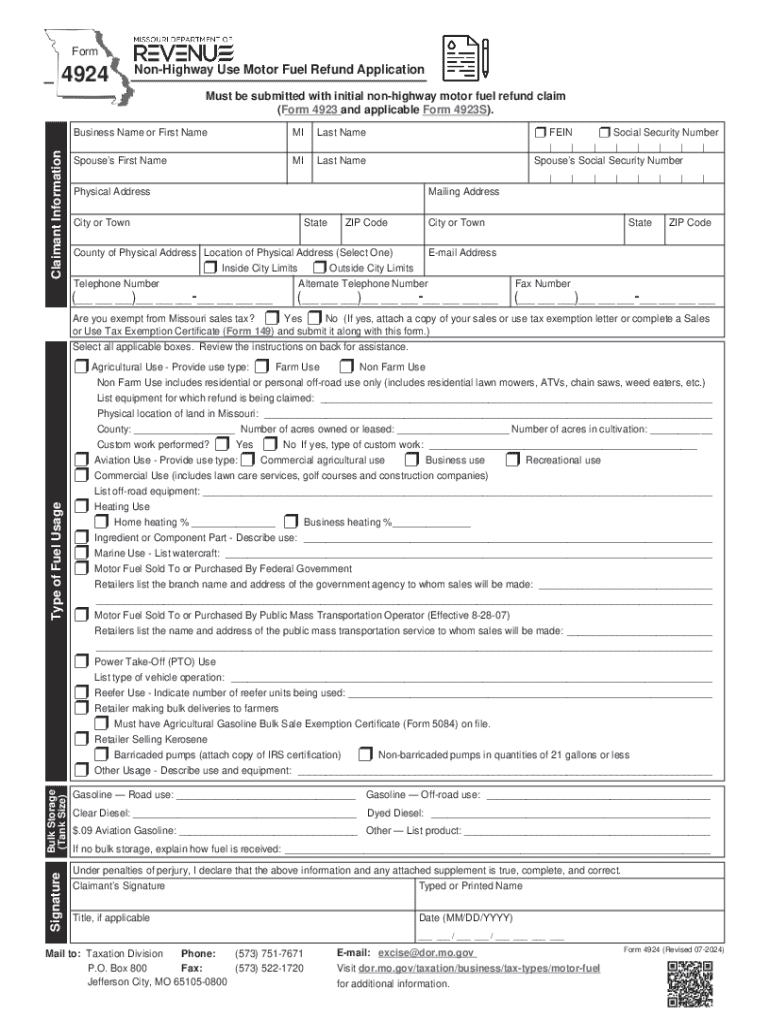

Form 4924 Non Highway Use Motor Fuel Refund Application 2024-2026

Overview of the Missouri Gas Tax Refund Form 4925

The Missouri Gas Tax Refund Form 4925 is designed for individuals and businesses seeking to claim a refund for gas taxes paid on fuel used for non-highway purposes. This form is particularly relevant for those who use fuel for agricultural, construction, or other off-road activities. Understanding the purpose and requirements of this form is essential for ensuring compliance and maximizing potential refunds.

Steps to Complete the Missouri Gas Tax Refund Form 4925

Completing the Missouri Gas Tax Refund Form 4925 involves several key steps. First, gather all necessary documentation, including receipts for fuel purchases and any relevant identification information. Next, accurately fill out the form, ensuring that all sections are completed, including details about the fuel usage and the amount of tax being claimed. Finally, review the form for accuracy before submission to avoid delays in processing.

Eligibility Criteria for the Missouri Gas Tax Refund Form 4925

To qualify for a refund using the Missouri Gas Tax Refund Form 4925, applicants must meet specific eligibility criteria. Generally, the fuel must be used for off-road purposes, such as farming or construction. Additionally, the applicant must have paid the gas tax on the fuel in question. It is important to ensure that all conditions are met to successfully receive a refund.

Required Documents for Filing the Missouri Gas Tax Refund Form 4925

When filing the Missouri Gas Tax Refund Form 4925, certain documents are required to support the claim. These typically include receipts or invoices for fuel purchases, documentation proving the fuel was used for non-highway purposes, and identification information such as a driver's license or tax identification number. Having these documents prepared in advance can streamline the filing process.

Form Submission Methods for the Missouri Gas Tax Refund Form 4925

The Missouri Gas Tax Refund Form 4925 can be submitted through various methods. Applicants may choose to file the form online, by mail, or in person at designated state offices. Each method has its own processing times and requirements, so it is advisable to select the option that best suits the applicant's needs and to ensure that all guidelines are followed for a successful submission.

Common Mistakes to Avoid When Filing the Missouri Gas Tax Refund Form 4925

When completing the Missouri Gas Tax Refund Form 4925, there are common mistakes that applicants should be aware of. These include failing to sign the form, providing incorrect or incomplete information, and not including necessary supporting documents. Taking the time to carefully review the form and ensuring all details are accurate can help prevent delays and complications in the refund process.

Quick guide on how to complete form 4924 non highway use motor fuel refund application

Prepare Form 4924 Non Highway Use Motor Fuel Refund Application easily on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 4924 Non Highway Use Motor Fuel Refund Application on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form 4924 Non Highway Use Motor Fuel Refund Application effortlessly

- Find Form 4924 Non Highway Use Motor Fuel Refund Application and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4924 Non Highway Use Motor Fuel Refund Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4924 non highway use motor fuel refund application

Create this form in 5 minutes!

How to create an eSignature for the form 4924 non highway use motor fuel refund application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri gas tax refund form 4925?

The Missouri gas tax refund form 4925 is a document used by individuals and businesses to claim a refund on excess gas taxes paid in Missouri. This form is essential for those who qualify for a refund due to specific criteria, such as using fuel for non-highway purposes. Completing the Missouri gas tax refund form 4925 accurately ensures you receive the refund you deserve.

-

How can I obtain the Missouri gas tax refund form 4925?

You can obtain the Missouri gas tax refund form 4925 from the official Missouri Department of Revenue website. The form is available for download in PDF format, making it easy to print and fill out. Ensure you have all necessary documentation ready to accompany your Missouri gas tax refund form 4925 for a smooth submission process.

-

What information do I need to complete the Missouri gas tax refund form 4925?

To complete the Missouri gas tax refund form 4925, you will need your personal information, details about the fuel purchased, and the reason for the refund request. Additionally, you may need to provide receipts or other documentation to support your claim. Having all this information ready will help streamline the process of submitting your Missouri gas tax refund form 4925.

-

How long does it take to process the Missouri gas tax refund form 4925?

The processing time for the Missouri gas tax refund form 4925 can vary, but it typically takes several weeks. Factors such as the volume of claims and the accuracy of your submission can affect the timeline. To avoid delays, ensure that your Missouri gas tax refund form 4925 is filled out correctly and all required documents are included.

-

Are there any fees associated with filing the Missouri gas tax refund form 4925?

There are no fees associated with filing the Missouri gas tax refund form 4925 itself. However, if you choose to use a tax professional or service to assist with your claim, there may be associated costs. It's advisable to review your options and choose the best method for submitting your Missouri gas tax refund form 4925.

-

Can I file the Missouri gas tax refund form 4925 online?

Currently, the Missouri gas tax refund form 4925 must be submitted via mail, as there is no online filing option available. You can complete the form digitally, but you will need to print it and send it to the appropriate address. Keep this in mind when preparing your Missouri gas tax refund form 4925 to ensure timely submission.

-

What should I do if my Missouri gas tax refund form 4925 is denied?

If your Missouri gas tax refund form 4925 is denied, you will receive a notice explaining the reason for the denial. You can appeal the decision by providing additional information or correcting any errors in your original submission. It's important to address the issues promptly to ensure you can successfully claim your refund.

Get more for Form 4924 Non Highway Use Motor Fuel Refund Application

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497322332 form

- Breach lease form

- Ohio violating form

- Oh provisions form

- Ohio affidavit form

- Request for release of funds corporation or llc ohio form

- Ohio notice form 497322342

- Business credit application ohio form

Find out other Form 4924 Non Highway Use Motor Fuel Refund Application

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free