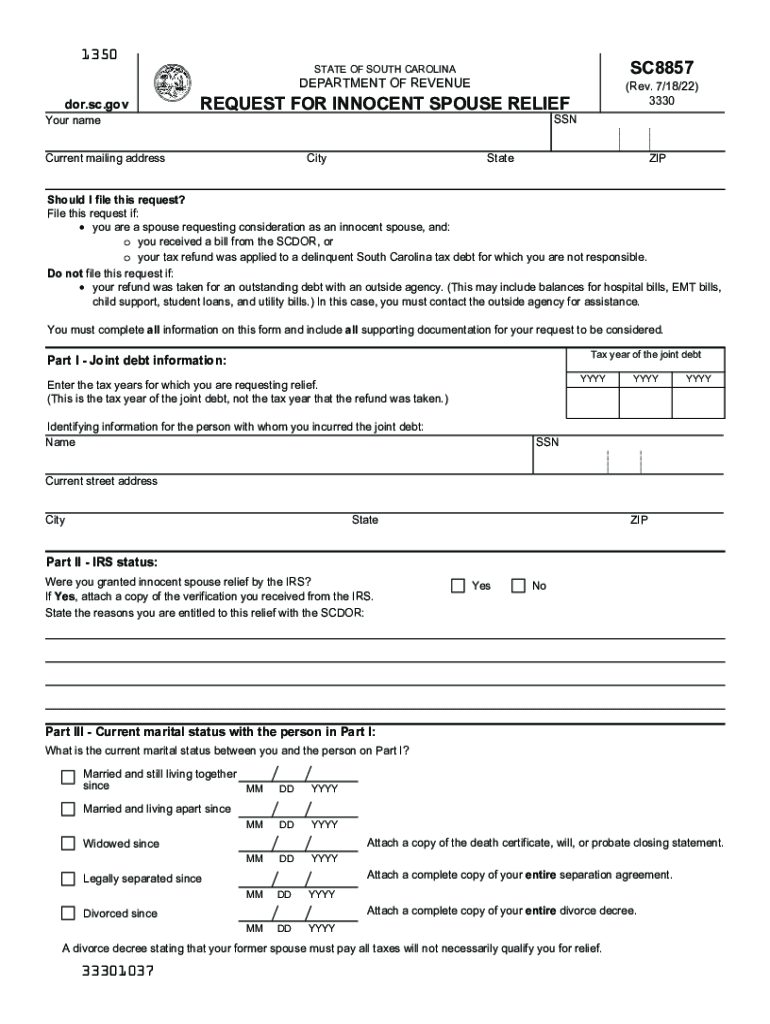

The SC8857 form, officially known as the South Carolina Request for Innocent Spouse Relief, is a document used by individuals who seek relief from joint tax liabilities incurred during a marriage. This form allows a spouse to request that the South Carolina Department of Revenue relieve them from paying taxes owed due to the actions of their partner. It is essential for individuals who believe they should not be held responsible for tax debts that are solely attributable to their spouse's actions.

Eligibility criteria for the SC8857 form

To qualify for relief under the SC8857 form, individuals must meet specific eligibility requirements. These include:

- The individual must have filed a joint tax return with their spouse.

- The tax liability must be attributable to the spouse's income or deductions.

- The individual must not have known or had reason to know about the tax liability at the time of signing the joint return.

- The request for relief must be made within the appropriate time frame as specified by the South Carolina Department of Revenue.

Steps to complete the SC8857 form

Completing the SC8857 form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary documentation, including the joint tax return and any relevant financial statements.

- Fill out the SC8857 form with accurate information regarding both spouses' financial situations.

- Clearly explain the reasons for requesting innocent spouse relief in the designated section of the form.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the South Carolina Department of Revenue through the appropriate method, whether online or by mail.

Legal use of the SC8857 form

The SC8857 form is legally recognized as a valid request for relief from joint tax liabilities. It must be completed in accordance with state laws and regulations. Proper use of the form ensures that individuals can protect themselves from unfair tax burdens resulting from their spouse's financial decisions. It is advisable to consult with a tax professional or legal advisor to ensure compliance with all legal requirements.

Form submission methods

Individuals can submit the SC8857 form through various methods:

- Online Submission: The form can be completed and submitted electronically through the South Carolina Department of Revenue's online portal.

- Mail Submission: Alternatively, individuals may print the completed form and mail it to the designated address provided by the Department of Revenue.

- In-Person Submission: Some individuals may choose to deliver the form in person at their local Department of Revenue office.

Required documents for the SC8857 form

When submitting the SC8857 form, individuals must include certain documents to support their request. These may include:

- A copy of the joint tax return for the year in question.

- Any relevant financial records that demonstrate the spouse's income and deductions.

- Documentation that supports the claim of innocence regarding the tax liability.

Quick guide on how to complete dorscgovforms siteformsstate of south carolina sc8857 department of revenue request

Complete Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST with ease

- Locate Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Update and eSign Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorscgovforms siteformsstate of south carolina sc8857 department of revenue request

Create this form in 5 minutes!

People also ask

-

What is SC innocent spouse and how does it work?

SC innocent spouse refers to a provision that protects one spouse from being held responsible for tax liabilities incurred by the other spouse. This is particularly relevant for couples who file joint tax returns and may face unexpected tax debts. Understanding this concept can help you utilize legal tools effectively with airSlate SignNow.

-

How can airSlate SignNow help with SC innocent spouse documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to SC innocent spouse claims. Our platform allows you to create, send, and e-sign any necessary forms securely and efficiently. By using airSlate SignNow, you can ensure that your documents are handled with the utmost care and legality.

-

Are there any costs associated with using airSlate SignNow for SC innocent spouse forms?

Yes, airSlate SignNow offers competitive pricing plans that ensure you can manage your SC innocent spouse documents affordably. Our pricing models cater to varied needs, from individuals to businesses, making it easier to choose a plan that suits your requirements. You can evaluate our subscription options before committing.

-

What features does airSlate SignNow offer that assist with SC innocent spouse claims?

airSlate SignNow provides features such as templates, real-time tracking, and integrated cloud storage, which are essential for managing SC innocent spouse documentation. These tools allow you to prepare necessary forms efficiently, ensuring that you meet deadlines and stay organized throughout the process.

-

Does airSlate SignNow allow me to collaborate with my spouse on SC innocent spouse forms?

Absolutely! airSlate SignNow facilitates seamless collaboration between users, allowing you and your spouse to work together on SC innocent spouse-related documents. You can share files, add comments, and e-sign together in real-time, ensuring transparency and joint agreement.

-

Can I integrate airSlate SignNow with other software for managing SC innocent spouse cases?

Yes, airSlate SignNow integrates with various third-party applications to enhance your experience with managing SC innocent spouse cases. By connecting with your existing tools, such as CRM systems or cloud storage services, you ensure a streamlined workflow that saves time and increases efficiency.

-

What are the benefits of using airSlate SignNow for SC innocent spouse situations?

Using airSlate SignNow for SC innocent spouse cases offers numerous benefits, such as enhanced security, convenience, and compliance. Our platform enables you to manage sensitive tax documents with confidence, knowing that your information is protected and that you have access to everything you need at your fingertips.

Get more for Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST

- Massachusetts health care proxy printable form

- New state resident package massachusetts form

- Revocation of health care proxy massachusetts form

- Commercial property sales package massachusetts form

- General partnership package massachusetts form

- Contract for deed package massachusetts form

- Power of attorney forms package massachusetts

- Massachusetts anatomical gift form

Find out other Dor sc govforms siteFormsSTATE OF SOUTH CAROLINA SC8857 DEPARTMENT OF REVENUE REQUEST

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy