Missouri Gas Tax Refund Form 4925 2011

What is the Missouri Gas Tax Refund Form 4925

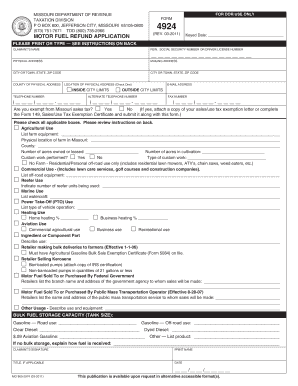

The Missouri Gas Tax Refund Form 4925 is a specific document issued by the Missouri Department of Revenue that allows individuals and businesses to claim a refund on excess fuel taxes paid. This form is particularly relevant for those who use fuel for non-highway purposes, such as agricultural or off-road activities. By submitting this form, eligible taxpayers can recover a portion of the fuel taxes they have paid, which can help alleviate operational costs.

How to use the Missouri Gas Tax Refund Form 4925

To effectively use the Missouri Gas Tax Refund Form 4925, individuals need to gather all necessary information regarding their fuel purchases and usage. This includes details about the type of fuel, the quantity purchased, and the purpose of use. Once the information is compiled, the form can be filled out accurately, ensuring that all required fields are completed. After filling out the form, it should be submitted to the Missouri Department of Revenue for processing.

Steps to complete the Missouri Gas Tax Refund Form 4925

Completing the Missouri Gas Tax Refund Form 4925 involves several key steps:

- Gather documentation related to fuel purchases, including receipts and invoices.

- Fill out the form with accurate details, including personal information and specifics about fuel usage.

- Calculate the total refund amount based on the fuel tax paid and the eligible usage.

- Review the form for completeness and accuracy to avoid delays.

- Submit the completed form to the Missouri Department of Revenue via the preferred submission method.

Eligibility Criteria

To qualify for a refund using the Missouri Gas Tax Refund Form 4925, applicants must meet specific eligibility criteria. Generally, the form is intended for individuals or businesses that use fuel for non-highway purposes. This may include farmers, commercial businesses, and other entities that consume fuel outside of standard highway operations. It is important to review the guidelines provided by the Missouri Department of Revenue to ensure compliance with all eligibility requirements.

Required Documents

When submitting the Missouri Gas Tax Refund Form 4925, applicants must include certain required documents to support their claim. These typically include:

- Receipts or invoices for fuel purchases.

- Proof of fuel usage for non-highway purposes.

- Any additional documentation specified by the Missouri Department of Revenue.

Providing accurate and complete documentation is essential for the successful processing of the refund request.

Form Submission Methods

The Missouri Gas Tax Refund Form 4925 can be submitted through various methods, ensuring convenience for applicants. The primary submission methods include:

- Online submission through the Missouri Department of Revenue's official website.

- Mailing the completed form to the designated address provided by the department.

- In-person submission at local Department of Revenue offices.

Choosing the appropriate submission method can help expedite the refund process.

Quick guide on how to complete missouri gas tax refund form 4925

Complete Missouri Gas Tax Refund Form 4925 seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Manage Missouri Gas Tax Refund Form 4925 on any platform with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to edit and eSign Missouri Gas Tax Refund Form 4925 with ease

- Obtain Missouri Gas Tax Refund Form 4925 and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your revisions.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Missouri Gas Tax Refund Form 4925 and ensure top-notch communication during any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri gas tax refund form 4925

Create this form in 5 minutes!

People also ask

-

What is the Missouri gas tax refund form 4925?

The Missouri gas tax refund form 4925 is a specialized document used by individuals and businesses to request a refund on the gas taxes paid in Missouri. It is important to fill out this form accurately to ensure timely processing of your refund request.

-

Who is eligible to file the Missouri gas tax refund form 4925?

Eligible individuals include those who have purchased gas for non-highway use, commercial enterprises, and government entities. Ensure that you meet the eligibility criteria outlined on the form to apply for a refund.

-

How do I complete the Missouri gas tax refund form 4925?

Completing the Missouri gas tax refund form 4925 involves providing specific details about your gas purchases, including dates and amounts. Follow the instructions carefully to avoid any mistakes that could delay your refund.

-

Is there a fee for submitting the Missouri gas tax refund form 4925?

No, there is no fee associated with submitting the Missouri gas tax refund form 4925. However, ensure that all information provided is accurate to avoid unnecessary delays in processing your refund.

-

How long does it take to receive a refund after filing the Missouri gas tax refund form 4925?

The processing time for the Missouri gas tax refund form 4925 can vary, but typically it takes about six to eight weeks. Be sure to keep your submission receipt as proof of filing.

-

What are the benefits of using airSlate SignNow to submit the Missouri gas tax refund form 4925?

Using airSlate SignNow to submit the Missouri gas tax refund form 4925 offers a streamlined, cost-effective solution for signing and sending documents securely. Our platform simplifies the eSigning process, ensuring that you can quickly complete your refund applications.

-

Can I integrate other tools with airSlate SignNow when filing the Missouri gas tax refund form 4925?

Yes, airSlate SignNow allows for seamless integrations with various productivity tools, enhancing your workflow. This capability makes it easy to manage all aspects of your refund process efficiently.

Get more for Missouri Gas Tax Refund Form 4925

- Legal last will and testament form for a single person with minor children massachusetts

- Legal last will and testament form for single person with adult and minor children massachusetts

- Legal last will and testament form for single person with adult children massachusetts

- Legal last will and testament for married person with minor children from prior marriage massachusetts form

- Legal last will and testament for civil union partner with minor children from prior marriage massachusetts form

- Legal last will and testament form for married person with adult children from prior marriage massachusetts

- Legal last will and testament form for divorced person not remarried with adult children massachusetts

- Massachusetts legal marriage form

Find out other Missouri Gas Tax Refund Form 4925

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast