Mpl Application Form

What is the Mpl Application Form

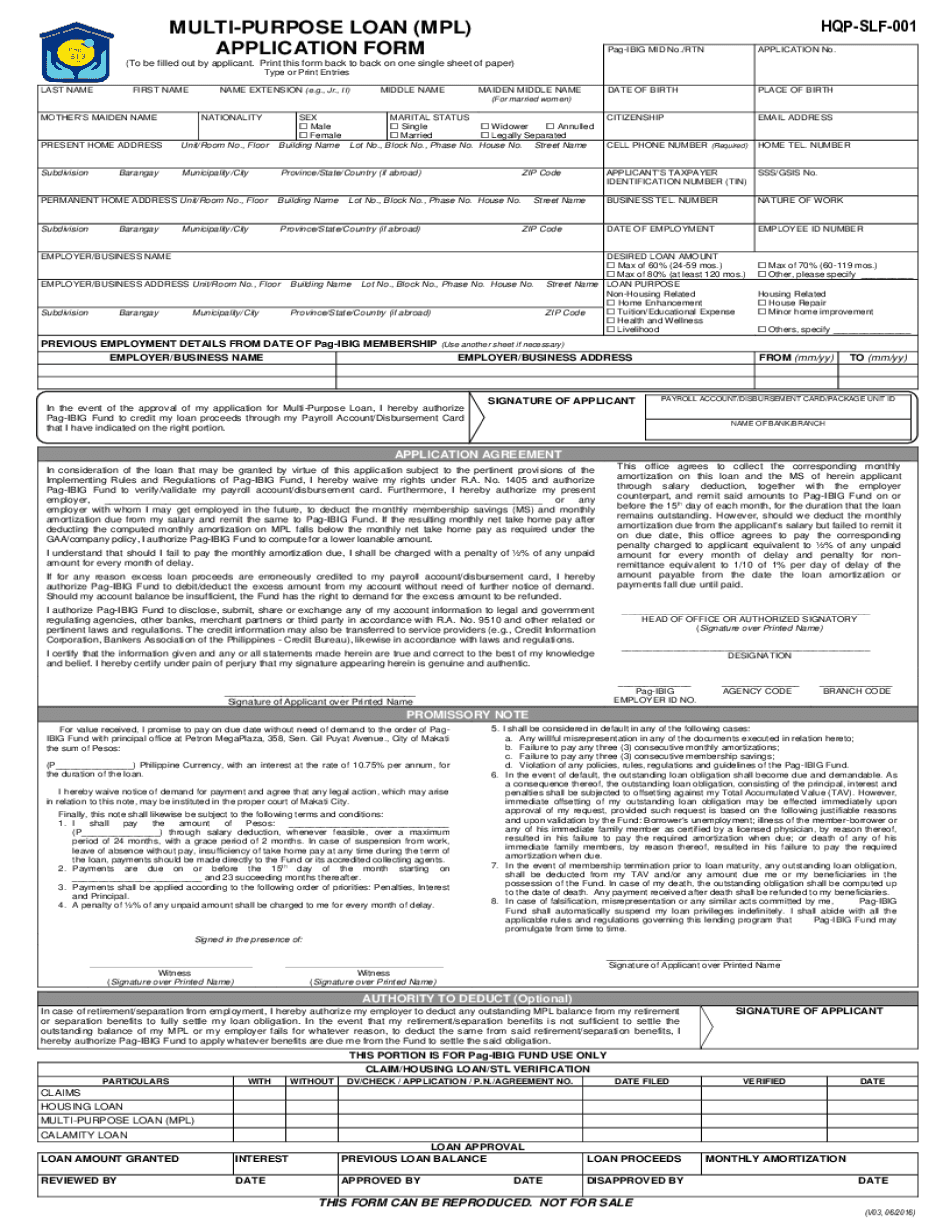

The MPL application form, often referred to as the pag ibig MPL form, is a document used to apply for a multi-purpose loan. This type of loan is typically offered by the Home Development Mutual Fund (HDMF) in the Philippines, allowing members to access funds for various purposes, such as home improvement, education, or other personal needs. The form collects essential information about the applicant, including personal details, loan amount requested, and the purpose of the loan.

How to use the Mpl Application Form

Using the MPL application form involves several steps. First, you need to download the form from an official source or obtain a physical copy. Once you have the form, fill it out with accurate information, ensuring that all required fields are completed. After filling out the form, you may need to gather supporting documents, such as proof of income or identification. Finally, submit the completed form along with the necessary documents to the appropriate HDMF office or through an online submission platform, if available.

Steps to complete the Mpl Application Form

Completing the MPL application form requires careful attention to detail. Follow these steps for a successful submission:

- Download or obtain the MPL application form.

- Fill in your personal information, including your name, address, and contact details.

- Specify the loan amount you wish to apply for and the intended use of the funds.

- Attach any required documents, such as proof of income, identification, and other relevant paperwork.

- Review the completed form for accuracy before submission.

- Submit the form and documents to the designated HDMF office or through the online platform.

Legal use of the Mpl Application Form

The MPL application form must be completed and submitted in accordance with legal requirements to ensure its validity. This includes providing accurate information and adhering to the guidelines set forth by the HDMF. An electronic version of the form can be legally binding if it meets specific criteria, such as proper electronic signatures and compliance with relevant laws, including the ESIGN Act and UETA. Ensuring that the form is filled out correctly and submitted through a secure platform can help protect your rights as a borrower.

Eligibility Criteria

To qualify for a multi-purpose loan using the MPL application form, applicants must meet certain eligibility criteria. Typically, individuals must be members of the HDMF and have made a minimum number of contributions. Additionally, applicants may need to demonstrate their ability to repay the loan, which often involves providing proof of income or employment. It's essential to review the specific requirements outlined by the HDMF to ensure you meet all necessary conditions before applying.

Required Documents

When applying for a loan using the MPL application form, several documents are generally required to support your application. Commonly requested documents include:

- Proof of identity, such as a government-issued ID.

- Proof of income, which may include pay slips or tax returns.

- Membership certificate or proof of HDMF contributions.

- Any additional documentation related to the purpose of the loan.

Gathering these documents in advance can streamline the application process and improve your chances of approval.

Form Submission Methods

The MPL application form can typically be submitted through various methods, depending on the policies of the HDMF. Common submission options include:

- In-person submission at designated HDMF offices.

- Online submission through the HDMF website or a secure platform.

- Mailing the completed form and documents to the appropriate office.

Choosing the most convenient submission method can help ensure that your application is processed in a timely manner.

Quick guide on how to complete mpl application form

Complete Mpl Application Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Mpl Application Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Mpl Application Form without hassle

- Obtain Mpl Application Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Mpl Application Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is pag ibig mpl and how does it work?

Pag ibig mpl is a financial product designed to provide loans to members of the Pag-IBIG Fund. It allows borrowers to access funds quickly and transparently. By utilizing digital platforms like airSlate SignNow, signing your pag ibig mpl documents becomes effortless and straightforward.

-

What are the main benefits of using pag ibig mpl?

The main benefits of pag ibig mpl include lower interest rates, flexible payment terms, and the opportunity to finance various needs such as housing or business. Additionally, the approval process is streamlined, enabling quicker access to funds. With airSlate SignNow, you can conveniently eSign your necessary documents for a pag ibig mpl loan.

-

How much does it cost to apply for pag ibig mpl?

The cost to apply for pag ibig mpl typically includes a minimal processing fee, which may vary depending on the amount borrowed. There are no hidden fees, ensuring transparent transactions. Utilizing airSlate SignNow's digital solution can further minimize administrative costs associated with document handling.

-

How can airSlate SignNow help with pag ibig mpl applications?

AirSlate SignNow simplifies the application process for pag ibig mpl by allowing you to securely eSign documents online. This eliminates the need for physical paperwork, saving time and effort. Our platform ensures that your application is processed efficiently and safely, directly supporting your pag ibig mpl needs.

-

Can I track the status of my pag ibig mpl application?

Yes, tracking the status of your pag ibig mpl application is easy through the Pag-IBIG Fund's online portal. Notifications and updates are often sent via email or SMS. Furthermore, if you use airSlate SignNow, you’ll receive real-time alerts regarding your eSigned documents, enhancing your application monitoring.

-

Are there any eligibility requirements for pag ibig mpl?

To qualify for pag ibig mpl, you must be an active member of the Pag-IBIG Fund and meet specific income and credit criteria. Proof of employment or a source of income is usually required as part of the application process. Using airSlate SignNow helps you to gather and submit your documents efficiently, increasing your chances of approval.

-

What types of documents do I need to provide for pag ibig mpl?

When applying for pag ibig mpl, you typically need to provide identification, proof of income, and a completed application form. Additional documents may be necessary depending on the loan purpose. AirSlate SignNow streamlines the document preparation and submission process, making your application faster.

Get more for Mpl Application Form

- Flooring contractor package louisiana form

- Trim carpentry contractor package louisiana form

- Fencing contractor package louisiana form

- Hvac contractor package louisiana form

- Landscaping contractor package louisiana form

- Commercial contractor package louisiana form

- Excavation contractor package louisiana form

- Louisiana contractor 497309371 form

Find out other Mpl Application Form

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later